Virtual assistants for insurance agency services make it easy to streamline your operations by handling admin tasks like claims processing, client follow-ups, and data entry, so you can focus on selling policies and growing your business. Stealth Agents provides highly skilled VAs at a fraction of in-house costs, helping insurance agencies save time, cut expenses, and boost client satisfaction.

Insurance agents typically spend up to 38-60% of their day on , data entry, follow-ups, renewals, documentation, leaving less than half their time for sales and client relationships.

Virtual assistants trained for insurance can recover 10–30 hours per week for an agency by handling these repetitive tasks.

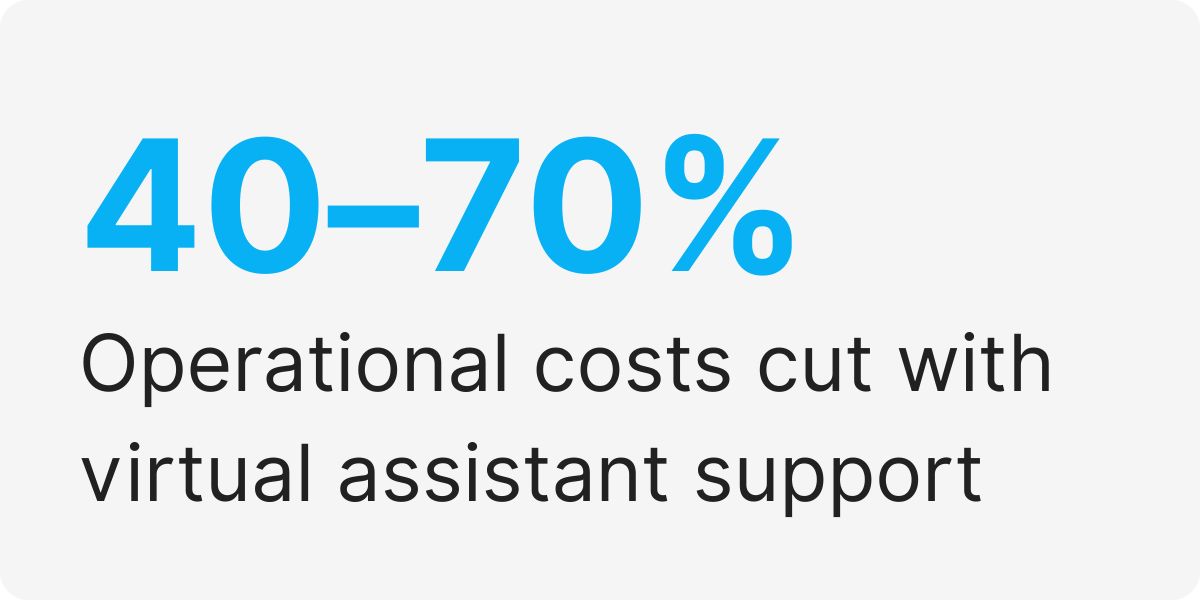

Agencies leveraging VAs often cut operational costs by 40-70% compared to hiring full-time in-house staff, once you factor in salary, benefits, office space, and training.

Virtual assistants can handle everything from managing policy renewals and claims to scheduling client meetings, helping you find a virtual assistant for insurance agency price rates that fit your budget while saving you time and resources.

What is a Virtual Assistant for an Insurance Agency?

A virtual assistant for an insurance agency provides essential support with time-consuming administrative tasks, helping agents focus on client relationships and sales. An insurance virtual assistant can manage customer inquiries, process claims, schedule appointments, and handle data entry efficiently. Recent studies show that businesses using virtual assistants can save up to 78% in operational costs compared to traditional hires.

Professionals in this field often possess expertise in CRM tools and industry-specific software, enabling precise task execution. Hiring a skilled insurance agency virtual assistant is a smart choice for scaling services without the expense of full-time staff.

Compliance Rules for Delegating Licensed Insurance Tasks

Virtual assistants can handle many tasks in your insurance agency, but it’s important to follow the rules when it comes to jobs that require a license. Most virtual assistants are not licensed agents, so they cannot sell insurance, give advice about coverage, or sign important documents.

Here’s how to stay compliant:

- Know the Rules: Check your state’s insurance laws and guidelines from groups like the National Association of Insurance Commissioners (NAIC).

- Assign Tasks Carefully: Make sure only licensed agents handle jobs that require a license. Keep administrative tasks separate.

- Give Clear Instructions: Provide virtual assistants with clear guidelines about what they can and cannot do.

- Audit Regularly: Review your processes often to ensure you’re following the rules.

- Ask for Help if Unsure: Consult your compliance officer or legal advisor if you’re not sure about task limits.

