Bookkeeping services are essential for keeping your business financially healthy and audit-ready, but managing it all in-house can be time-consuming and risky. Stealth Agents provides expert, tech-powered bookkeeping solutions that save you hours, ensure accuracy, and let you focus on growing your business book your free consultation today.

The global bookkeeping services market is estimated at USD 11.59 billion in 2025 and is projected to grow to USD 25.95 billion by 2034, at a CAGR of around 9.4%. Small to medium businesses make up roughly 70% of bookkeeping clients worldwide, and 70-90% now use cloud-based tools for record-keeping, reconciliation, and reporting. Moreover, in the US alone, payroll & bookkeeping services are expected to generate about USD 82.1 billion in 2025. To find the best among Top 50 services, look for firms that combine strong tech adoption, transparent pricing, scalability, and proven accuracy. At Stealth Agents, we vet bookkeeping services on all those metrics—ensuring you partner with one who delivers both reliability and growth.

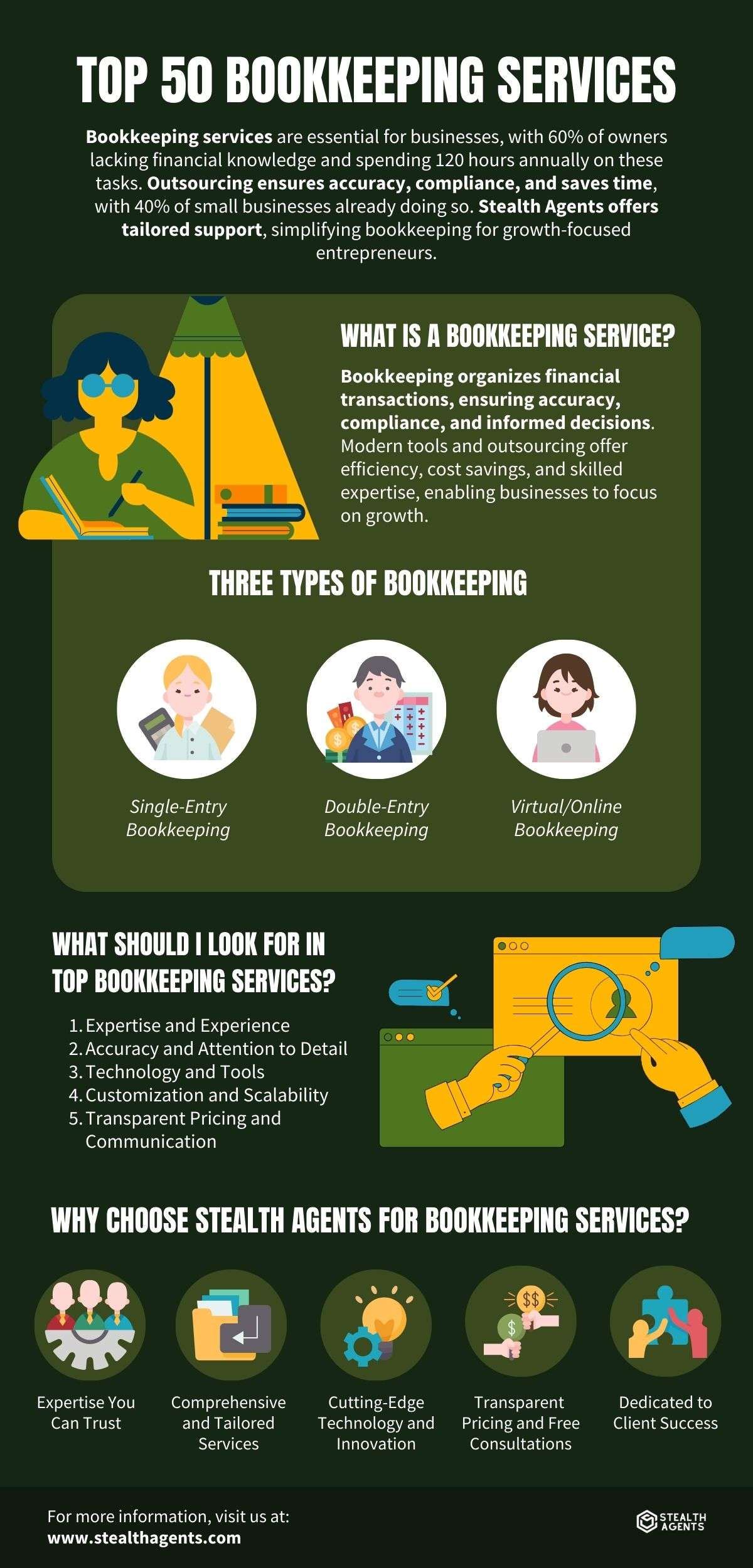

Bookkeeping Services are the backbone of efficient financial management for businesses of all sizes.

Studies show that over 60% of small business owners feel they lack financial knowledge, leading to costly errors and lost opportunities for growth.

Whether you’re managing a startup or leading an established enterprise, streamlined accounting can free up your time and reduce stress.

With businesses spending an average of 120 hours annually on bookkeeping tasks, outsourcing can be a game-changer.

Transitioning to professional bookkeeping ensures accuracy, compliance, and more time to innovate.

From payroll to tax prep, the right service delivers peace of mind and bottom-line results.

Trusted financial systems not only minimize risk but also improve decision-making with precise data.

According to recent reports, 40% of small businesses rely on outsourcing financial tasks for these very reasons.

At Stealth Agents, we take it a step further. With free consultations tailored to your preferences and virtual assistant pricing, we simplify your bookkeeping so you can focus on growth.

Bookkeeping Providers in the Global Marketplace

Business owners and finance leaders around the world have access to a wide range of bookkeeping services, with thousands of providers listed on platforms like Clutch and GoodFirms. These providers operate across regions such as North America, Europe, and Asia, offering options from small boutique firms to large, enterprise-level companies.

However, not all providers are clear about their services. Many don’t share much information about their processes, pricing, or success stories. This makes it important to choose providers who are open and transparent. Look for those who share case studies, client references, and clear details about their work. This way, you can compare options and find the best fit for your business.

