Virtual assistants for wealth managers help streamline client communication, administrative tasks, and data management—so you can focus on growing portfolios, not paperwork. Stealth Agents provides expert, cost-effective VAs tailored for financial professionals, giving you back your time and boosting productivity.

When leveraging support for wealth advisory operations, a virtual assistant for wealth managers can make a significant difference. Firms report that automation and digital workflows have reduced operational costs by up to 67% and improved onboarding speed by 40% in recent years. By partnering with Stealth Agents, wealth managers gain access to specialized VAs who handle tasks like client communications, portfolio monitoring, and administrative workflows, freeing advisers to focus on high-touch, strategic client service.

Managing a wealth management business can be overwhelming when you’re juggling client relationships, preparing reports, and staying on top of endless paperwork. Virtual Assistants for Wealth Managers provide a smart, cost-effective way to handle these time-consuming tasks efficiently. Studies show that outsourcing tasks can save up to 40% of operational costs, giving you more time to focus on growing your business.

By partnering with Stealth Agents, you can access experienced virtual assistants for wealth managers who specialize in administrative support, research, and client management. Imagine delegating routine responsibilities and having more bandwidth to focus on high-value strategies and client satisfaction.

Whether you need help organizing your schedule, managing client communications, or preparing for key meetings, a virtual assistant can be your secret weapon for success. With virtual assistants for wealth managers price rate options that fit your budget, you can easily boost productivity. Book a free consultation now to learn more about how Stealth Agents can help your business thrive!

What Are Virtual Assistants in Wealth Management?

Virtual assistants in wealth management are highly skilled professionals who offer remote support for tasks that help improve efficiency and save time. They can handle scheduling meetings, organizing financial data, managing customer accounts, and creating reports, all tailored to meet your specific needs. By taking care of these administrative and repetitive tasks, a virtual assistant allows financial advisors like you to focus entirely on providing expert financial advice and growing your client base.

You won’t need to worry about missing deadlines or keeping track of endless paperwork because they ensure everything runs smoothly in the background with a GoHighLevel workflow. They are cost-effective compared to hiring in-house staff since you only pay for the exact time or tasks you require, helping you manage your budget smartly. With their help, you can maintain consistent communication with clients or ensure reports are prepared accurately without sacrificing your time or energy.

If you’re looking for someone to support your work, a virtual assistant offers a flexible, reliable, and efficient solution to streamline your wealth management operations.

What Are the Key Benefits of Hiring Virtual Assistants for Wealth Managers?