How Virtual Assistants Help Insurance Agencies

Virtual assistants (VAs) have made a big difference for insurance agencies by taking on important tasks and helping teams work more efficiently. Here are some real-world examples:

- Better Administrative Workflows: VAs handle tasks like data entry, policy renewals, claims processing, and scheduling. This frees up in-house teams to focus on bigger projects and building client relationships.

- Faster Client Service: VAs help with follow-ups, document checks, and client communication, ensuring nothing is missed. For example, mortgage companies use VAs to track loans and verify paperwork, speeding up the process.

- Marketing Support: VAs manage social media, create content, and organize email campaigns, helping agencies stay connected with clients while licensed staff focus on sales.

- Accurate Billing: VAs take care of invoicing and payments, reducing errors and keeping cash flow steady.

- Help with Hiring: When agencies grow, VAs assist with screening candidates, scheduling interviews, and managing onboarding paperwork.

- Time Savings: Across different insurance fields, VAs save teams hours each week, allowing staff to focus on bringing in new clients and increasing revenue.

Are Insurance Virtual Assistants Licensed Agents?

Most virtual assistants in the insurance industry are not licensed agents. They focus on support tasks like entering policy data, following up on claims, scheduling appointments, and answering customer questions.

However, they cannot sell insurance, give advice about coverage, or handle tasks that require a state license. These jobs should always stay with your licensed staff to follow industry rules.

Virtual assistants are there to make your work easier, not to replace licensed agents. This way, your agency stays compliant while enjoying the benefits of extra support.

How Do Insurance Companies use VMS?

Insurance companies use Vendor Management Systems (VMS) to streamline and manage their relationships with third-party vendors and service providers.

A VMS helps insurance companies track and oversee vendor performance, ensuring that all services meet the required standards and compliance regulations. It allows them to manage contracts, monitor deadlines, and ensure that vendors deliver services on time and within budget.

Insurance companies also use VMS to handle billing and payments, making the process more efficient and reducing errors. The system provides detailed reporting and analytics, helping insurers make data-driven decisions about vendor selection and performance.

Additionally, a VMS can assist in managing temporary staffing needs, such as hiring claims adjusters during peak periods, ensuring the right resources are available when needed. Overall, VMS helps insurance companies improve efficiency, reduce costs, and maintain better control over their vendor relationships.

How Virtual Staffing Solutions Address Key Insurance Workforce Challenges

The insurance industry is no stranger to staffing headaches, think endless recruitment cycles, high turnover, and mounting admin tasks that make your desk look like a paperweight convention.

Virtual staffing solutions step in as the smart fix for agencies navigating these workforce hurdles.

