Accounts receivable virtual assistant services help businesses get paid faster and stay organized without the stress of constant follow-ups. Stealth Agents provides expert ARVAs who handle invoicing, collections, and reporting, so you can maintain healthy cash flow and focus on growing your business.

Handling overdue invoices and tracking payments shouldn’t keep you up at night. When cash flow suffers and collections take too much time, your business starts feeling the strain. That’s why savvy businesses turn to a Hire Accounts Receivable Virtual Assistant to take control of these challenges and make cash flow smoother.

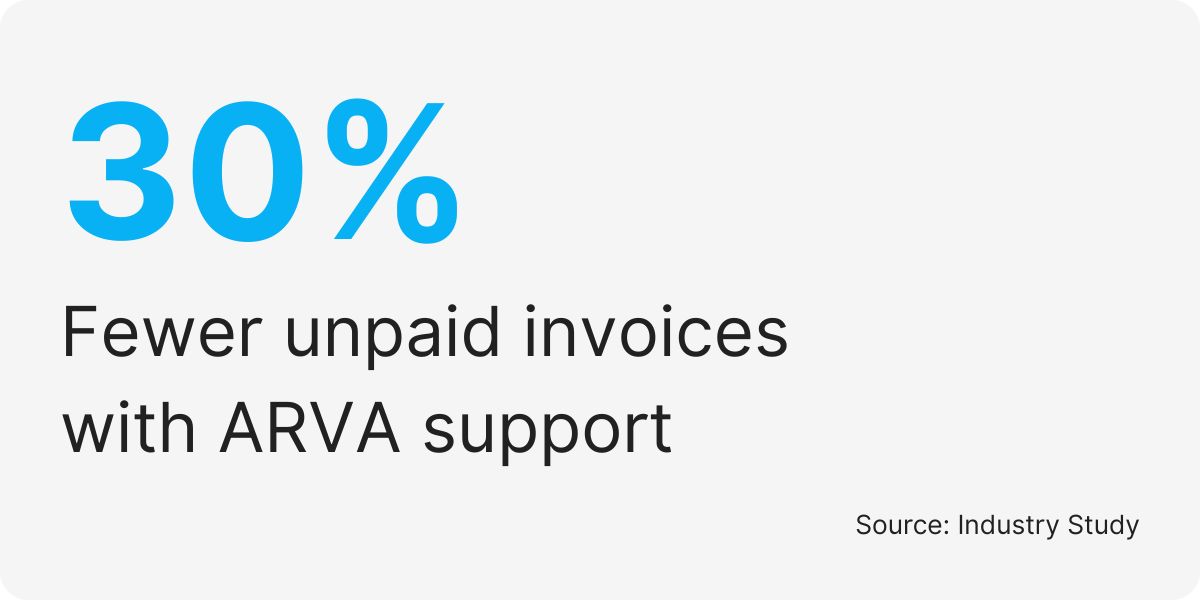

With tailored support from Stealth Agents, you gain expert help that ensures faster follow-ups, streamlined processes, and fewer payment delays. Studies show businesses with dedicated accounts receivable support reduce unpaid invoices by up to 30%.

From managing invoices to maintaining accurate financial records, these assistants handle it all so you can focus on growing your business. Don’t waste another day chasing payments—secure reliable accounts receivable management today. Visit Stealth Agents to find the perfect virtual assistant for your needs at a great hire accounts receivable price rate.

Why Outsourcing Admin & Accounting Roles Fuels Business Growth?

Outsourcing administrative and accounting roles can make a real difference in your company’s growth trajectory.

Instead of juggling back-office tasks and burning valuable time, you gain the freedom to double down on strategies that drive revenue.

- Cost Efficiencies: By leveraging dedicated professionals for administrative and accounting functions, businesses reduce overhead and reinvest savings into expansion or innovation.

- Expertise on Demand: Outsourced teams bring proven experience in accounting, record-keeping, and compliance—meaning fewer errors and stronger controls.

- Focus on Core Growth: Freeing your in-house staff from time-consuming paperwork and reconciliations lets your team focus on sales, marketing, and customer relationships.

- Scalable Support: As your business grows, outsourced support flexes with you. Whether you need basic bookkeeping or more advanced financial planning, you get the resources when you need them.

What is an Accounts Receivable Virtual Assistant?

An Accounts Receivable Virtual Assistant helps businesses manage and collect payments from clients.