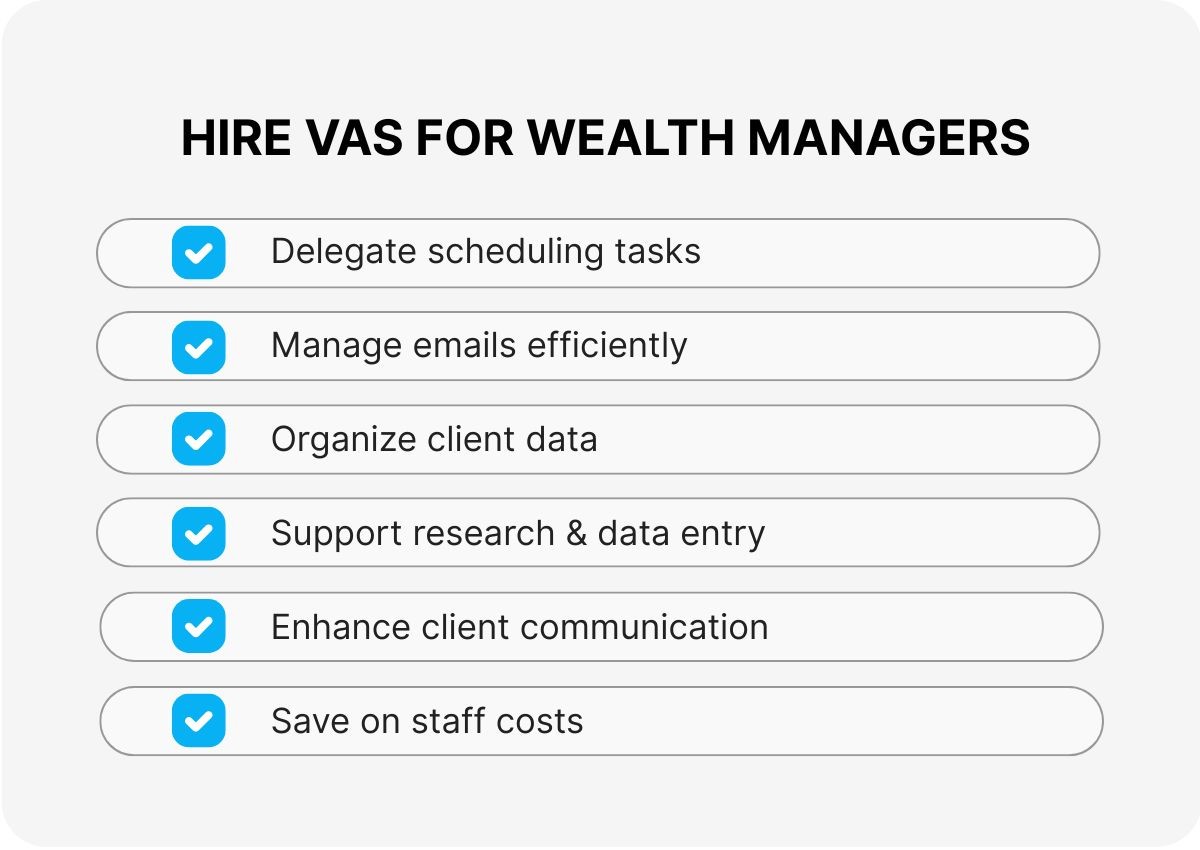

Hiring virtual assistants can save wealth managers a lot of time by handling tasks like scheduling meetings, managing emails, and organizing client data so you can focus on financial strategies. These assistants are a cost-effective solution because you pay only for the hours worked instead of hiring full-time staff, helping you lower expenses without sacrificing quality. They also enhance client satisfaction by ensuring prompt responses and seamless communication, which fosters trust and loyalty.

With virtual assistants keeping operations on track, you’ll have more time to build relationships with clients and develop strategies to grow their wealth. Tasks like research and data entry, when handled by skilled assistants, allow you to make informed decisions faster and more efficiently. Plus, you don’t need extra office space or equipment since they work remotely, keeping your setup simple and hassle-free.

By hiring virtual assistants, you’re investing in better time management, improved productivity, and a smoother experience for both you and your clients.

Common Services a Wealth Manager Delegates to a Virtual Assistant

Hiring a virtual wealth assistant can make managing your responsibilities easier and more productive. Below are the most common services you, as a wealth manager, can delegate to wealth assistants, ensuring a smoother workflow and happier wealth clients.

Each service is carefully crafted to save time and improve results for your virtual wealth management tasks.

1. Scheduling Appointments and Calendar Management

A wealth management assistant can handle scheduling your client meetings, setting reminders, and coordinating with other professionals, making your day smoother and more organized. When you rely on wealth assistants for this task, you free up hours every week that would’ve been spent juggling calls and emails.

Why

Virtual client management ensures that your schedule stays up-to-date and free of conflicts, which reduces stress. If last-minute changes happen, a virtual wealth assistant can notify clients and reschedule accordingly, keeping things professional. This level of organization helps maintain strong relationships with wealthy clients because they feel valued and important. Virtual wealth tools used by trained assistants make managing even complex schedules easier.

Simply communicating your needs allows them to take full responsibility for keeping your calendar perfect.