-

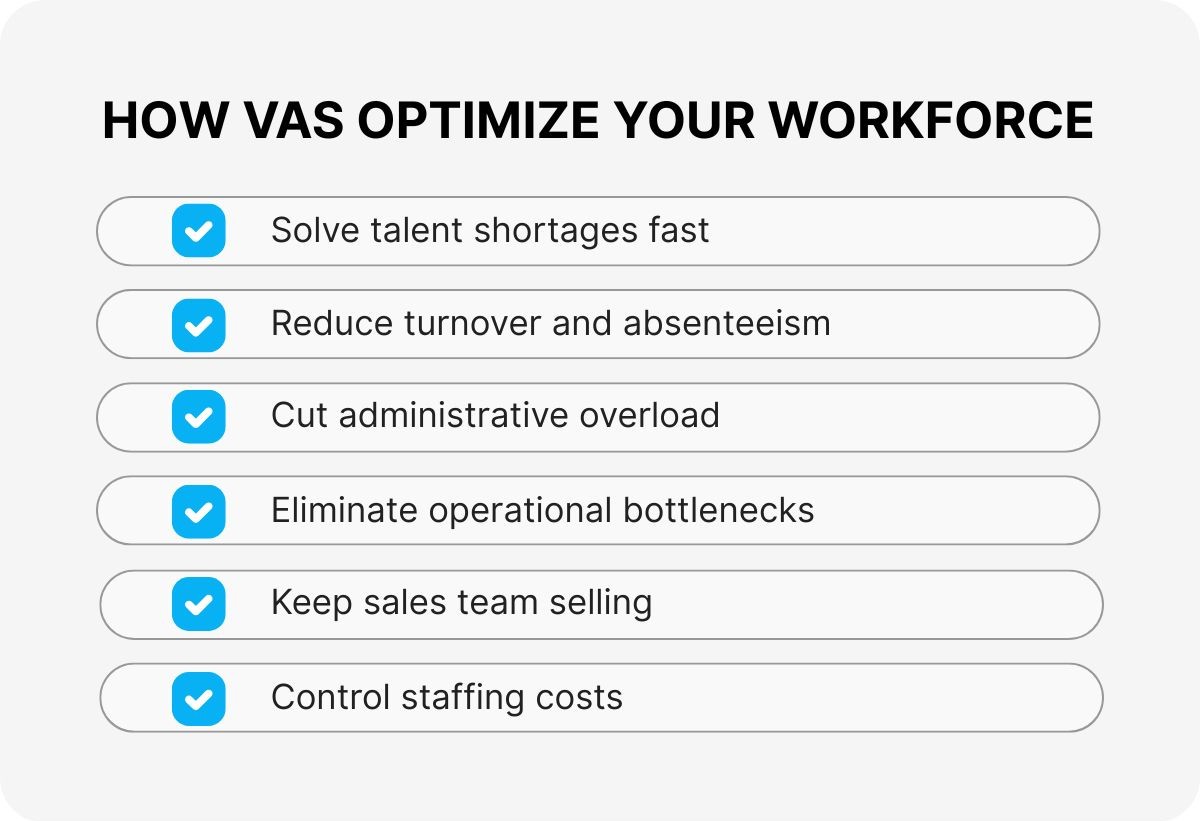

Solve Talent Shortages Fast

Don’t let the shortage of qualified professionals in your area hold your agency back.

Virtual assistants, especially those trained for insurance operations, are ready to hit the ground running, so you skip the lengthy recruiting process and fill team gaps without delay.

-

Reduce Turnover and Absenteeism

Frequent staff changes can throw a wrench in your workflow and client service.

With reliable virtual support, you gain consistent team members who stick around, ensuring continuity and reducing disruptions in daily operations.

-

Cut Down Administrative Overload

Agencies often find staff buried under mounds of data entry, billing, and document management, none of which brings in revenue.

By outsourcing these time-consuming tasks to insurance-savvy virtual assistants, your employees reclaim valuable hours for strategic, client-focused work.

-

Eliminate Operational Bottlenecks

Backlogs in quoting, policy issuance, and renewals can stall your agency’s growth.

Virtual staffing streamlines these processes, ensuring faster turnaround across the insurance lifecycle while keeping service levels high.

-

Keep Your Sales Team Selling

You hired producers to close deals, not chase paperwork.

Virtual assistants take over appointment scheduling, lead follow-ups, and CRM maintenance, so your sales team can get back to what they do best, building relationships and driving revenue.

-

Control Staffing Costs

Balancing payroll against service quality is always tricky.

Virtual staffing offers a cost-effective way to scale your workforce, letting you adjust support levels to meet your agency’s demands and budget, all without the hidden costs of full-time hires.

-

Access Specialized Skills on Demand

When you need expertise in compliance, claims management, or insurance accounting, but aren’t ready to commit to another full-time hire, virtual assistants with these niche skills are available.

This means you get specialized support without additional overhead.

-

Scale Support as Your Business Grows

Agencies fluctuate; sometimes you need extra hands, other times you scale back.

Virtual staffing brings that flexibility, allowing you to right-size your support team seasonally or as your business expands.

By tapping into virtual staffing solutions, insurance agencies can tackle workforce challenges head-on, promoting stability, efficiency, and growth in a fast-changing market.

Qualifications and Training for Insurance Sector Virtual Assistants

To excel as a virtual assistant within the insurance industry, candidates need a strong foundation in both administrative skills and sector-specific knowledge. Most insurance VAs come equipped with:

- Excellent communication and organizational skills

- Experience with client correspondence and managing schedules

- Comfort with data entry, document handling, and CRM tools such as Salesforce or Zoho

- Familiarity with insurance terminology, compliance standards, and policy processes

Many aspiring VAs choose to enhance their expertise through relevant certifications.

Popular options include courses from platforms like Coursera, Udemy, or LinkedIn Learning, covering topics like customer service, data protection, and insurance-specific systems.

Best Virtual Assistant for Insurance Agency

A virtual assistant for insurance agency tasks is an invaluable support system for busy insurance professionals. They handle daily responsibilities like data entry, client follow-ups, managing policy renewals, and organising claims, allowing agents to shift their focus to growing their business.

Trending job skills like CRM management, customer service, and lead generation are integrated into their roles, making them even more versatile. Agencies can further optimize operations by including an insurance virtual assistant to support administrative tasks or manage client communications, adding efficiency without increasing headcount.

Virtual assistant insurance services are particularly appealing for agencies aiming for cost efficiency, as they reduce the need for in-house staff. With the rise of remote work, hiring such assistants has become popular, offering flexibility without compromising work quality. They bridge the gap between administrative efficiency and customer satisfaction, ensuring smoother operations. Investing in a virtual assistant for insurance agency roles is an innovative and practical decision for agencies seeking reliable and cost-effective support.