They keep track of invoices and follow up on unpaid bills.

Using stealth agents, they approach collection tasks discreetly and respectfully.

This ensures clients feel valued and not pressured during the process.

What Does an Accounts Receivable Virtual Assistant Do?

Managing your accounts receivable can be overwhelming, draining your time and focus away from growing your business. Small delays, missed follow-ups, and inaccurate records can cause overdue payments to pile up, straining your cash flow in no time.

An accounts receivable virtual assistant steps in to solve these headaches, streamlining processes and keeping your business financially steady. If you’ve been wondering what these professionals do and how they can save you time and money, here’s everything you need to know.

With this guide, we’ll break down the key tasks an accounts receivable virtual assistant typically handles. By the end, you’ll understand their value and why outsourcing to skilled professionals can make a world of difference.

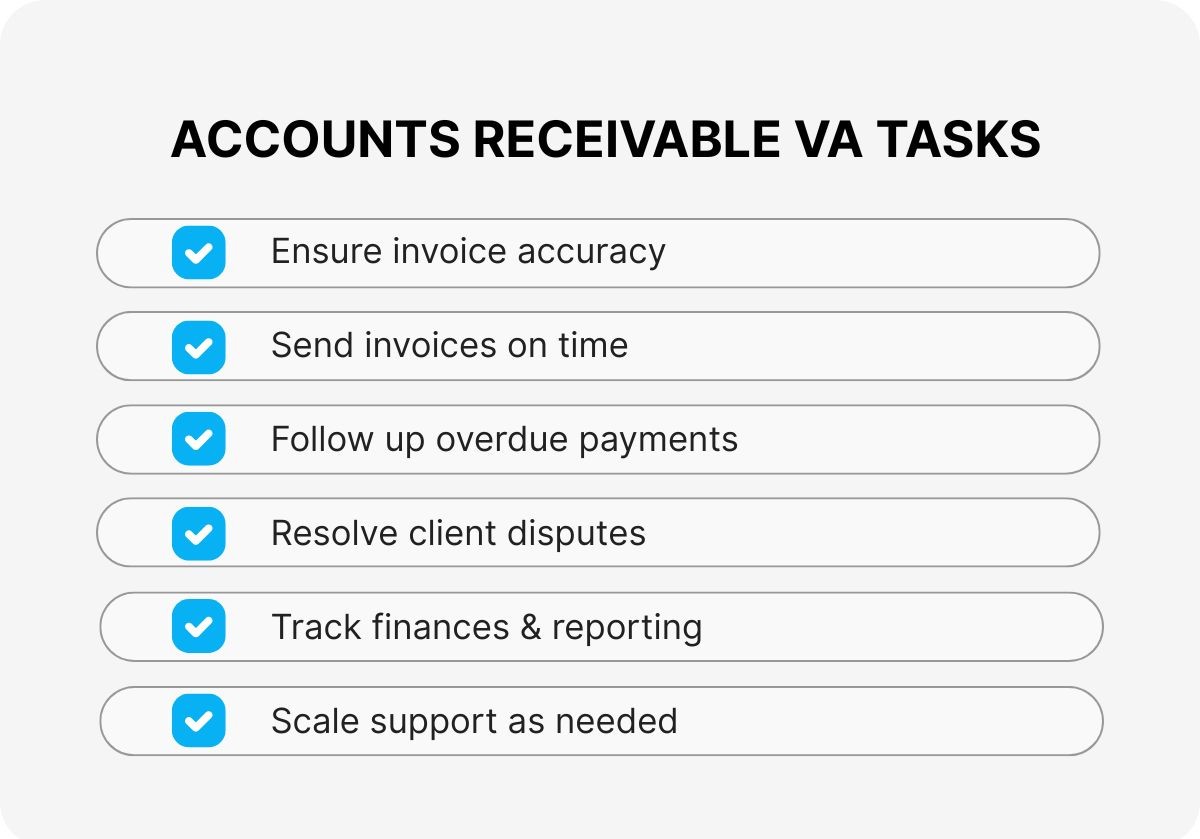

1. Invoice Management and Payment Coordination

One of the main responsibilities of an accounts receivable virtual assistant is creating, sending, and tracking invoices with precision. Delays or errors in invoicing can disrupt your cash flow, but a virtual assistant for invoicing ensures every bill is accurate and sent on time. They meticulously cross-check purchase orders or contracts to minimize errors that could lead to disputes or delays.