2. Managing Emails and Client Communication

Delegating email management to a wealth assistant ensures that you aren’t overwhelmed by a flood of daily messages. Your wealth management assistant can organize inquiries, reply to non-priority emails, and flag critical ones for your attention. This keeps your inbox from feeling chaotic and ensures no important communication with your wealth clients gets lost or delayed. Virtual client management also allows health assistants to draft well-written responses that maintain a professional tone.

They can set up automated systems for common inquiries or reminders, saving even more time. With a reliable wealth assistant, your virtual wealth management communication becomes seamless and stress-free. Trusting someone to handle routine interactions keeps you focused on bigger, more important tasks.

3. Client Onboarding Support

Client onboarding is a time-consuming process, but a virtual wealth assistant can make it hassle-free and thorough. They help collect essential documents, send out welcome material, and guide wealth clients through the first steps of your services. A wealth management assistant ensures no details are missed, creating a great first impression for your virtual wealth management business. They can also maintain detailed records for compliance purposes, which is critical in this industry.

With health assistants overseeing this, the onboarding process is quicker and feels personalized for the client. A smoother and well-managed start builds trust with your clients right away. Giving this responsibility to a virtual wealth assistant allows you to focus on faster and more strategic growth for your business.

4. Researching Investment Opportunities

Wealth managers often rely on strong research to provide sound financial advice, and a wealth assistant can handle a big part of this workload. Virtual wealth assistants can compile detailed reports on markets, new investment opportunities, and potential risks. This saves you time while ensuring your clients benefit from informed decisions. Wealth assistants excel at identifying trends and presenting the information clearly, making their findings easy to review.

Being prepared with accurate insights enhances your credibility with wealthy clients and helps them trust your expertise. Virtual wealth management tools make this research process faster and more efficient. Delegating this work allows you to focus on crafting the best financial strategies for your clients without losing valuable time.

5. Maintaining Client Databases and Confidential Records

A clean, well-maintained database is crucial for any wealth manager, and this is another job perfect for a wealth management assistant. Virtual wealth assistants can organize, update, and secure client records, ensuring that your files stay accurate. They can also track client preferences and past transactions, helping you offer more personalized service to your wealth clients. This is especially important if you handle virtual client management or assist clients from different time zones.

By trusting wealth assistants with this task, you minimize the risk of errors or gaps in important information. Keeping these records up to date ensures better compliance and smoother communication. Assigning this role to a virtual wealth assistant saves you time and improves the overall quality of your service.

6. Preparing Client Reports and Presentations

Creating detailed client reports can eat up a lot of time, but it’s a service a virtual wealth assistant can handle with ease. They gather data, analyze it, and summarize it in a way that’s easy for your wealth clients to understand. Whether it’s quarterly performance updates or financial summaries, wealth assistants produce professional materials that build trust. Virtual wealth management’s tools and resources make the process even more efficient and polished.

You’ll have more time to focus on explaining these reports rather than compiling them. Clients appreciate thoughtful and clear insights because they help them feel more confident in their decisions. By assigning this task to a wealth management assistant, you ensure accuracy and timeliness in every report.

7. Tracking and Sending Client Follow-Ups

Maintaining strong client relationships often depends on staying in consistent contact, which is something a wealth assistant excels at managing. Wealth assistants can send personalized follow-ups, reminders, or birthday greetings to help you nurture rapport with wealth clients. Virtual client management allows them to create preset but highly personal communication strategies based on client preferences. These small but meaningful interactions keep you top of mind for your clients and show that you genuinely care.

By trusting this duty to a virtual wealth assistant, you maintain professional interactions without letting anything slip through the cracks. With their help, each client feels valued and prioritized, which strengthens long-term relationships. Regular, well-timed follow-ups lead to greater satisfaction and more potential referrals.