How much does Stealth Agents charge?

Stealth Agents takes pride in delivering exceptional value, with our pricing starting at $18.75 per hour or $3,000 per month for 160 hours of dedicated assistance. These rates reflect our commitment to providing access to the industry’s leading 1% of virtual assistants, ensuring you receive reliable, high-quality support.

If you hire virtual assistants from Stealth Agents, you are selecting a reliable partner that ensures top-notch quality and efficiency at unbeatable prices. This makes us the best choice for US businesses seeking to boost productivity without exceeding their budget. Whether you need administrative support, project management, or specialised skills, our dedicated virtual assistants help you succeed.

Why Stealth Agents?

– Unique Corporate Identity

– Dedicated Support Staff

– Flexible Contract Terms

– Streamlined Candidate Evaluation

– Professional Indemnity Coverage

– Onboarding Process

– Enhanced Data Security

Pros:

– Highly skilled

– Very responsive

– Experienced agents

– Cost-effective support

What Does an Insurance Virtual Assistant Do?

1. Client Onboarding and Account Management

A virtual assistant for insurance agents takes charge of onboarding new clients, ensuring all required paperwork is completed accurately and securely filed. This includes setting up detailed client profiles that are easy to access for future reference. They also maintain ongoing communication, proactively checking in with clients to provide updates and share information about policies or changes that could benefit them, fostering strong client relationships.

2. Email and Communication Management

Insurance virtual assistants expertly manage your emails, filtering out unnecessary messages while responding promptly to routine inquiries. This guarantees that no critical communication goes unnoticed. They also streamline social media messages and phone calls, ensuring all channels of communication are operating effectively and saving you valuable time.

3. Appointment Scheduling

A virtual assistant for an insurance agency enhances appointment management by making it more efficient and organised. They handle incoming appointment requests, quickly update schedules, and even send reminders to both agents and clients. This ensures your calendar runs smoothly, reducing the likelihood of missed meetings and increasing productivity.

4. Claims Processing and Follow-Up

With insurance virtual assistance, managing claims becomes hassle-free as the assistant oversees every step of the process with accuracy. They verify claim details, coordinate with involved parties, and resolve any complications swiftly. This detailed handling ensures claims are processed efficiently, allowing insurance agents to provide better service.

5. Policy Management

A virtual insurance assistant helps keep client policies updated and accurate, making sure all information is current and stored securely. They also manage renewals, edits, and other associated paperwork. By taking over these tasks, agents can focus on delivering exceptional customer service without being bogged down by administrative work.

6. Lead Management

Insurance virtual assistants help streamline your lead management process by organising and tracking every prospective client efficiently. Using advanced CRM tools, they ensure a steady flow of opportunities within your sales pipeline. This decreases the chances of missed follow-ups while effectively securing new business leads for your insurance agency.

7. Financial and Administrative Tasks

From processing client documents to managing billing inquiries, insurance virtual assistants can handle various daily administrative needs. They also support bookkeeping and keep client records updated for better operational flow. This allows your agency to allocate more resources toward core areas like attracting new clients and policy development.

8. Marketing and Social Media Management

A virtual insurance assistant elevates your online presence by creating well-designed posts, managing social media accounts, and responding to feedback. They analyse engagement statistics to refine future strategies. Effective online management helps attract potential clients while reinforcing your agency’s credibility and brand image.

9. Customer Service

Through outsourced insurance answering services, VAs ensure inquiries are answered promptly and accurately, leaving customers satisfied. They also assist clients during the claims process by addressing concerns and providing timely updates. Reliable service enhances client satisfaction and showcases your agency’s dedication to customer care.

10. Data Management and Reporting

Insurance verification virtual assistants assist with tracking claims, managing policy updates, and compiling detailed reports. These reports provide insight into trends and help streamline decision-making processes. This organised data management allows your agency to operate more efficiently, delivering better results for clients while staying competitive in the market.

What are the Benefits of a Virtual Assistant for Insurance Agencies?

