Do virtual assistants need insurance? Where 59% of companies employ remote workers, virtual assistants have become indispensable, offering services like productivity enhancement and social media strategies.

As the roles of virtual assistants, including insurance virtual assistants and personal assistant insurance tasks, expand, the need for virtual assistant insurance becomes crucial to mitigate potential liabilities. Notably, 75% of small business owners view insurance as vital for maintaining operational stability and demonstrating professionalism.

This understanding reduces risks and enhances trust, especially for virtual assistants home-based or working for insurance agencies.

Stealth Agents stands ready to ensure your business and virtual assistant needs are met, offering free consultations on client preferences and virtual assistant pricing.

Do Virtual Assistants Need Insurance?

Like any business, operating as a virtual assistant does carry certain risks, and getting insurance can help mitigate those risks.

Here are the main types of insurance you might consider:

1. Professional Liability Insurance

2. General Liability Insurance

3. Cyber Liability Insurance

*advertisement*

Tired & Overwhelmed With Administrative Tasks?

Hire A Top 1% Virtual Assistant From Stealth Agents!

Sign Up Below & Hire A Top 1% Virtual Assistant

Rated 4.7 Stars Serving Over 2,000+ Customers.

Hire Top 1% Virtual Assistants For $10-$15 Per Hour

Ask About Our 14 Day Trial!

*advertisement*

4. Home-Based Business Insurance

5. Health Insurance

Having the right insurance helps ensure that an accident or lawsuit doesn’t spell the end of your business.

