In today’s busy world, Certified Public Accountants (CPAs) are always looking for ways to do their work more efficiently.

A Stealth Agent virtual assistant accounting is like a helping hand from the internet, who can handle many routine tasks without being in the same room as the CPA.

In this article, we’ll explore how a virtual assistant accountant can be a game-changer for CPAs, how they can help you, and how to hire them.

Onboard a Stealth Agents virtual assistant and schedule a session to learn about pricing.

How do you ensure accuracy in routine tasks such as processing expenses and preparing reports?

Ensuring accuracy in routine tasks such as processing expenses and preparing reports requires a systematic approach.

One effective method is to use a virtual assistant for accounting, which helps in maintaining consistency and reducing human errors.

It’s important to set up clear guidelines and checklists for each task to ensure nothing is overlooked.

Virtual staff for accounting firms can be beneficial as they bring specialized skills and knowledge to handle complex accounting tasks.

Regular training and updates on accounting software can further enhance task accuracy.

When you hire virtual accountant, it allows for more flexibility and access to expert insights without geographical limitations.

Finally, double-checking and reviewing the work before final submission can prevent errors and ensure the highest level of accuracy.

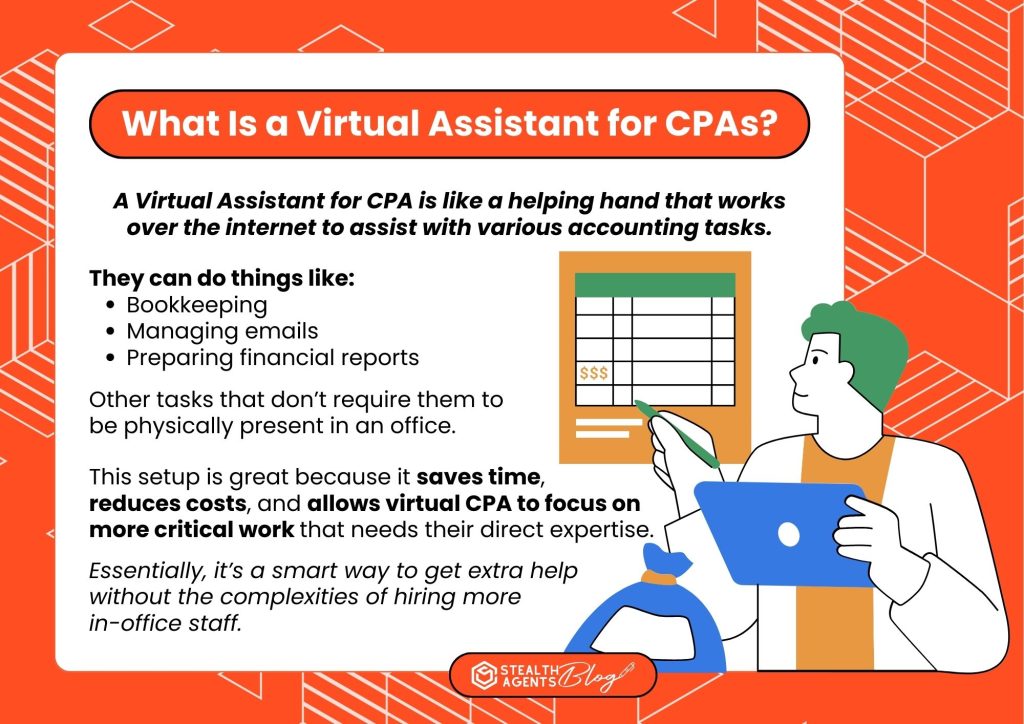

What Is a Virtual Assistant for CPAs?

A Virtual Assistant for CPA is like a helping hand that works over the internet to assist with various accounting tasks.

They can do things like bookkeeping, managing emails, preparing financial reports, and other tasks that don’t require them to be physically present in an office.

This setup is great because it saves time, reduces costs, and allows virtual CPA to focus on more critical work that needs their direct expertise.

Essentially, it’s a smart way to get extra help without the complexities of hiring more in-office staff.

Can a Virtual Assistant for Accountants help during tax season? How?

During the hectic tax season, a virtual assistant can be invaluable in several ways.

They can manage finances by organizing expenses, tracking payments, and preparing financial reports needed for tax filing.

Additionally, accountant assistants can handle the labor-intensive tasks of bookkeeping, such as recording transactions, reconciling bank statements, and generating financial statements.