Where Are Most Bookkeeping Providers Located?

When we look at bookkeeping around the world, a few places are at the top. The United States has the most bookkeeping companies. Right after the US are India and the United Arab Emirates. They are growing fast because they have skilled workers and use a lot of technology. The United Kingdom and Canada are also important places for bookkeeping.

These countries are the main players in the worldwide bookkeeping business. They give companies everywhere many good and new accounting choices. If you want to hire someone to do your bookkeeping, these places are a good place to start looking for a partner with experience and modern tools.

In-House vs. Outsourced Bookkeeping: Weighing the Options

There is no single right answer for whether hiring an outside bookkeeper is better or cheaper than hiring one to work in your office. The best choice depends on what your business needs.

An in-house bookkeeper is always there and can sometimes do other jobs, like HR or managing the office. This can be great for businesses that need someone present all the time.

Hiring an outside bookkeeper can save money, which is very helpful for new or small businesses. Instead of paying a full-time salary and benefits, you only pay for the work you need.

In the end, deciding between an in-house and an outside bookkeeper is about finding the right mix of control, cost, and ease. The right choice will let you focus on growing your business, knowing your money is being handled by an expert.

What is a Bookkeeping Service?

Bookkeeping is the process of recording and organizing a business’s financial transactions to ensure accurate financial management.

Key tasks involved in bookkeeping include tracking income and expenses, managing invoices, and reconciling bank statements to ensure financial data aligns.

Bookkeeping services help businesses maintain accurate financial records, which are crucial for analyzing financial performance and making informed decisions, just like the task of a Filipino financial analyst.

These services also play a vital role in ensuring compliance with tax regulations by preparing timely and accurate tax filings.

Modern bookkeeping often leverages technology, such as specialized software, to improve efficiency, minimize errors, and provide real-time financial insights.

Outsourcing bookkeeping services offers businesses cost savings and access to skilled professionals who understand complex financial requirements.

By delegating these tasks, businesses can focus on core activities while ensuring their finances are well-managed. Ultimately, effective bookkeeping supports sustainable growth and strengthens a company’s financial foundation.

What Additional Business Functions Can Outsourced Bookkeeping Services Support?