This proactive approach means no invoice slips through the cracks. Your assistant will also send payment reminders to clients, reducing the likelihood of overdue balances. Whether you’re overseeing a creative business or need bookkeeping for painters, handling invoices with care ensures payments come in smoothly. With their help, you can avoid tedious back-and-forths with clients over payment errors while focusing on growing your operations.

2. Following Up on Overdue Payments

Chasing overdue invoices can be awkward and draining. A skilled accounts receivable virtual assistant manages this with professionalism, ensuring clients pay their due balances promptly. They send polite yet firm reminders, follow structured timelines for follow-ups, and maintain positive client relationships in the process.

These assistants use systems such as stealth accounts to avoid letting unpaid receivables spiral into a major issue. By outsourcing this responsibility, you no longer have to worry about delicate conversations concerning overdue payments. Instead, you’ll have a dedicated professional working behind the scenes to ensure every interaction is respectful and productive. Whether you need help to reduce overdue receivables or set up flexible payment terms, an accounts receivable VA has you covered.

3. Maintaining Accurate Financial Records

Keeping track of every transaction in real-time is vital for financial stability, and this is where a virtual assistant for invoicing proves their worth. They ensure all payments, invoices, and adjustments are logged properly, providing you with up-to-date, error-free records. Tasks such as reconciling bank deposits and creating aging reports might feel daunting, but a VA ensures these functions are carried out seamlessly.

This accuracy isn’t just about bookkeeping—it’s about having confidence in your financial clarity. A VA can also assist with financial modeling support, virtual assistant tasks, helping you analyze trends or forecast cash flows with reliable data on hand. With organized financial records, you can make smarter decisions for the future of your business.

4. Resolving Client Disputes and Payment Issues

Sometimes clients dispute charges or experience billing errors. Handling these situations requires diplomacy, and your accounts receivable virtual assistant excels at resolving issues calmly and efficiently. They communicate with clients to investigate discrepancies and negotiate resolutions, ensuring both parties are satisfied.

These professionals understand the importance of keeping relationships intact while protecting your revenue. Whether it’s clarifying a charge, adjusting an invoice, or correcting a misapplied payment, a skilled assistant knows how to mitigate problems before they escalate. With their help, you can manage sensitive situations without losing clients or leaving funds on the table.

5. Providing Regular Cash Flow Updates

Your accounts receivable may be under control, but without consistent monitoring, it’s hard to know where your business stands financially. That’s why an accounts receivable virtual assistant provides regular updates on your receivables, including detailed reports on outstanding balances. They generate insights into payment trends, helping you identify potential problems such as recurring late payers.

These insights are crucial for adjusting your strategies, whether that’s tightening credit terms or forecasting future earnings. A VA’s timely reports give you the tools to make data-driven decisions, whether you’re managing accounts receivable locally or utilizing overseas virtual assistant services for added cost benefits. By having a clearer picture of your financial health, you can plan for sustainable growth.

6. Cost-Effective Support for Growing Businesses

Hiring a full-time, in-house accounts receivable specialist might not be feasible for many businesses, especially smaller ones. That’s where virtual accounts receivable outsourcing provides immense value. Whether you work with a VA based locally or decide to hire an accounts receivable virtual assistant in the Philippines, the cost efficiencies are undeniable.

Outsourcing allows you to pay for the time and resources you actually need, without worrying about overhead costs like benefits and office space.

These virtual professionals often bring expertise in accounting, virtual assistant job descriptions, and systems, meaning they can deliver results from day one. If your business is resource-constrained but eager to maintain strong financial management, outsourcing to a VA is an excellent solution.

An accounts receivable virtual assistant does far more than just chase invoices—they act as an extension of your team, ensuring that your business stays financially healthy and well-organized. From accurate invoicing to building client relationships and maintaining clear records, their role is integral to keeping cash flow steady.

Whether you’re looking to reduce overdue receivables or explore how to hire virtual assistants for account management, investing in a VA is a step toward smoother operations and peace of mind.

Why spend your invaluable time managing collections when someone else can handle it better, faster, and more cost-effectively? With the right assistant by your side, you can stay focused on what you do best—growing your business.

Why Choose an Accounts Receivable Virtual Assistant for Invoicing Needs?

Handling invoicing efficiently is the lifeblood of any business. Whether you’re a small business owner or managing a thriving operation, errors or delays in invoicing can hurt your cash flow and tarnish client relationships. That’s where hiring an accounts receivable virtual assistant can completely change the game.