They are also equipped to assist with tax preparation, including gathering documents, filling out forms, and calculating deductions.

To ensure no deadlines are missed, they can send timely reminders for tax-related due dates.

Moreover, virtual assistants can conduct research and provide support for any tax queries, thus freeing up your time to focus on more critical aspects of your business or personal life during this busy period.

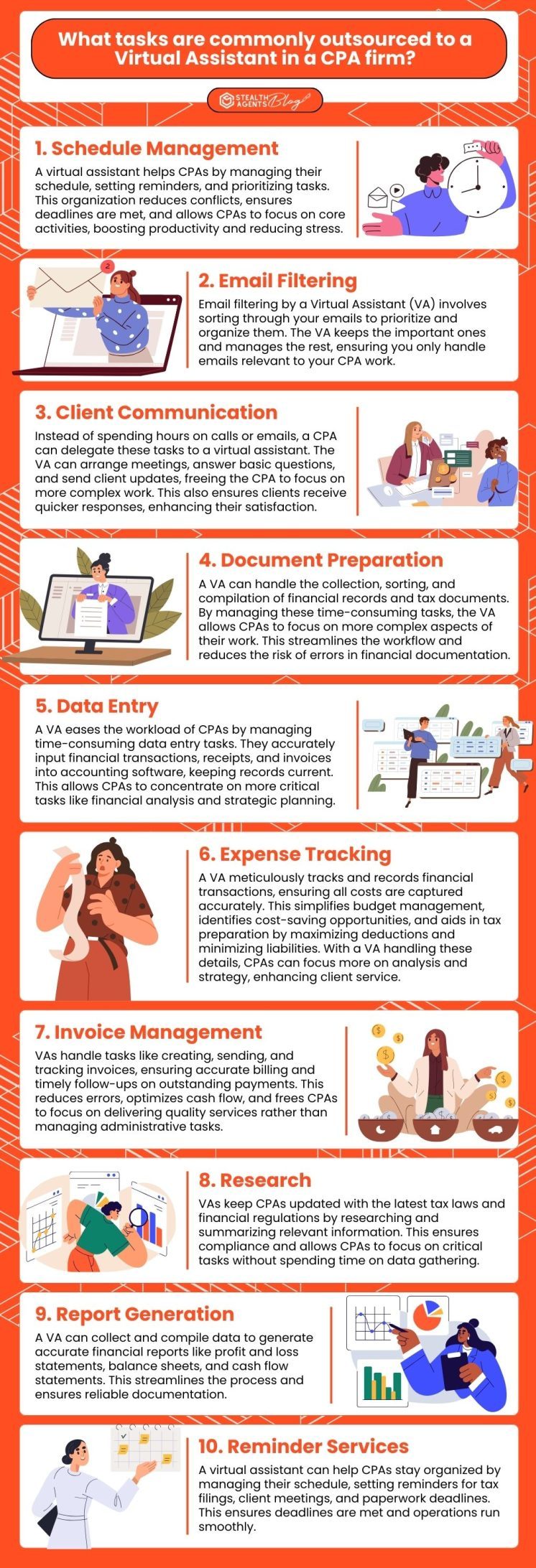

What tasks are commonly outsourced to a Virtual Assistant in a CPA firm?

1. Schedule Management

A virtual assistant can play a pivotal role in this aspect by organizing and prioritizing a CPA’s appointments, meetings, and work deadlines.

They can ensure that no conflicts occur in the schedule and reminders are set for important dates, allowing the CPA to focus on their core activities.

This saves time and helps in maintaining a work-life balance; XNSPY also can help you monitor, leading to increased productivity and reduced stress.

2. Email Filtering

Email filtering is a process where your Virtual Assistant (VA) for CPA sorts through all the emails you receive.

They keep the important ones that you need to see and organize the rest. This way, you don’t have to spend time going through every single email yourself.

The VA makes sure you only deal with emails that matter for your work as a CPA, saving you time and hassle.

3. Client Communication

Instead of spending hours on the phone or writing lengthy emails, a CPA can rely on a virtual assistant to handle these tasks.

This assistant can set up meetings, answer basic questions, and send updates to clients, making sure the CPA is free to focus on more complex tasks.

Plus, with a VA, clients can get faster responses to their queries, improving their overall experience and satisfaction.

4. Document Preparation

This involves collecting financial records, sorting receipts, and compiling important tax documents; all tasks that are crucial but time-consuming.

By handling the meticulous process of document preparation, a VA ensures that CPAs can focus on more complex aspects of their job.