Outsourcing companies can do more than just manage your money. Many bookkeeping services, like the ones at Stealth Agents, offer other business support to help you with different tasks.

Here are some of the most valuable services you can get with bookkeeping:

- Payroll: They can handle your employees’ payments, including taxes and pay stubs, ensuring everything is correct and on time.

- Financial reports: You can access detailed reports that show how your business is performing financially, such as cash flow and profits.

- Taxes: They can help you get your papers ready for tax season, fill out your tax forms, and make sure you follow all the tax rules.

- Bills and payments: They can help you keep track of bills, pay them on time, and collect money that is owed to you.

- Legal admin help: Some companies can also help with contracts, business paperwork, and legal documents.

- Business advice: You can get advice from experts on how to make a budget, plan for the future, and grow your business using your financial information.

What Are the Most Common Working Models Among Bookkeeping Firms?

Bookkeeping firms know that every business is different, so they usually offer three main ways to work together:

- Full-Time Help: This is best for businesses that have a lot of financial work to do every day. You get a bookkeeper who works for you all the time, just like a regular employee.

- Part-Time Help: This works for businesses that need help regularly but not every single day. It’s a good choice for smaller companies that want to save money but still get expert help.

- Help When You Need It: This is perfect for new or small businesses that only need help sometimes, like at the end of the month or during tax time. You pay for a professional only when you need them.

What are the Three Types of Bookkeeping?

1. Single-Entry Bookkeeping

Single-entry bookkeeping is the simplest method, ideal for smaller businesses or sole proprietors.

It records only one side of each transaction, typically noting income and expenses in a cash book.

While easy to use, it lacks the depth needed for advanced financial tracking or detailed reporting.

This system works best for businesses with straightforward financial activities and no inventory to manage.

However, it’s limited in accuracy and scalability as your business grows.

2. Double-Entry Bookkeeping

Double-entry bookkeeping is a more sophisticated system widely used by businesses of all sizes.

It ensures every transaction is recorded in two accounts—one as a debit and the other as a credit, maintaining balance.

This method provides a full financial picture, making it easier to track assets, liabilities, and equity.

It’s crucial for companies with complex transactions or those needing to comply with financial regulations.

While it requires more effort, the accuracy and financial insights it offers are invaluable for growth and strategy.

3. Virtual/Online Bookkeeping

Virtual bookkeeping uses cloud-based tools or remote professionals to manage your business’s finances.

It combines the principles of traditional bookkeeping methods with the ease of modern technology.

This approach saves time, offers real-time updates, and allows access to expertise without hiring in-house staff.

It’s especially beneficial for startups or companies looking to cut costs while maintaining efficiency.

Virtual services often include advanced software that helps with reporting, payroll, and tax preparation, all accessible from anywhere.

What Should I Look for in Top Bookkeeping Services?

1. Expertise and Experience

Top bookkeeping services should have a team with substantial expertise and a proven track record. Experienced bookkeepers understand industry-specific needs and can handle complex financial scenarios with ease. Look for providers who specialize in your business niche, ensuring they align with your financial goals. Their experience helps avoid errors, ensures compliance, and saves valuable time. A skilled service provider can also offer insights to optimize your financial strategies.

2. Accuracy and Attention to Detail

Accurate bookkeeping is vital for making sound financial decisions and avoiding costly mistakes. The best services ensure meticulous data entry, thorough account reconciliation, and error-free records. Attention to detail means you’ll never face misfiled taxes, payroll issues, or overlooked expenses. Reliable accuracy builds confidence and keeps your books audit-ready at all times. High precision in record-keeping reflects a service’s dedication to professional standards.

3. Technology and Tools

Look for services that leverage advanced accounting software and tools, such as business accounting and tax preparation software, to enhance efficiency. Modern bookkeeping solutions often include cloud-based systems for real-time updates and secure data management. Automation features like expense tracking and invoice generation streamline your operations tremendously. Providers using cutting-edge technology deliver actionable insights through customizable financial reports. Access to such tools can reduce manual errors and increase your accounting’s productivity.

