Outsourced bookkeeping services help businesses save time and cut costs by offloading financial tasks to experts. Stealth Agents simplifies your bookkeeping with accurate reporting, real-time tracking, and scalable support—so you can focus on growing your business. Book your free consultation.

Outsourcing bookkeeping services has become a strategic advantage for many companies.

According to a report by Deloitte, 59% of businesses outsource to cut costs, and 57% focus on core business functions.

Outsourcing your bookkeeping needs can reduce operational costs by 40-60%and allow businesses to access expert financial management without the overheads of maintaining an in-house team.

This ensures accuracy and compliance while freeing up valuable time and resources for strategic growth initiatives.

Stealth Agents is here to help you find the perfect outsourced bookkeeping services tailored to your business needs.

Schedule a free discussion today to explore how our virtual assistants can streamline your financial operations with virtual assistant pricing and exceptional service.

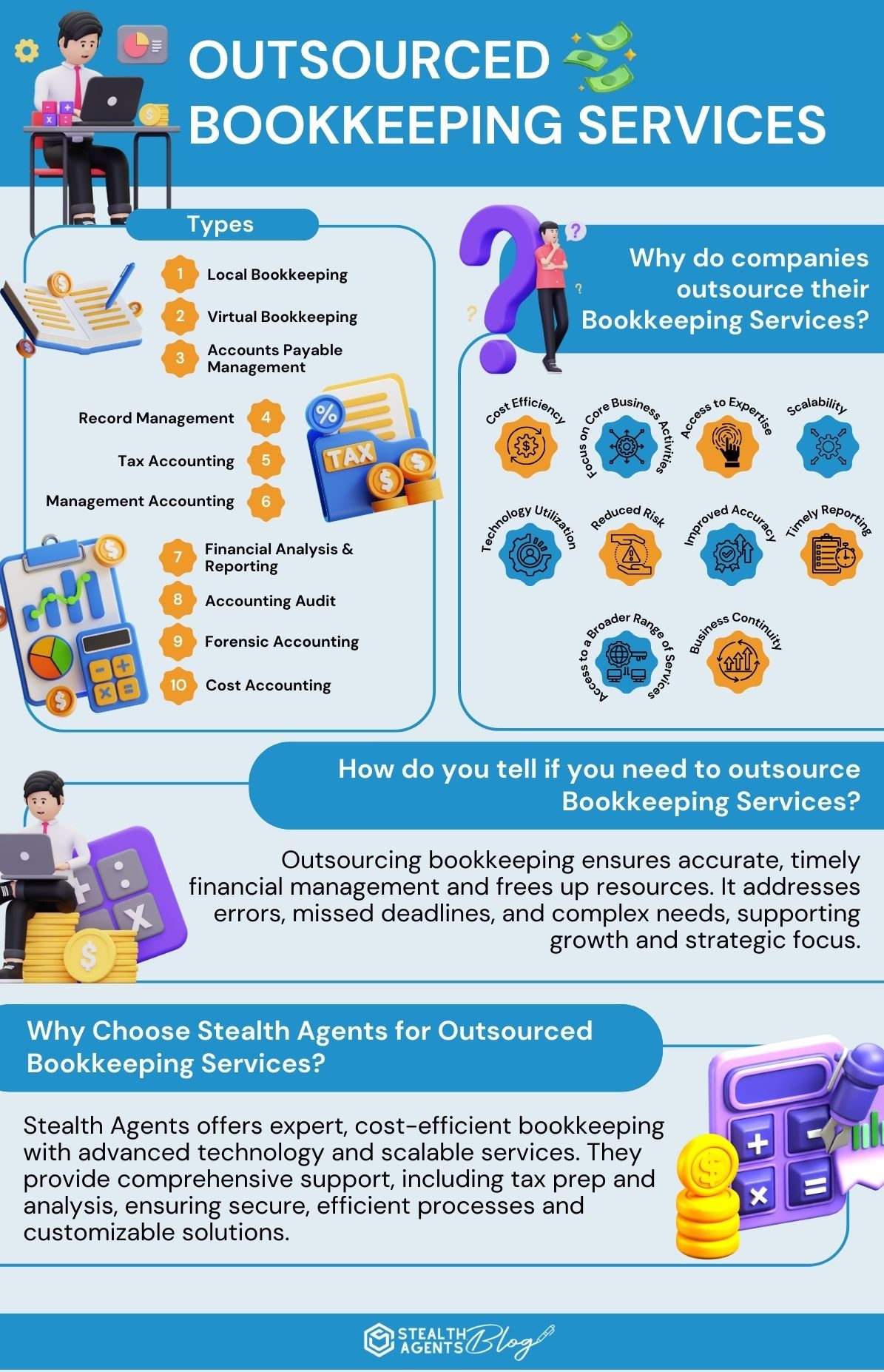

What are the Types of Outsourcing Bookkeeping Services?

1. Local Bookkeeping

This involves hiring a local bookkeeper who can physically visit the business premises.

It might be beneficial for businesses that prefer face-to-face interactions.

Local bookkeepers often have a deep understanding of regional regulations and tax laws. They can also offer personalized advice tailored to the local economic climate.

2. Virtual Bookkeeping

Virtual bookkeepers work remotely, often leveraging cloud-based accounting software to manage a company’s finances.

The company’s flexible and cost-effective option for many businesses.

Virtual bookkeeping allows for real-time updates and access to financial data from anywhere.

Additionally, it reduces overhead costs associated with maintaining an in-house bookkeeping outsourced team.

3. Accounts Receivable/Accounts Payable Management

This service involves managing the company’s incoming and outgoing payments.

It includes invoicing, payment processing, and tracking outstanding debts.

Efficient management ensures timely payments and maintains healthy cash flow.

It also helps maintain good relationships with suppliers and customers through prompt transactions.

4. Record Management

Ensures all financial transactions are accurately recorded and maintained.

This includes handling receipts, invoices, and other financial documents. Proper record management simplifies financial audits and tax filings.