This not only streamlines workflow but also reduces the risk of errors in financial documentation.

5. Data Entry

A VA significantly reduces the workload of CPAs by handling time-consuming data entry virtual assistant tasks

They meticulously input financial transactions, receipts, and invoices into accounting software, ensuring accuracy and up-to-date records.

This process enables CPAs to focus on more critical aspects of their job, like financial analysis and strategic planning.

6. Expense Tracking

By meticulously monitoring and recording every financial transaction, a VA ensures that all costs are accurately captured.

This process simplifies budget management and aids in identifying potential areas for cost reductions.

Furthermore, accurate expense tracking is essential for tax preparation, helping to maximize deductions and minimize liabilities.

So, you can focus more on analysis and strategy, thus providing better service to your clients; with a VA taking care of this detailed work.

7. Invoice Management

The VAs take over tasks such as creating, sending, and tracking invoices, ensuring that each client is billed correctly for the services rendered.

This saves time and reduces the likelihood of errors. Moreover, they can handle follow-ups on outstanding invoices, ensuring that payments are received promptly.

This optimizes cash flow and allows the CPA to focus more on providing quality services rather than getting bogged down with administrative tasks.

8. Research

For CPAs and accounting firms, staying updated with the latest tax laws, accounting standards, and financial regulations is crucial.

A VA can diligently comb through the vast sea of information to find relevant data, updates, and insights.

This ensures that a CPA’s knowledge remains current and saves valuable time that can be redirected toward more critical tasks.

9. Report Generation

A VA can gather data from various sources, compile it, and generate comprehensive reports.

This not only saves time but also ensures accuracy and reliability in financial documentation.

A VA can produce detailed reports such as profit and loss statements, balance sheets, and cash flow statements; with advanced software tools.

10. Reminder Services

A virtual assistant can greatly assist CPAs by managing their schedule and ensuring they don’t miss important deadlines.

VAs can set up reminder services for various tasks such as submitting tax filings, preparing for client meetings, or following up on pending paperwork.

This helps you stay organized and focused on your key responsibilities, ensuring everything runs smoothly and efficiently.

Where to Find Virtual Assistant for CPA?

Finding the right virtual assistant for CPA tasks can streamline your accounting needs, making operations more efficient and effective.

Here are the top five VAs for CPA tasks:

1. Stealth Agents

Stealth Agents offer a wide range of virtual assistant services, including specialized CPA tasks.

Their team of certified accounting virtual assistants is equipped to handle bookkeeping, tax preparation, and much more, ensuring you get the professional support you need.

They offer skilled and top-notch virtual assistants. Visit their website for free booking and discuss your preference and pricing information.

2. Belay

Belay is known for its high-quality virtual assistants, and Belay provides professionals who are well-versed in CPA-related tasks.

They carefully match your virtual accounting assistant to meet your accounting needs, offering services such as bookkeeping and financial planning.

3. MyOutDesk

This platform specializes in virtual professionals for various industries, including certified public accountants.

MyOutDesk virtual assistants can handle a broad spectrum of CPA tasks, from day-to-day bookkeeping to complex financial analyses.

4. Time Etc

Offering flexible virtual assistant services, Time Etc has professionals skilled in a variety of tasks, including those needed by CPAs.

Whether it’s managing finances, bookkeeping, or preparing reports, their assistants can handle it.

5. WoodBows

They provide virtual assistants who are experienced and have a strong background in accounting and CPA tasks.

WoodBows makes it easy to find someone who can manage your financial documentation, prepare reports, and support your accounting needs efficiently.