4. Customization and Scalability

The best bookkeeping services offer flexible solutions that adapt to your business needs. Whether you’re a startup or an established company, services should scale with your growth. They should provide tailored packages, often allowing you to choose from a range of features. Customization ensures you only pay for the services you need without unnecessary expenses. Scalability allows smooth transitions as your operations expand or evolve.

5. Transparent Pricing and Communication

Clear and transparent pricing structures are essential when choosing the right bookkeeping service. Avoid hidden fees by selecting providers who provide a detailed breakdown of costs upfront. Additionally, seamless communication is crucial for addressing your questions, concerns, or adjustments in real time. Look for services that assign a dedicated account manager or ensure consistent availability. Transparency and open communication foster trust and a productive working relationship.

How Can I Assess the Reputation and Credibility of a Bookkeeping Firm?

Checking a bookkeeping service’s reputation takes more than a quick online search. Reliable firms should have a history of happy clients and proven professionalism.

Start by reading reviews on their website and platforms like Google Reviews, Trustpilot, or the Better Business Bureau. These sites show real feedback from clients and can reveal both good and bad experiences.

Look for industry recognition too—check if the firm is part of groups like the American Institute of Professional Bookkeepers (AIPB) or the National Association of Certified Public Bookkeepers (NACPB). Awards or mentions in trusted media also build confidence.

If you know other businesses, ask for their recommendations to learn from their experiences. You can also check the firm’s case studies, client portfolio, or success stories to see their past work.

In short, a good bookkeeping service will have positive reviews, strong industry connections, and clear proof of their experience. This shows they are serious about offering great service and building trust.

Top 50 Bookkeeping Services

1. Stealth Agents

Stealth Agents provides comprehensive bookkeeping services designed to enhance business efficiency through meticulous financial management. Their team handles tasks such as transaction recording, reconciliation, and financial reporting, ensuring accurate and up-to-date financial records. With a strong emphasis on data security and personalized support, Stealth Agents empowers businesses to focus on their core operations while maintaining financial clarity.

2. Bookkeeper360

Bookkeeper360 specializes in providing bookkeeping and accounting solutions tailored to startups and growing businesses. Their integration with platforms like Xero allows for efficient management of payroll, bookkeeping, and tax services. With a dedicated team and advisory support, Bookkeeper360 helps businesses make strategic financial decisions and scale effectively.

3. Pilot

Pilot offers startups and small businesses a comprehensive suite of financial services, including bookkeeping, tax preparation, and CFO-level insights. Their team prioritizes accuracy and compliance, delivering detailed monthly reports that help businesses understand their financial health. With scalable solutions, Pilot enables enterprises to plan for growth and easily manage complex financial needs.

4. inDinero

inDinero delivers all-in-one accounting and tax services that simplify financial management for businesses of all sizes. Their offerings include bookkeeping, payroll, and CFO support, with a focus on streamlining operations. By leveraging their platform, businesses gain access to real-time insights, making it easier to manage finances and focus on expansion.

5. KPMG Spark

KPMG Spark provides modern, technology-driven bookkeeping and tax services for small and medium-sized businesses. Clients benefit from real-time data and insights, ensuring accurate financial records and better decision-making. Backed by the resources of KPMG, this service offers personalized support and compliance expertise, making it a trusted option for businesses.

6. Merritt Bookkeeping

Merritt Bookkeeping simplifies financial management for small businesses with its affordable and straightforward approach. Their services focus on delivering clean, accurate financial statements, ensuring businesses can maintain compliance. Merritt integrates seamlessly with popular accounting software, making it easy for clients to manage their books without additional hassle.

7. Bookkeeper.com

Bookkeeper.com provides a wide range of bookkeeping, payroll, and tax preparation services to small and medium-sized businesses. Their personalized approach ensures tailored financial solutions, allowing businesses to meet their unique needs. With experienced professionals and a strong focus on customer service, Bookkeeper.com delivers reliability and value.

8. AcctTwo

AcctTwo offers outsourced accounting and bookkeeping services that utilize cloud-based technology to provide real-time financial insights. Their expertise spans across various industries, offering scalable solutions to meet diverse needs. AcctTwo also delivers robust reporting and forecasting tools, helping businesses align their financial strategies with their goals.