These professionals take the stress out of invoicing, ensuring that payments are processed accurately, on time, and with minimal effort on your end. If you’ve been grappling with overdue payments or outdated systems, here’s why choosing a virtual assistant for these tasks is an investment in your success.

1. Precision in Creating and Managing Invoices

A virtual assistant for invoicing makes sure every invoice is accurate, detailed, and sent on time. From confirming quantities in purchase orders to double-checking payment terms, they handle the minutiae that often slip through the cracks. Missing or incorrect details on invoices can lead to delays, but with a professional managing this process, you minimize errors and improve cash flow.

Their expertise ensures every invoice aligns with your clients’ specific billing requirements, which is particularly important for businesses like bookkeeping for painters or industries with unique needs. Whether you manage stealthy finance via stealth accounts or require specialized knowledge, a virtual assistant adapts to your systems. Best of all, they stay on top of the invoicing process so you can focus on other priorities.

2. Efficient Payment Follow-Ups to Reduce Overdue Receivables

Chasing clients for overdue payments is a time-consuming process, yet it’s vital to keeping your business running smoothly. This is where an accounts receivable virtual assistant really shines. They handle all the follow-ups with professionalism, sending reminders and making polite but firm requests for payment.

Overdue receivables don’t just drain finances—they drain your energy too. A virtual assistant steps in to manage this burden, helping you reduce overdue receivables significantly. Whether they are following your pipeline in-house or through virtual accounts receivable outsourcing, they’ve got the tools and personality to resolve these issues seamlessly. This extra layer of support makes collecting what’s owed far less stressful and a lot more effective.

3. Cost-Effective and Flexible Support

For many businesses, hiring a full-time in-house employee for accounts receivable tasks isn’t feasible. That’s where the cost-effectiveness of a virtual assistant for invoicing stands out. Particularly if you choose to hire an accounts receivable virtual assistant in the Philippines, you’ll gain access to highly skilled professionals at a fraction of the cost.

These overseas virtual assistant services adapt to your time zone, needs, and budget. Paying only for the hours worked or specific tasks ensures tremendous value. For example, they can also perform complementary tasks, like financial modeling and support virtual assistant services, giving you a well-rounded solution. With this level of flexibility, scaling your operations doesn’t feel like a financial strain.

4. Clear Communication and Dispute Resolution

Miscommunication over invoices can damage client relationships, especially if disputes or errors go unresolved. An accounts receivable virtual assistant acts as a middleman to communicate clearly and effectively with clients, resolving any inconsistencies before they escalate into problems.

Whether it’s clarifying line items, issuing credit notes, or adjusting terms, your assistant ensures these sensitive matters are handled professionally. Clients appreciate the prompt and friendly approach, which can maintain goodwill even during tense situations.

This element of trust is key, whether you’re outsourcing via stealth accounts or managing a customized accounting virtual assistant job description for your specific needs. A virtual assistant helps bridge any gaps, keeping both your clients and your cash flow happy.

5. Enhanced Financial Tracking and Reporting

Staying on top of your financial health is only possible with accurate, up-to-date tracking. A virtual assistant for invoicing not only manages payment tasks but also generates detailed reports on your accounts receivable. This includes aging summaries, cash flow projections, and regular updates that show exactly where you stand.

For businesses balancing multiple priorities, these insights are invaluable. A VA can identify patterns, such as clients habitually paying late, and suggest proactive solutions to improve overall efficiency. By delegating this function to experienced professionals, whether locally or through virtual accounts receivable outsourcing, you gain clarity on your financial standing while focusing on strategy and growth.

6. Scalable Solutions for Growing Businesses

Your invoicing needs may fluctuate depending on the scale of your operations, seasonal trends, or new projects. Virtual assistants are perfectly suited to handle this flexibility, expanding their workload as your business grows. They seamlessly adjust to shifting priorities, whether you need more help during peak seasons or specialized tasks like bookkeeping for painters.

When you work with professionals who know how to hire virtual assistants for account management, you’re setting yourself up for success. They grow with you, ensuring that your systems, processes, and collections always match your operational needs. This means you can confidently pursue new opportunities knowing your invoicing runs like clockwork.

Choosing an accounts receivable virtual assistant for your invoicing needs is more than a convenience—it’s a game-changer for your business. From ensuring accuracy and timely follow-ups to providing flexibility and cost savings, these professionals elevate how you manage accounts receivable.