8. Managing Social Media and Marketing Efforts

Many wealth managers overlook the impact of an online presence, but a virtual wealth assistant can take care of your social media and marketing needs effortlessly. From posting updates to sharing helpful financial tips, they handle everything while staying consistent with your voice. Virtual wealth management benefits greatly from staying visible and accessible online, where potential wealth clients can easily discover you. Wealth assistants can also track analytics, showing which efforts gain the most engagement, so your strategy keeps improving.

This lets you focus on your financial expertise while still building a strong personal brand. With an assistant promoting your services, you engage your audience without spreading yourself too thin. A trusted social media strategy ensures that your practice grows without overloading you.

Why Choose Stealth Agents for Hiring Virtual Assistants for Wealth Managers?

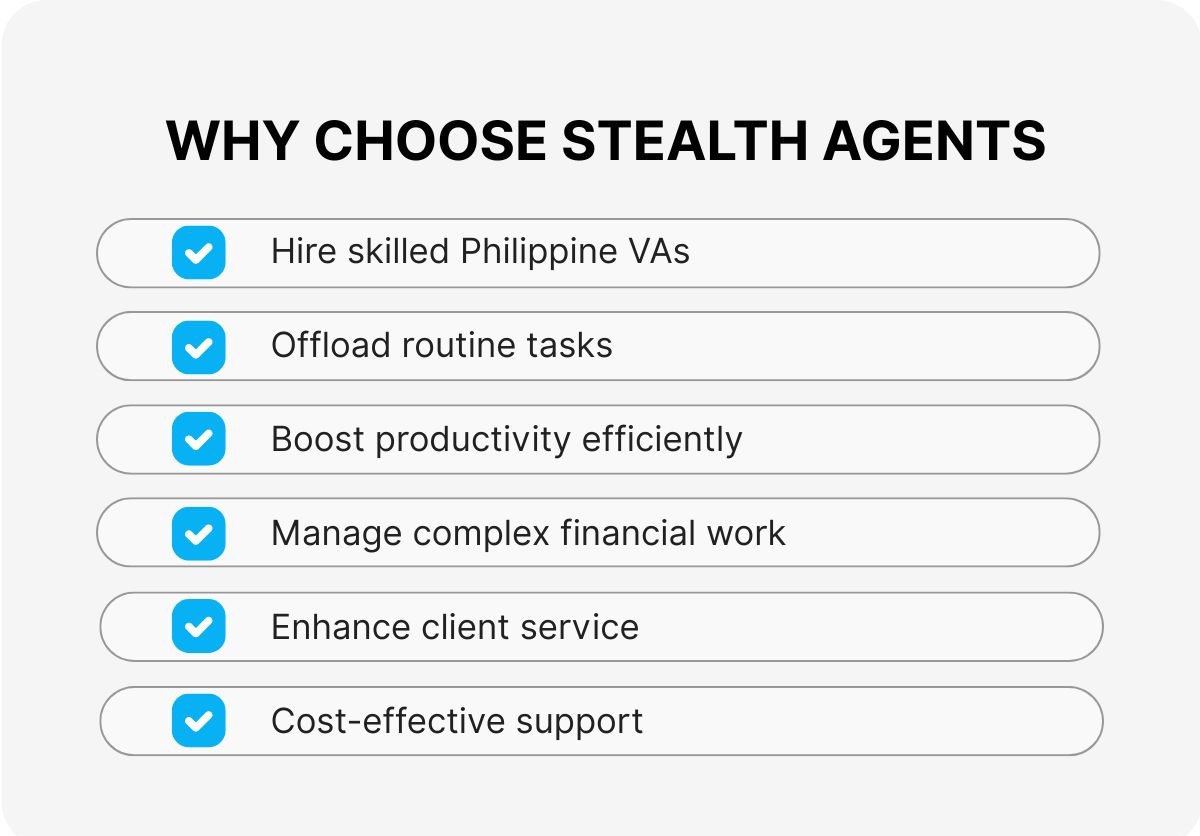

Stealth Agents is a top-tier choice for wealth managers seeking virtual assistants.