9. Supporting Strategies

Supporting Strategies specializes in outsourced bookkeeping and operational support services for growing businesses. Using secure, cloud-based platforms, their team manages tasks such as accounts payable, receivable, and financial reporting. With a focus on efficiency and accuracy, Supporting Strategies helps businesses streamline their financial operations.

10. Bench Accounting

Bench provides online bookkeeping services tailored to small businesses, combining professional bookkeepers with user-friendly software. Their team delivers monthly financial statements and keeps business owners informed with real-time financial tracking. Known for its simplicity and accessibility, Bench helps clients stay organized and prepared for tax season.

11. QuickBooks Live Bookkeeping

QuickBooks Live connects clients with certified bookkeepers who manage day-to-day financial tasks directly through the QuickBooks platform. This service provides real-time collaboration, ensuring accurate financial records and insightful reporting. Ideal for small businesses, QuickBooks Live also includes cleanup services to help organize past financial data, making it easy to transition to seamless bookkeeping.

12. Xendoo

Xendoo offers flat-rate bookkeeping and tax services for small businesses, with plans designed to suit varying financial needs. Their team delivers monthly financial reports, including profit and loss statements, to keep businesses informed. With a focus on transparency and affordability, Xendoo also integrates seamlessly with popular platforms like QuickBooks and Xero, ensuring businesses have up-to-date insights.

13. Booksy

Booksy caters to service-based businesses by integrating scheduling tools with financial management and bookkeeping solutions. This combination allows business owners to streamline operations while maintaining accurate records of transactions. With additional features like client management and analytics, Booksy is a versatile tool for businesses in industries like beauty, wellness, and hospitality.

14. Wave Accounting

Wave offers free accounting and bookkeeping software, making it an excellent choice for freelancers and small businesses with tight budgets. Users can access features like expense tracking, invoicing, and receipt scanning for free. For those needing expert assistance, Wave provides paid professional bookkeeping and advisory services, ensuring businesses stay tax-ready and compliant.

15. Reconciled

Reconciled delivers virtual bookkeeping services tailored to small businesses and startups. Their team uses industry-leading software to provide accurate, up-to-date financial statements, including bank reconciliation and expense categorization. Reconciled’s advisory services also include strategic insights to help businesses optimize their financial health and plan for future growth.

16. Botkeeper

Botkeeper combines AI-powered automation with human oversight to handle bookkeeping tasks efficiently. This hybrid approach ensures error-free data entry, transaction categorization, and real-time reporting. Designed for scalability, Botkeeper is an ideal solution for accounting firms and growing businesses seeking to streamline their financial processes.

17. Sunrise by Lendio

Sunrise provides free tools for bookkeeping, making it an accessible option for startups and small businesses. Users can manage invoices, track expenses, and generate financial reports. For additional support, Sunrise offers paid bookkeeping services, including tax preparation and financial advice, giving businesses peace of mind during tax season.

18. FreshBooks

FreshBooks, widely recognized for its invoicing capabilities, also offers bookkeeping support tailored to freelancers and small businesses. The platform allows users to track expenses, send invoices, and generate financial reports. With its intuitive design and integrations with various apps, FreshBooks is a go-to solution for professionals seeking simple financial management tools.

19. Paro

Paro connects businesses with a network of vetted financial professionals for services ranging from bookkeeping to CFO-level advisory. Their on-demand model allows businesses to scale their financial management efforts without committing to full-time staff. Paro’s bookkeepers bring specialized industry knowledge, ensuring tailored solutions for every client.

20. Ignite Spot

Ignite Spot specializes in outsourced bookkeeping, accounting, and CFO services, catering to growing businesses. Their team provides detailed financial reports, cash flow analysis, and forecasting to help clients make informed decisions. With a focus on personalization, Ignite Spot’s services empower businesses to focus on scaling while maintaining financial clarity.

21. Bookkeeping Express

Bookkeeping Express tailors its services to franchise businesses, startups, and small enterprises looking for reliable financial management. Their team handles tasks like payroll, expense tracking, and financial reporting. With a focus on scalability, Bookkeeping Express offers cloud-based solutions that integrate seamlessly with existing accounting software.