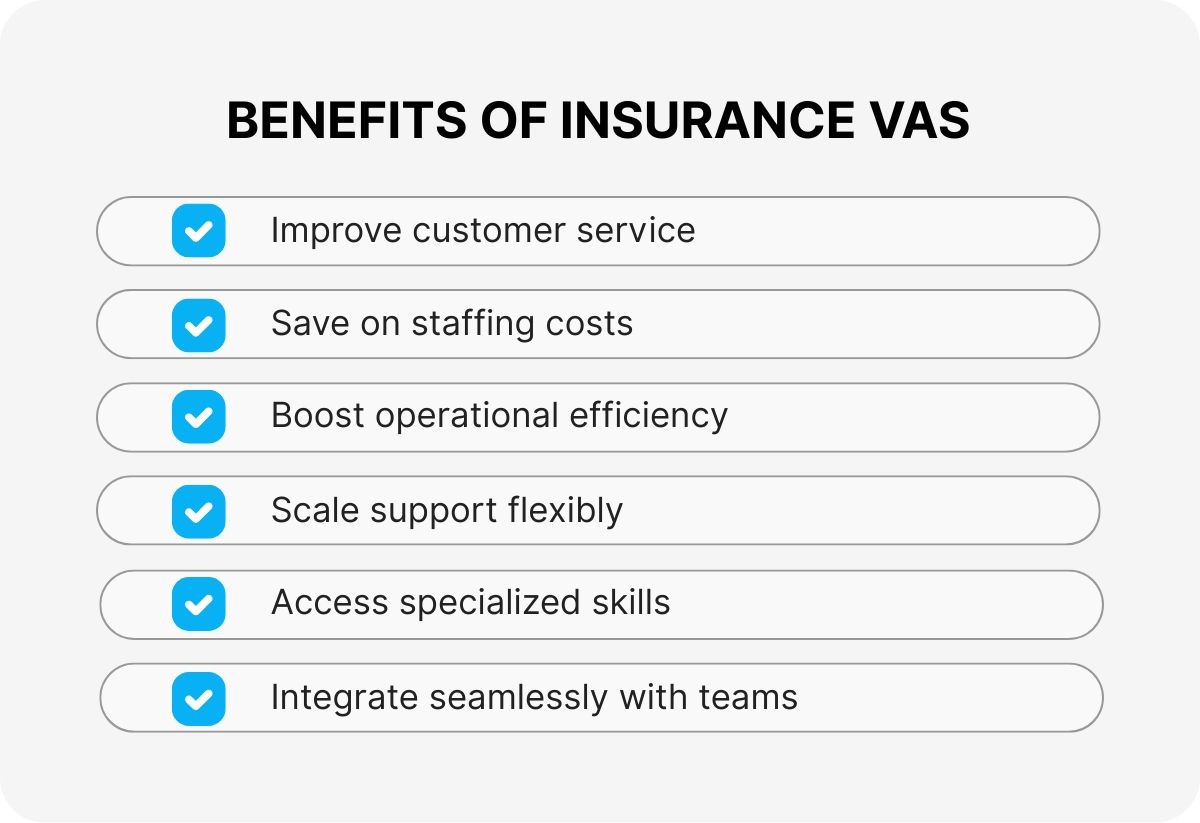

✅ Improved Customer Service

A virtual assistant for insurance agency tasks greatly improves customer service through prompt and personalised responses. They can manage claims effectively, handle inquiries, and provide essential support, ensuring clients always feel cared for. Studies show businesses offering 24/7 customer service see up to a 93% boost in retention rates, making VAs an invaluable asset. From basic client queries to complex claims management, they guarantee seamless communication between insurance agencies and their clients.

✅ Cost Savings

Hiring an insurance virtual assistant significantly reduces expenses by cutting costs tied to full-time staff, such as workspace, benefits, and equipment. Insurance brokers leveraging virtual assistants can save up to 50% compared to maintaining in-house employees. Project-based or hourly charges, like $3,000 monthly for 160 hours, help agencies effectively manage resources. This approach ensures financial stability while maintaining exceptional service quality.

✅ Enhanced Efficiency

Virtual assistants for insurance brokers provide crucial support by efficiently managing claims, updating records, and processing client inquiries. Their expertise ensures quick and accurate task completion, which boosts overall productivity and customer satisfaction. Insurance brokers using virtual assistants can handle up to 40% more customer requests without compromising quality. This streamlining allows agencies to focus on core responsibilities while maintaining client confidence.

✅ Flexibility and Scalability

Insurance agency virtual assistants allow businesses to scale operations effortlessly in response to workload demands. During peak seasons or unexpected surges, insurance cold-calling VAs can manage high volumes of outreach efficiently. Additionally, agencies can easily reduce reliance on VAs during slower periods without the complications tied to traditional hiring. This adaptability ensures resources are allocated effectively, regardless of business fluctuations.

✅ Access to Specialised Skills

Insurance virtual assistants bring expertise in handling industry-specific tasks like claims processing, regulatory compliance, and database management. These particular abilities offer effective help without the time and money required for hiring and internal staff training. With a virtual assistant for an insurance agency, agencies gain access to experienced professionals who improve service quality and ensure operational success. This approach supports both immediate needs and long-term agency growth.

✅ Seamless Integration and Global Team Advantages

One of the standout benefits of using an international virtual assistant team for insurance operations is their ability to blend smoothly with your agency’s existing workflows.