It also provides a clear historical financial trail for future reference.

5. Tax Accounting

A virtual assistant tax specialist can assist in preparing and filing tax returns, ensuring compliance with tax laws, and planning for future tax obligations. Expert tax accountants keep businesses informed about changing tax regulations. They also identify opportunities for tax savings and credits.

6. Management Accounting

This involves preparing detailed reports and analyses to help management make informed business decisions. It also includes budgeting, forecasting, and performance reporting.

Management accountants provide insights into operational efficiency and profitability.

Their analysis assists in strategic planning and resource allocation.

7. Financial Analysis & Reporting

Provides insights into the business’s financial health through detailed reports and analysis.

This helps identify trends, strengths, and weaknesses. Comprehensive financial reports also aid in stakeholder communication and investment decisions.

They also support compliance with regulatory requirements.

8. Accounting Audit

It involves examining the accuracy of financial statements and records to ensure compliance with laws and regulations.

Audits increase transparency and accountability within a business.

They also uncover potential areas of risk or fraud, thereby safeguarding the company’s assets.

9. Company’s accounting

Used to investigate financial discrepancies and fraud.

It involves thoroughly examining financial records to detect and prevent fraudulent activities.

Forensic accountants often collaborate with legal teams during litigation. Their findings can be crucial in legal proceedings and insurance claims.

10. Cost Accounting

Tracks, records, and analyses costs associated with producing goods or services.

Helps in budgeting and cost control. Cost accounting identifies areas where expenses can be reduced without compromising quality.

It also aids in setting competitive pricing for products and services.

Why Do Companies Outsource Their Bookkeeping Services?

1. Cost Efficiency

Outsourcing can significantly reduce the costs associated with hiring, training, and maintaining an in-house bookkeeping team.

Companies save on salaries, benefits, office space, and equipment.

This allows businesses to allocate their financial resources more effectively.

Additionally, outsourcing firms often provide flexible pricing models tailored to the company’s budget.