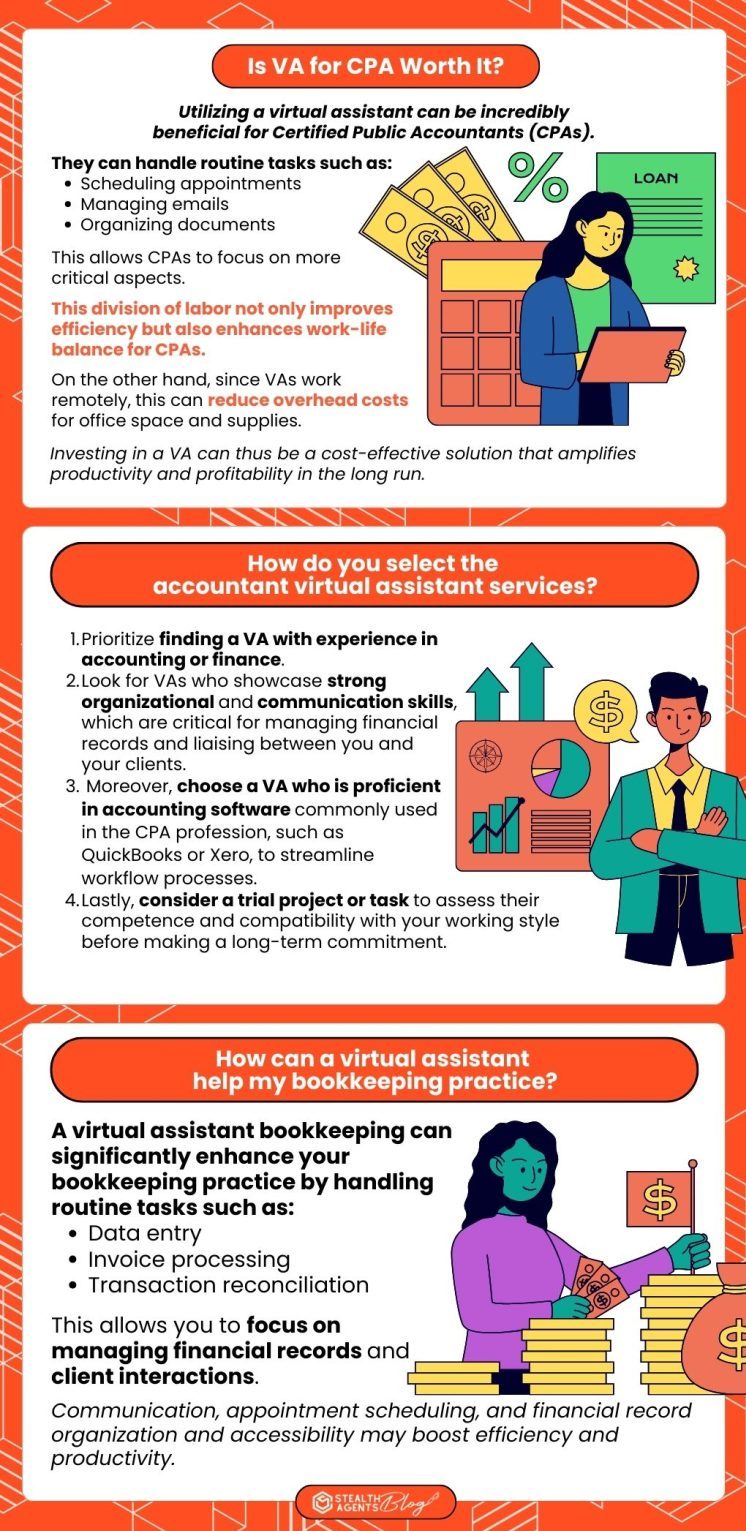

Is VA for CPA Worth It?

Utilizing a virtual assistant can be incredibly beneficial for Certified Public Accountants (CPAs).

They can handle routine tasks such as scheduling appointments, managing emails, and organizing documents, allowing CPAs to focus on more critical aspects.

This division of labor not only improves efficiency but also enhances work-life balance for CPAs.

On the other hand, since VAs work remotely, this can reduce overhead costs for office space and supplies.

Investing in a VA can thus be a cost-effective solution that amplifies productivity and profitability in the long run.

How do you select the accountant virtual assistant services?

Firstly, prioritize finding a VA with experience in accounting or finance, as this background knowledge is essential for handling CPA-specific tasks accurately.

Look for VAs who showcase strong organizational and communication skills, which are critical for managing financial records and liaising between you and your clients.

Moreover, choose a VA who is proficient in accounting software commonly used in the CPA profession, such as QuickBooks or Xero, to streamline workflow processes.

Lastly, consider a trial project or task to assess their competence and compatibility with your working style before making a long-term commitment.

How can a virtual assistant help my bookkeeping practice?

A virtual assistant bookkeeping can significantly enhance your bookkeeping practice by handling routine tasks such as data entry, invoice processing, and transaction reconciliation, allowing you to focus on managing financial records and client interactions.

Communication, appointment scheduling, and financial record organization and accessibility may boost efficiency and productivity.

Takeaways

A Virtual Assistant can greatly enhance the efficiency and productivity of Certified Public Accountants.

This not only leads to better client service but also contributes to a better work-life balance for CPAs.

You should consider hiring a Virtual Assistant to streamline your accounting practice and focus on high-value tasks.