Many leading agencies find their VAs easily synchronize with both remote and in-office teams using popular collaboration tools like Slack, Zoom, and Microsoft Teams.

Here’s what an international VA team brings to the table:

- No Recruitment Hassles: Save valuable time and resources by bypassing lengthy hiring processes,your agency gains instant access to pre-vetted talent with relevant industry experience.

- Customizable Coverage: Virtual assistants can align with your business hours, regardless of time zones. That means efficient support for clients across multiple regions,even during peak periods or after-hours.

- Collaborative Culture: International teams often work from dynamic, tech-forward environments that foster teamwork, professional development, and accountability.

- Improved Work-Life Balance: Many international virtual assistant providers emphasize a healthy balance, reducing turnover and ensuring your agency receives dependable support.

- Scalable Staffing: Whether you need to quickly ramp up for a busy season or scale down during slower months, global VAs provide flexibility without the administrative headaches of traditional hiring.

Summary

Virtual assistants play a crucial role in insurance agencies by improving customer service, enhancing efficiency, reducing costs, and providing scalability. Their specialised skills and adaptability make them indispensable for insurance brokers aiming to thrive in a competitive market. If you’re seeking ways to grow your business and deliver exceptional service, hiring a virtual assistant for insurance company support could be the ideal solution.

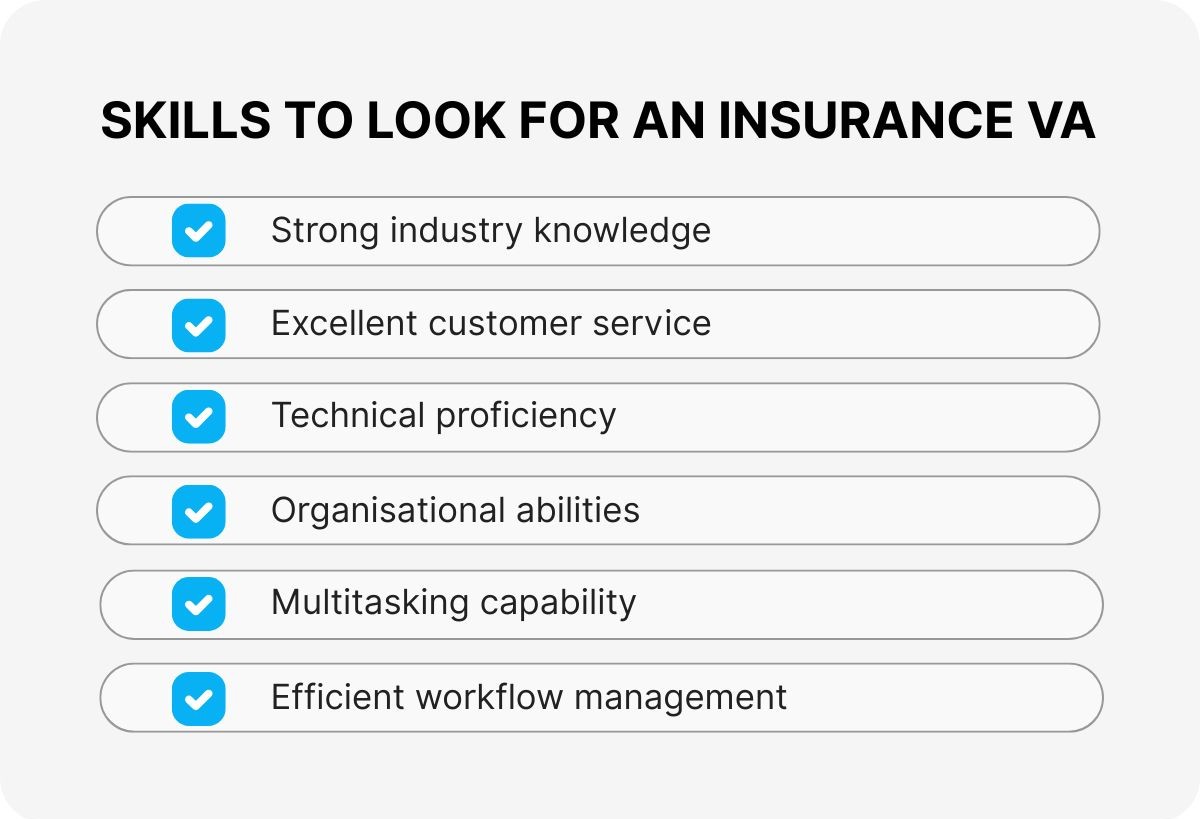

What to Look for in an Insurance Virtual Assistant?