It is renowned as one of the best virtual assistant agencies and has solid expertise in supplying skilled professionals from the Philippines.

Their reputation is built on delivering reliable and highly specialized services tailored to the unique demands of the financial industry; they hire the Philippines’ best virtual assistants to ensure cost-effectiveness.

Wealth managers benefit from their ability to enhance productivity by offloading routine tasks.

This allows managers to focus on strategic decision-making and client engagement.

Stealth Agents produce virtual assistants adept at managing complex financial tasks, ensuring seamless operations and superior client service.

This combination of quality, expertise, and affordability makes Stealth Agents an invaluable partner in the competitive landscape of wealth management.

Takeaways

The integration of virtual assistants for wealth managers is transforming the financial services landscape by significantly boosting efficiency and client satisfaction.

These skilled professionals manage administrative tasks, allowing wealth managers to redirect their focus to strategic planning and personalized client interactions.

This shift enhances productivity and fosters substantial cost savings, making it a highly cost-effective solution for firms aiming for growth.

Virtual assistants contribute to improved time management, ensuring wealth managers can devote more attention to high-value activities and optimize their service delivery and competitiveness.

As the demand for streamlined operations and exceptional client service rises, the strategic employment of virtual assistants positions wealth managers at the forefront of the industry, offering a distinct advantage in a dynamic marketplace.

Managing your clients can be tough. A virtual assistant can help you with calls, paperwork, and more. Get started today and take back your time.

Frequently Asked Questions

How do virtual assistants help with regulatory compliance in wealth management?

Virtual assistants help wealth managers stay compliant by organizing and updating important documents, keeping track of deadlines, and making sure industry rules are followed. They can also assist with audits and keep records of communications to avoid mistakes and ensure transparency.

What tools do virtual assistants use for data management in wealth management?

They use tools like CRM systems, spreadsheets, and financial software to manage data. These tools help them organize client details, track financial transactions, and monitor investment portfolios, making sure the information is accurate and easy to access.

Why is cybersecurity important when hiring virtual assistants for wealth management?

Cybersecurity is important because virtual assistants handle private financial and client information. Strong security measures protect this data from being stolen, keep client details safe, and build trust in the wealth management service.

How can virtual assistants improve client satisfaction in wealth management?

Virtual assistants improve client satisfaction by responding to questions quickly, offering personalized help, and managing tasks efficiently. This allows wealth managers to spend more time building relationships and giving clients the advice they need.

What are common challenges when integrating virtual assistants into wealth management?

Challenges include keeping data secure, setting up clear communication rules, and fitting virtual assistants into existing workflows. Proper training, secure tools, and clear instructions can help solve these issues and make the process smooth.

How do virtual assistants assist with portfolio monitoring in wealth management?

They help by keeping track of how investments are performing, creating reports on market trends, and alerting wealth managers about risks or opportunities. This helps wealth managers make better decisions and adjust plans when needed.

What criteria should wealth managers consider when selecting a virtual assistant?

Wealth managers should look for virtual assistants with experience in finance, knowledge of financial tools, good communication skills, and the ability to keep information private. These qualities ensure the assistant can meet the needs of the business.

How can virtual assistants contribute to business development in wealth management?

Virtual assistants can help grow the business by researching potential clients, managing outreach efforts, and tracking how people respond. This allows wealth managers to focus on finding new clients and growing their services.

What are the best practices for effectively managing virtual assistants in wealth management?

Best practices include setting clear goals, staying in regular contact, using tools to manage tasks, and providing training when needed. These steps help virtual assistants stay on track and provide the best support possible.

How do virtual assistants support tax preparation for wealth managers?

They help with tax preparation by organizing financial records, keeping track of expenses, and preparing basic reports. This makes the tax filing process easier, ensures accuracy, and allows wealth managers to focus on advising clients.