2. Fcompany’s core Business Activities

Companies can concentrate on their primary business functions and strategic goals by outsourcing bookkeeping tasks.

This allows management to allocate more time and resources to areas directly impacting growth and profitability.

Improved focus can lead to innovation, better customer service, and faster market adaptation.

It also helps maintain a competitive advantage by leveraging core competencies.

3. Access to Expertise

Outsourcing firms typically employ experienced professionals who are well-versed in current accounting standards and regulations.

This ensures high-quality, accurate financial records and compliance with legal requirements.

Outsourced bookkeepers can provide valuable insights and best practices that in-house teams might lack.

They can also anticipate and mitigate potential financial issues before they become problematic.

4. Scalability

Bookkeeping services outsourcing can easily scale up or down based on the company’s needs.

This is particularly beneficial for businesses experiencing growth or seasonal fluctuations in their operations.

Scalability helps in managing workload during peak times without the need for long-term commitments.

It also allows businesses to adapt quickly to changes in market conditions or business strategies.

5. Technology Utilization

Many outsourcing firms use advanced accounting software and tools, providing clients access to the latest technology without significant investment.

This ensures efficient and accurate bookkeeping processes. It enhances data security and streamlines workflows.

It also provides real-time access to financial information, aiding in quick decision-making.

6. Reduced Risk

Outsourced bookkeeping firms stay updated on regulatory changes and ensure compliance, reducing the risk of errors and penalties.

They also have measures in place to protect sensitive financial data.

Comprehensive risk management practices help safeguard against fraud and financial mismanagement.

Outsourcing firms also offer liability coverage, providing an additional layer of protection.

7. Improved Accuracy

With dedicated professionals handling bookkeeping tasks, the likelihood of errors decreases.

Accurate financial records are crucial for reliable reporting and decision-making.

This precision supports better forecasting and financial planning and builds trust with stakeholders, including investors and creditors.

8. Timely Reporting

Outsourced services often guarantee regular and timely financial reports, providing businesses with up-to-date information on their economic status.

This enables better cash flow management and financial planning.

Timely reporting ensures compliance with regulatory deadlines and internal schedules. It also enhances transparency and accountability within the organization.

9. Access to a Broader Range of Services

Outsourcing firms often offer additional services such as tax preparation, payroll processing, and financial analysis, providing businesses with a comprehensive financial management solution.

This outsourced bookkeeping solution’s integrated approach can lead to a more cohesive financial strategy.

It also simplifies vendor management by consolidating multiple financial services under one provider.

10. Business Continuity

Outsourcing eliminates the risk of disruptions caused by employee turnover, absences, or other internal issues.

The continuity provided by an outsourcing firm ensures consistent and uninterrupted bookkeeping services.

This stability is crucial for maintaining ongoing financial operations. It also provides peace of mind, knowing that a professional team always handles the company’s finances.

Need to outsource bookkeeping services?

Our company provides reliable and professional bookkeeping solutions to meet your needs. Outsourcing bookkeeping services can be a strategic decision for businesses facing time constraints, frequent financial errors, or a lack of expertise.

Indicators such as missed deadlines, complex financial needs, and inconsistent cash flow management suggest that professional help is needed.

Rapid growth, outdated technology, and the need for detailed financial analysis may also warrant outsourcing.

Cost considerations, employee turnover, and the desire to focus on strategic initiatives further highlight the benefits of outsourcing.

By addressing these factors, businesses can ensure accurate, timely, and compliant financial management while freeing resources to concentrate on core activities.

Why Choose Stealth Agents for Outsourced Bookkeeping Services?

Choosing Stealth Agents for outsourced bookkeeping services offers businesses expertise, cost efficiency, and advanced technology.

Their team of experienced professionals ensures accurate, timely, and compliant financial management while reducing overhead costs.

A virtual assistant for accountants is a scalable service, and businesses can seamlessly adapt to growth or seasonal changes.

Stealth Agents provides comprehensive support beyond standard bookkeeping, including tax preparation and financial analysis, enabling companies to focus on core activities and strategic growth.