1. Industry Knowledge

A deep industry understanding is crucial when searching for a virtual assistant for an insurance agency role. Insurance requires expertise beyond policies, covering regulations and specific customer needs. A Philippines-based intelligent virtual assistant for insurance companies brings experience in effectively addressing complex industry demands. Their knowledge ensures smooth operations and better client support.

2. Customer Service Skills

Excellent customer service is essential for virtual assistants and insurance agents to provide outstanding client experiences. With polished interpersonal and communication skills, they can handle policyholder inquiries professionally and courteously. Insurance virtual receptionist services improve client satisfaction by building loyalty with effective responses. Exceptional service skills leave a long-lasting positive impression on your customers.

3. Technical Proficiency

Advanced technical skills are vital for a digital assistant to perform insurance company tasks, ensuring seamless efficiency. These assistants work expertly with CRM systems, analytics tools, and insurance databases like Allstate’s virtual assistant. Insurance verification virtual assistant services deliver accurate, timely claims and manage documentation. Their technical proficiency adds value by avoiding delays or errors.

4. Organisational Abilities

Organisational skills allow a virtual assistant for an insurance agency to keep operations efficient and precise. Whether juggling scheduling or maintaining detailed records, their expertise reduces operational hiccups. Outsourced insurance verification services benefit from well-structured workflows and minimised inconsistencies. Strong organisational abilities make them instrumental to your agency’s productivity.

5. Multitasking Capability

The multitasking ability of an insurance virtual assistant ensures they can manage multiple responsibilities simultaneously. From handling emails to addressing claims and scheduling, they maintain operational balance effectively. Their ability to juggle tasks without compromising quality ensures nothing is overlooked. Virtual assistants for insurance agents enable you to focus on larger goals while they accurately manage day-to-day details.

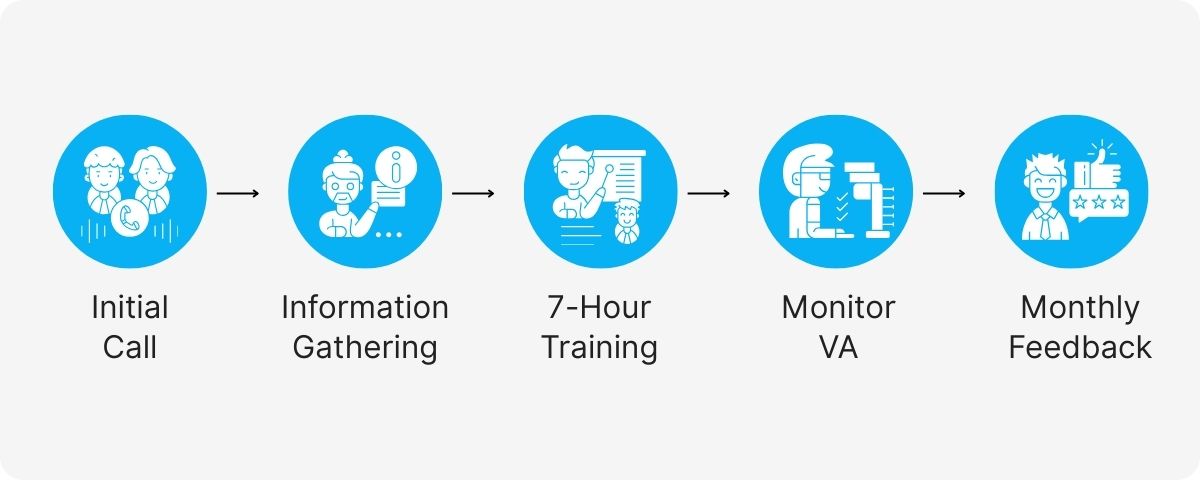

What is the Onboarding Process for Stealth Agents

The onboarding process at Stealth Agents ensures a smooth transition and customised support to meet your business needs. This process is designed to align your objectives with the expertise of the virtual assistant while keeping everything simple, efficient, and effective.

- ✅ After the initial call, gather all necessary information to align your needs with the VA’s skills and expertise.

- ✅ We dedicate seven business hours to training and identifying skills that best fit your requirements.

- ✅ Your VA’s performance is supervised and monitored by a campaign manager for added reliability.

- ✅ Monthly VA reviews allow you to provide feedback, request changes, or adjust tasks through the campaign manager.

Seamless Integration and Ongoing Support

Stealth Agents’ VAs integrate seamlessly into your team, no need to worry about recruiting hassles, onboarding headaches, or training marathons.

Your virtual assistant aligns with your business hours, preferred tools, and established workflows.

Our team is based in a collaborative environment, fostering smooth communication and strong teamwork, so your VA becomes a true extension of your business.