22. H&R Block Small Business

H&R Block provides a blend of traditional accounting expertise and modern bookkeeping solutions designed for small businesses. Services include income tracking, expense categorization, and tax preparation. With nationwide offices and online support, H&R Block ensures businesses have access to personalized bookkeeping and advisory services year-round.

23. Flatworld Solutions

Flatworld Solutions offers customized outsourced bookkeeping services for industries like real estate, e-commerce, and healthcare. Their skilled professionals provide comprehensive financial management, including accounts payable/receivable, bank reconciliation, and financial reporting. Businesses benefit from cost-effective solutions without compromising accuracy and reliability.

24. ProLedge Bookkeeping

ProLedge Bookkeeping specializes in quick-turnaround bookkeeping for small businesses and entrepreneurs. They offer services such as bank reconciliation, payroll processing, and tax-ready financial statements. Known for its fast and efficient service, ProLedge helps businesses stay on top of their finances without delays.

25. Belay

Belay provides U.S.-based virtual bookkeepers who manage tasks such as financial reporting, bank reconciliation, and payroll processing. Their services are tailored to help small businesses and entrepreneurs focus on growth while maintaining financial clarity. Belay also prides itself on its exceptional customer service and experienced bookkeeping professionals.

26. GrowthForce

GrowthForce combines bookkeeping with advanced financial management to give businesses a comprehensive view of their financial health. Their services include cash flow analysis, budgeting, and custom financial dashboards. GrowthForce is ideal for businesses needing more than basic bookkeeping, offering insights that drive strategic decision-making.

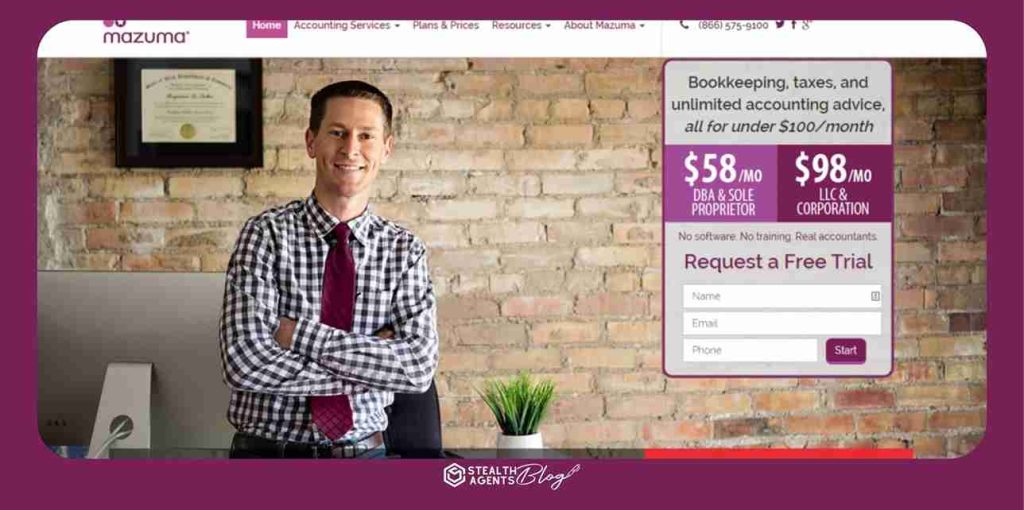

27. Mazuma USA

Mazuma USA offers affordable bookkeeping, tax, and advisory services for small businesses and freelancers. Their flat-rate pricing includes unlimited consultations and year-round support. Mazuma’s simple approach helps clients manage finances effectively, while their tax preparation services ensure compliance and accuracy.

28. Kashoo

Kashoo provides a user-friendly accounting platform paired with optional bookkeeping assistance. Business owners can track income, categorize expenses, and generate financial reports with ease. For added support, Kashoo’s professional bookkeeping services help ensure accurate records and tax readiness.

29. Outsourced Bookkeeping

Outsourced Bookkeeping focuses on delivering high-quality bookkeeping services for CPAs and accounting firms worldwide. Their services include data entry, ledger management, and reconciliation. With an emphasis on precision and confidentiality, Outsourced Bookkeeping enables accounting firms to scale operations effectively.