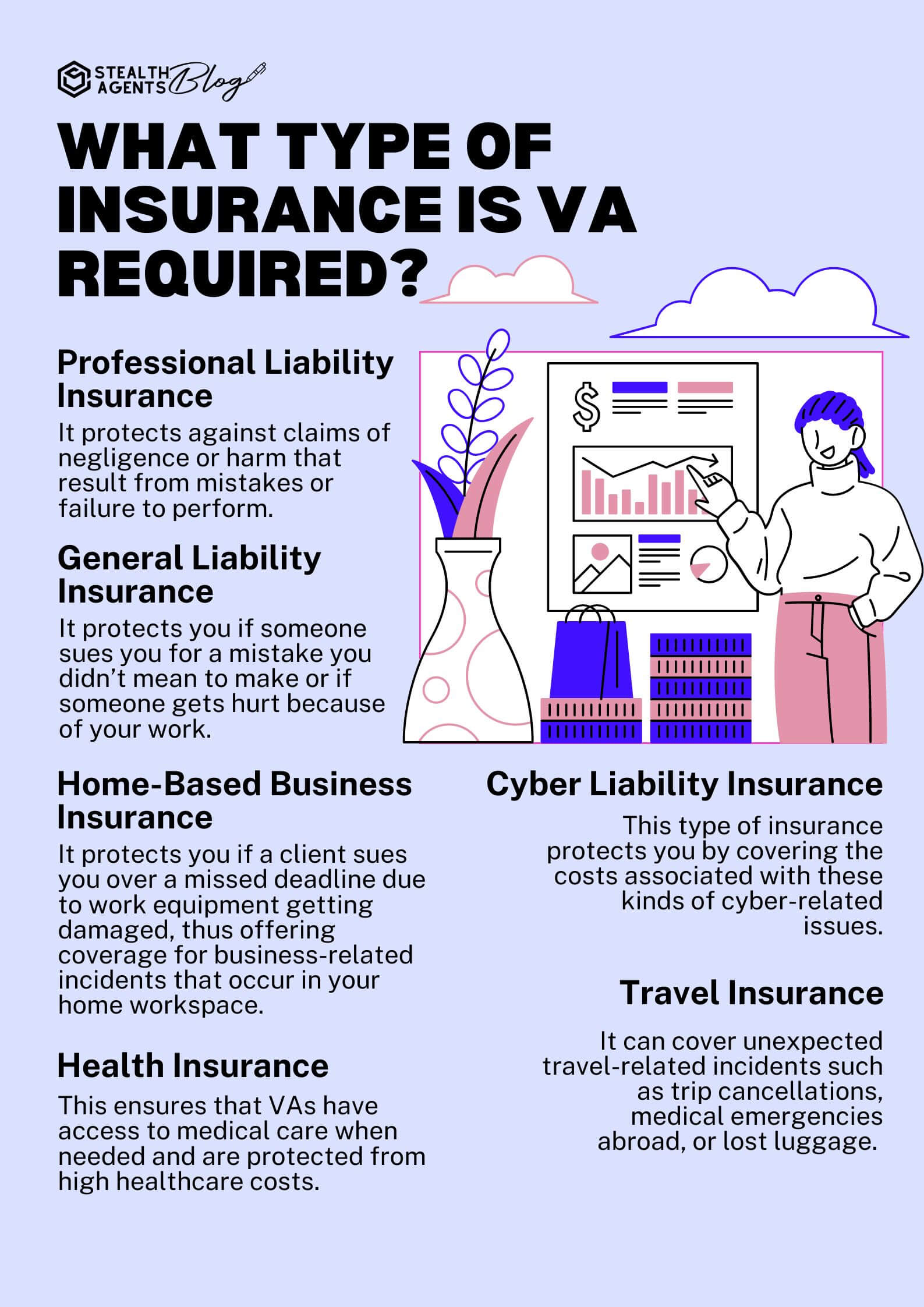

What Type of Insurance Is VA Required?

1. Professional Liability Insurance

Professional liability insurance is pivotal to the question, “Do virtual assistants need insurance?” It offers crucial protection against claims of negligence or harm that may arise from mistakes or failures to perform tasks effectively.

This type of insurance is essential for any insurance virtual assistant, as it covers legal costs and damages when clients allege financial loss due to the virtual assistant’s errors. Whether you’re a virtual assistant for an insurance agency or working as a personal assistant insurance provider, this coverage acts as a safeguard.

For instance, a scheduling mishap causing a client to miss an important meeting and lose business could be mitigated through strategic decision-making supported by this insurance.

Protecting your reputation and business operations is critical, and professional liability insurance helps increase productivity by allowing virtual assistants to focus on work without the looming fear of potential lawsuits. Moreover, it reduces stress associated with possible legal issues, contributing to better work-life balance techniques.

Including this insurance in your risk management strategy is a wise move for virtual assistants looking to thrive in their field.

2. General Liability Insurance

General liability insurance is a vital virtual assistant home-based business safety net. It offers protection when you’re sued for unintended mistakes or when someone is injured due to your professional activities.

Even though virtual assistants work online, this insurance is crucial for covering non-physical accidents that could lead to financial setbacks. Whether you’re an insurance virtual assistant or offering personal assistant insurance services, the risks associated with data breaches or sharing confidential information are accurate.

General liability insurance helps manage these risks, fostering strategic decision-making that bolsters your business’s reputation. It ensures that unplanned legal expenses do not hinder your ability to increase productivity.

Moreover, having this insurance supports increase productivity by mitigating the anxiety associated with potential lawsuits. Ultimately, this coverage is an indispensable component of a comprehensive virtual assistant insurance plan.

3. Cyber Liability Insurance

Cyber liability insurance is a critical component for those handling online data. With the rise of digital operations, security breaches, and data leaks pose significant threats to a virtual assistant home-based business.

This insurance is essential for a virtual assistant for an insurance agency, where sensitive client information is frequently handled. Cyber liability insurance covers the costs of cyber-related incidents, offering a strategic decision-making advantage by safeguarding against potential legal and financial repercussions.

It enables insurance virtual assistants to focus on their tasks, thereby increasing productivity without the constant fear of data mishaps.

Additionally, this insurance aids in maintaining work-life balance techniques by alleviating stress related to cybersecurity concerns. Cyber liability insurance is a necessary protection for virtual assistants aiming to maintain their professional integrity and operational efficiency.

4. Home-Based Business Insurance

Home-based business insurance is an essential consideration in the broader context of virtual assistant insurance. Often, virtual assistants operate from home, under the impression that standard homeowner’s policies suffice.

However, these policies typically do not cover business-related losses, making specific insurance vital. This coverage is crucial for virtual assistants offering personal assistant insurance services or those working as a virtual assistant for insurance agencies.

It fills the gap left by regular home insurance, covering incidents like equipment damage or client lawsuits over missed deadlines. Incorporating this insurance into your strategy allows for strategic decision-making that enhances your business’s resilience.

It supports efforts to increase productivity by ensuring unexpected costs do not derail your operations.