Their use of cutting-edge software guarantees secure and efficient processes, while consistent service continuity minimizes risks associated with employee turnover.

Customizable solutions cater to specific business needs, making Stealth Agents a reliable partner in financial management.

Takeaways

Outsourced bookkeeping provides businesses with reliable, cost-effective solutions for managing their financial records.

By outsourcing a virtual assistant, companies can ensure accurate, timely bookkeeping, freeing valuable resources to focus on core business operations.

This bookkeeping outsourcing company enhances financial accuracy and compliance and allows businesses to scale efficiently and maintain a competitive edge.

Embrace bookkeeping outsourcing services to streamline financial processes, reduce overhead costs, and drive business growth.

Invest in this solution to optimize your financial management and achieve long-term success.

Are you ready to simplify your finances? Outsourced bookkeeping can save you time and money. Let Stealth Agents help you focus on growing your business. Schedule your consultation today!

Frequently Asked Questions

What are outsourced bookkeeping services, and how do they make managing money easier?

Outsourced bookkeeping means hiring outside experts to handle your business’s money tasks, like keeping records, sending bills, and making reports. It makes managing money easier by giving you skilled help, cutting costs by 40-60%, making sure everything is accurate and follows the rules, and saving you time to focus on growing your business. You also don’t need to hire and manage a team in-house.

How much money can businesses save by outsourcing bookkeeping?

Businesses can save 40-60% on costs by outsourcing bookkeeping. This is because they don’t have to pay for salaries, benefits, office space, or equipment for an in-house team. A study by Deloitte found that 59% of businesses outsource to save money while still getting expert help.

What types of bookkeeping services can businesses outsource?

Businesses can outsource many bookkeeping tasks, such as:

- Local or online bookkeeping

- Managing bills and payments

- Keeping records

- Handling taxes

- Creating financial reports

- Checking accounts for mistakes

- Investigating financial issues

- Tracking costs

Why do companies choose outsourced bookkeeping instead of hiring their own team?

Companies choose outsourcing because it costs less, gives them access to experts, and is easier to adjust as their needs change. It also reduces mistakes, provides regular reports, and ensures everything follows the rules. This lets businesses focus on their main work while knowing their finances are in good hands.

How do outsourced bookkeeping services make finances more accurate and follow the rules?

Outsourced bookkeeping services are handled by trained professionals who stay updated on the latest rules. They use advanced tools to reduce mistakes, protect sensitive information, and ensure everything is done correctly. This helps avoid penalties and keeps financial reports reliable.

What technology benefits do outsourced bookkeeping services offer?

Outsourced bookkeeping services use modern tools and software, often based in the cloud. This means businesses can see their financial data in real time, from anywhere. It also keeps data safe, speeds up tasks, and helps businesses make quick decisions.

When should a business think about outsourcing bookkeeping?

A business should consider outsourcing if:

- They don’t have enough time to handle finances.

- There are frequent mistakes in their records.

- They miss important deadlines.

- Their financial needs are too complicated.

- They are growing quickly or have seasonal changes.

- They want to focus on other important work.

How do outsourced bookkeeping services help businesses grow?

Outsourced bookkeeping can grow with a business. If a company gets busier, the service can handle more work. If things slow down, they can handle less. This flexibility is helpful for businesses that are expanding or have busy seasons. It also frees up time and resources for other important work.

What’s the difference between virtual and local bookkeeping services?

Virtual bookkeeping is done online. It’s usually cheaper, gives updates in real time, and lets you access your financial data from anywhere. Local bookkeeping is done in person. It’s better for businesses that want face-to-face meetings or need help with local rules.

How do outsourced bookkeeping services keep businesses running smoothly and reduce risks?

Outsourced bookkeeping ensures there are no interruptions, even if someone quits or is absent. They always have a team ready to handle your finances. They also reduce risks by following the latest rules, protecting data, and preventing fraud. This keeps your business safe from financial problems.