30. SLC Bookkeeping

SLC Bookkeeping specializes in bookkeeping and financial reporting for service-based businesses, including contractors, consultants, and agencies. Their services cover everything from cash flow management to custom financial reporting. With a dedicated team and proven methods, SLC helps clients maintain organized and accurate financial records.

31. MyOutDesk

MyOutDesk provides virtual assistant bookkeepers trained in bookkeeping and financial tasks, offering businesses a cost-effective way to manage their finances. Services include expense tracking, bank reconciliation, and financial reporting. MyOutDesk’s assistants work remotely and are trained to integrate seamlessly with popular accounting software, ensuring efficient and accurate bookkeeping.

32. Virtual Latinos

Virtual Latinos offers bilingual bookkeeping support for businesses catering to Spanish-speaking markets. Their team provides services like invoice management, expense categorization, and financial reporting. With a focus on cultural and linguistic alignment, Virtual Latinos is a great choice for businesses operating across diverse markets in the Americas.

33. WoodBows

WoodBows combines administrative and bookkeeping tasks into cost-effective virtual solutions, perfect for small businesses. Their team handles tasks like bank reconciliation, payroll processing, and financial statement preparation. With a focus on quality and reliability, WoodBows ensures clients can focus on their core business activities.

34. Remote CoWorker

Remote CoWorker offers competitive bookkeeping services for businesses worldwide, catering to industries such as e-commerce, real estate, and retail. Their bookkeepers manage tasks like expense tracking, financial reporting, and account reconciliation. Remote CoWorker’s affordability and flexibility make it a popular choice for startups and small businesses.

35. Prialto

Prialto provides managed bookkeeping services integrated with CRM tools to improve workflow and productivity. Their team handles routine tasks like invoicing, expense tracking, and reconciliation, ensuring businesses stay organized. With an emphasis on data security and seamless integration, Prialto helps businesses optimize their financial processes.

36. GoToMyAccounts

GoToMyAccounts specializes in remote bookkeeping services for real estate and property management firms. They offer tailored solutions, including rent collection tracking, ledger management, and tax preparation. Known for their expertise in the real estate sector, GoToMyAccounts helps property managers maintain accurate financial records.

37. Bookkeeping Angels

Bookkeeping Angels provides personalized bookkeeping solutions for nonprofits and small businesses. Their team focuses on tasks like donor contribution tracking, grant management, and expense categorization. By offering tailored services, Bookkeeping Angels helps organizations maintain transparency and compliance in their financial reporting.

38. Outsource2India

Outsource2India delivers bookkeeping support for U.S. and U.K.-based businesses at highly competitive rates. Their services include ledger maintenance, payroll processing, and financial statement preparation. With a focus on accuracy and efficiency, Outsource2India enables businesses to save time and reduce costs.

39. UAssist.ME

UAssist.ME specializes in bilingual bookkeeping services for growing businesses across the Americas. Their team handles tasks like invoice management, expense categorization, and financial reporting. With a focus on language flexibility and cost-effectiveness, UAssist.ME supports businesses expanding into Spanish-speaking markets.

40. TaskBullet

TaskBullet offers bucket-hour plans for bookkeeping services, combining flexibility with affordability. Their bookkeepers handle financial tasks such as bank reconciliation, expense tracking, and financial reporting. TaskBullet’s unique model allows businesses to allocate hours as needed, making it a practical choice for dynamic bookkeeping needs.

41. Freelance Bookkeepers

Freelancer Bookkeepers connects businesses with independent bookkeeping professionals, offering flexible and cost-effective solutions. These bookkeepers are skilled in various financial tasks such as expense tracking, bank reconciliation, and financial reporting. This platform allows businesses to find and collaborate with experienced bookkeepers tailored to their specific needs.

42. LedgerGurus

LedgerGurus specializes in bookkeeping services for e-commerce businesses, offering expertise in inventory tracking, sales tax management, and profit analysis. They integrate with major e-commerce platforms like Amazon and Shopify to provide accurate and actionable financial insights. Their team’s deep industry knowledge makes them a top choice for online retailers.

43. Zeni

Zeni uses AI-driven tools to automate bookkeeping, providing businesses with real-time financial insights and analytics. Their platform handles tasks such as transaction categorization, financial reporting, and expense tracking with minimal human intervention. Zeni’s innovative approach is ideal for startups and tech-savvy businesses seeking efficient bookkeeping solutions.