Moreover, home-based business insurance aligns with work-life balance techniques by providing peace of mind, knowing your business is protected.

5. Health Insurance

Health insurance is a pivotal aspect of virtual assistant insurance, particularly for those who are self-employed or operate as independent contractors. Without the backing of an employer, securing personal health insurance becomes a necessity.

This is true for a virtual assistant home-based and an insurance virtual assistant working in various capacities.

Virtual assistants can make strategic decisions about their health and financial well-being by investing in health insurance. It ensures access to medical care and protects against the high costs of unexpected medical emergencies, ultimately aiding in maintaining work-life balance techniques.

This coverage allows virtual assistants to focus on increasing productivity without worrying about medical expenses disrupting their finances.

Health insurance is crucial for a comprehensive risk management strategy, protecting virtual assistants from unforeseen personal and professional challenges. When asked the question, “Do virtual assistants need insurance?” the answer is a resounding yes, ensuring stability in unpredictable situations and safeguarding their career longevity.

6. Travel Insurance

Travel insurance emerges as a key element of virtual assistant insurance for those who occasionally travel for work-related events. Whether attending conferences, client meetings, or working temporarily abroad, travel insurance provides necessary coverage.

In the context of a virtual assistant working for an insurance agency, where travel might be sporadic yet essential, the question becomes: Do virtual assistants need insurance? Understanding insurance needs becomes crucial to ensure protection during necessary business travel.

Travel insurance covers unforeseen incidents like trip cancellations, medical emergencies, or lost luggage, offering invaluable support. It allows for strategic decision-making by ensuring disruptions do not affect business operations or personal finances.

As a result, virtual assistants can maintain their focus on increasing productivity, even when traveling.

Moreover, having travel insurance complements work-life balance techniques by reducing the stress associated with travel uncertainties. Overall, it serves as a vital safeguard, ensuring virtual assistants can operate with assurance beyond their usual workspace.

What Insurance Company Should I Use?

When selecting an insurer, evaluate the company’s financial stability, customer service reputation, coverage options, and competitive pricing. Consider discounts available and the ease of filing claims. Also, explore if virtual assistants need insurance to ensure comprehensive protection for all professionals.

You should look for a virtual assistant for insurance companies with high ratings from independent agencies like A.M. Best, S&P, or Moody’s, as these ratings indicate financial health.

To ensure you receive the best rate for the coverage you need, it’s crucial to compare quotes and policies from multiple insurers. This is particularly important when asking, “Do virtual assistants need insurance,” considering their unique professional requirements and potential risks.

You should also review each policy’s details, including deductibles, policy limits, and exclusions.

To ensure compliance and protection, verifying if a company or its virtual assistant is licensed in your state is crucial. Check with your state’s insurance department and address the question: Do virtual assistants need insurance?

What’s the Cost of Virtual Insurance Assistant?

The cost of personal assistant insurance varies depending on several factors, such as the level of coverage, your business size, the specific services you offer, and where you’re located.

Most companies that hire a virtual assistant are covered. Typically, a general liability insurance policy covering claims of bodily injury and property damage could range from $300 to $600 annually.

If you add professional liability insurance, which protects against claims of errors and omissions, your premium might increase.

If you handle sensitive information, you should consider cyber liability insurance to protect against data breaches, which can impact costs. Do virtual assistants need insurance? Cyber liability insurance is crucial for safeguarding against data-related financial losses.

On average, virtual assistants can expect to pay between $500 and $1,000 per year for a comprehensive insurance package that includes general and professional liability coverage.

Takeaways

Understanding the importance of virtual assistant insurance is crucial for anyone in the industry. As the question “Do virtual assistants need insurance?” arises, it becomes clear that protecting one’s business from potential liabilities is essential.

Personal assistant insurance offers peace of mind, ensuring unforeseen events won’t derail your professional journey. For those working as a virtual assistant for an insurance agency, the right coverage can safeguard against issues like data breaches, client disputes, or technical failures.

While opinions vary on the necessity of insurance, its value in risk management is undeniable, especially for virtual assistant home-based professionals.

As the digital landscape evolves, having adequate insurance virtual assistant coverage is a proactive step toward securing your business’s future. Embracing this protection allows you to focus on growth and delivering exceptional service.

To truly thrive in this competitive market, consider how Stealth Agents can enhance your business resilience with expert solutions tailored for virtual assistants.