Focus on Growth and Team Well-being

We don’t just match you with a VA and call it a day.

Our culture emphasizes ongoing growth and professional development for your assistant, ensuring they’re motivated and equipped to deliver top-tier service.

Work-life balance is a core value, and we believe a happy, supported VA leads to better support for you.

Stealth Agents goes the extra mile to ensure that every virtual assistant for insurance agency tasks is tailored to deliver high-quality support. By combining structured onboarding and ongoing evaluations, this process helps businesses save time and ensure satisfaction, giving you a trusted partner to grow effectively.

Takeaways

A virtual assistant for insurance agency tasks is the support system you never knew you needed until now. With expertise in handling administrative work, managing claims, and scheduling, they help you save time and focus on growing your business. Their specialized skills and a proven track record in offering reliable assistance make them an essential asset for busy insurance professionals.

By outsourcing to a trusted service, you gain access to efficient, high-quality help without the overhead of a full-time employee. This combination of practicality and skill ensures your agency operates smoothly, even during peak workloads. Choose Stealth Agents today for the best virtual assistance in the insurance industry, with $18.75 per hour or $3,000 per month for 160 hours, no part-time options, and over 10 years of VA experience to meet your agency’s needs.

Why Insurance Agencies Are Turning to Virtual Assistants

- Talent shortages & hiring delays

Struggling to find qualified insurance professionals locally? Virtual assistants are ready to support your team from day one, no lengthy recruiting processes or gaps in coverage.

- High turnover & absenteeism

Frequent staff changes can disrupt workflows and client service. A dedicated virtual assistant offers consistent, reliable support, reducing your agency’s dependency on in-house staffing and creating a steady backbone for your operations.

- Administrative overload

Insurance teams are often buried in non-revenue-generating tasks like data entry, billing, and document management. By delegating these to a skilled virtual assistant, your staff can redirect their focus to strategic, client-facing work and business growth.

Are you ready to save time on admin tasks? Our virtual assistants can help you focus on your clients and sales. Get started today and unlock your agency’s potential!

Frequently Asked Questions

How much does a virtual assistant for an insurance agency cost per month?

Insurance virtual assistants usually cost between $1,500 and $4,000 per month, depending on their experience and the hours you need. For full-time support (160 hours per month), rates often start at around $3,000. This can save 40-70% compared to hiring in-house staff when you include salary, benefits, and office costs.

What time zone do insurance virtual assistants work in?

Most insurance virtual assistants can work during your business hours, no matter the time zone. Many VAs are available to match US time zones like EST, CST, MST, or PST, making it easy to communicate with clients and work with your team.

How secure is client data when using insurance virtual assistants?

Trusted VA providers use strong security measures like encrypted communication, secure file sharing, and HIPAA-compliant systems. VAs sign confidentiality agreements and follow strict rules to protect client information. This ensures sensitive data stays safe and meets compliance standards.

How quickly can I hire a virtual assistant for my insurance agency?

It usually takes 5-10 business days to hire an insurance virtual assistant. The process includes a consultation (1-3 days), matching you with the right VA (3-7 days), and a live evaluation (1-2 days). Many agencies get their trained VA within a week.

Can insurance virtual assistants work with specific CRM software like Applied Epic or AMS360?

Yes, experienced insurance VAs can use industry tools like Applied Epic, AMS360, QQCatalyst, and Salesforce. During onboarding, they are trained to use your agency’s specific software to ensure they can start working smoothly right away.

What happens if my insurance virtual assistant doesn’t work out?

Good VA providers offer free replacements if the assistant isn’t a good fit. Replacing a VA usually takes 3-5 days, and the new assistant is trained to take over quickly. This helps keep your agency running without major interruptions.

Do insurance virtual assistants require workers’ compensation or employee benefits?

No, insurance virtual assistants are independent contractors, not employees. This means you don’t have to provide workers’ compensation, health benefits, or paid time off. This reduces costs and makes managing them easier for your agency.

Can virtual assistants help with insurance lead generation and prospecting?

Yes, insurance VAs can help with lead generation by making cold calls, sending emails, researching databases, and using social media. They can also manage leads in your CRM, set appointments, and support your sales team to help grow your client base.

What insurance licenses or certifications do virtual assistants need?

Virtual assistants don’t need insurance licenses because they handle tasks like admin work, not selling policies or giving advice. Licensed activities, like discussing coverage or selling insurance, must be done by your licensed agents to follow the rules.

How do insurance virtual assistants handle emergency or after-hours client calls?

Insurance VAs can be trained to handle emergencies by answering urgent calls, contacting on-call agents, and helping with after-hours claims. They follow specific steps to assist clients and make sure serious issues are passed to licensed staff when needed.