44. BooksTime

BooksTime matches businesses with dedicated bookkeepers for full-service support, including accounts payable/receivable, payroll processing, and financial reporting. Their personalized approach ensures each client receives tailored bookkeeping solutions. BooksTime’s team provides ongoing support and consultation to help businesses maintain financial clarity.

45. Virtual Bookkeepers USA

Virtual Bookkeepers USA offers remote bookkeeping services tailored to small and medium-sized businesses. Their team handles tasks such as bank reconciliation, expense management, and financial reporting. With a focus on affordability and convenience, they serve as an accessible option for businesses seeking reliable virtual bookkeeping solutions.

46. Bench Tax Assist

Bench Tax Assist combines Bench’s bookkeeping services with expert tax filing assistance for seamless year-round financial management. Their team ensures books are up-to-date and tax-ready, helping businesses avoid last-minute surprises. This integrated approach is perfect for small businesses looking to streamline bookkeeping and tax compliance.

47. BKE Bookkeeping

BKE Bookkeeping specializes in managing day-to-day financial operations for small businesses and entrepreneurs. Services include cash flow management, invoice tracking, and preparing tax-ready financial statements. Their experienced bookkeepers provide reliable and timely support, ensuring businesses remain financially organized.

48. CloudBooks

CloudBooks offers cloud-based bookkeeping solutions for startups and tech-focused businesses. Their platform simplifies financial management with features like automated expense tracking, invoicing, and reporting. CloudBooks also provides optional bookkeeping services, allowing businesses to focus on growth while professionals handle their finances.

49. AccountingDepartment.com

AccountingDepartment.com provides full-service virtual accounting, including bookkeeping, payroll, and tax preparation for mid-sized businesses. Their dedicated team ensures compliance and accuracy with advanced software tools and custom financial dashboards. AccountingDepartment.com is a reliable partner for businesses seeking comprehensive financial solutions.

50. CapActix

CapActix offers outsourced bookkeeping services powered by advanced technology to deliver cost-efficient and accurate financial management. Their team provides services such as financial reporting, tax preparation, and payroll management. CapActix caters to businesses globally, ensuring seamless operations and scalability.

How Stealth Agents Help Your Business

Stealth Agents provides tailored solutions to help businesses streamline operations, save time, and focus on growth. From seamless onboarding to advanced automation, their services are designed to deliver measurable results.

1. Seamless Onboarding and Task Setup for Immediate Impact

Stealth Agents ensures a smooth onboarding process, allowing businesses to get started quickly without disruptions. Their team works closely with you to understand your needs, set up tasks, and align with your workflows. This approach ensures that your virtual assistant can start delivering value from day one.

2. Integration with Cloud Accounting Software like QuickBooks and Xero

Stealth Agents integrates seamlessly with popular cloud accounting tools like QuickBooks and Xero to simplify financial management. This allows businesses to track expenses, manage invoices, and maintain accurate records effortlessly. By leveraging these integrations, you can ensure your financial data is always up-to-date and accessible.

3. KPI Monitoring and Performance Reporting for Business Insights

Stealth Agents provides detailed KPI tracking and performance reports to help you make data-driven decisions. These insights allow you to monitor progress, identify areas for improvement, and measure the impact of your virtual assistant’s work. With regular updates, you can stay informed and maintain control over your business operations.

4. Automation of Recurring Bookkeeping Tasks to Save Hours Weekly

By automating repetitive bookkeeping tasks, Stealth Agents helps businesses save valuable time and reduce errors. Tasks like data entry, bank reconciliation, and expense categorization are handled efficiently, freeing up your team to focus on strategic priorities. This automation ensures consistency and accuracy in your financial processes.

5. Dedicated Support for SMEs, Startups, and Growing Enterprises

Stealth Agents specializes in supporting small and medium-sized businesses, startups, and enterprises with tailored solutions. Their virtual assistants are trained to adapt to your unique needs, whether it’s administrative support, customer service, or marketing assistance. This dedicated approach ensures that businesses of all sizes can scale effectively and achieve their goals.