Whether through overseas virtual assistant hiring or a local expert, their ability to reduce overdue receivables and handle disputes ensures uninterrupted cash flow and satisfied clients.

Isn’t it time to take invoicing off your plate and focus on growing your business? With their support, you can streamline processes, enhance client relationships, and make room for what truly matters—your long-term success.

Why Hire an Accounts Receivable Virtual Assistant for Your Business?

Hiring an Accounts Receivable Virtual Assistant can save your business time by managing invoicing, payment follow-ups, and collections.

This allows you to focus on your primary operations without worrying about the details of accounts receivable tasks.

Virtual assistants are cost-effective, with businesses saving up to 78% in operating expenses compared to in-house teams.

They accurately track finances, ensuring your company’s cash flow stays on track.

Stealth Agents connects businesses with skilled virtual assistants who can take over accounts receivable responsibilities.

Their professionals simplify hiring and ensure you find a perfect match for your needs.

How to Get Started with Hiring a Remote Accounts Receivable Virtual Assistant

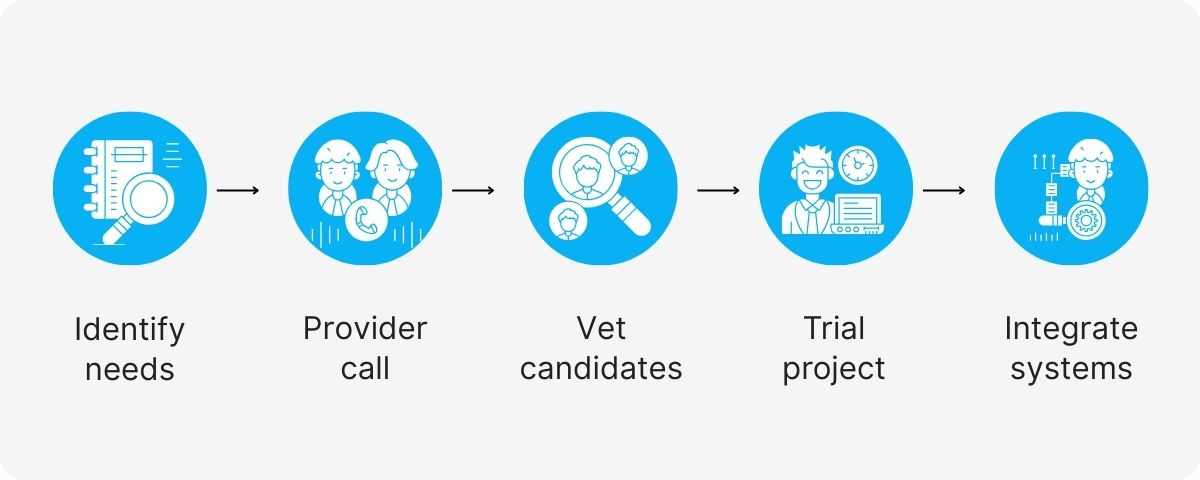

Beginning your search for the perfect accounts receivable virtual assistant is easier than you might think—and the process is designed to be as seamless as possible for busy business owners.

- Assess Your Needs: Identify which AR tasks you want to delegate, such as invoicing, payment tracking, or reconciliations. The more specific you are, the more tailored the support you’ll receive.

- Reach Out for a Consultation: Connect with a reputable outsourcing provider specializing in virtual accounting talent. Platforms like Upwork, Belay, and Prialto are excellent places to start. Many offer free consultations to understand your workflow and recommend matches.

- Review Qualified Candidates: After your initial discussion, you’ll be introduced to a shortlist of vetted professionals. Carefully review their experience, certifications, and familiarity with your preferred accounting software—whether that’s QuickBooks, Xero, or FreshBooks.

- Interview and Trial: Set up interviews to assess cultural fit and communication skills. Most providers will let you arrange a short trial or project to ensure alignment before moving forward.

- Onboard and Integrate: Once you’ve chosen your new AR virtual assistant, share access to necessary tools and outline your procedures. A clear onboarding checklist (think secure logins, SOPs, and reporting requirements) ensures a successful start.

What Services Does an Accounts Receivable Virtual Assistant Offer?

1. Invoice Management

Accounts Receivable Virtual Assistants handle the preparation and issuance of invoices.

They ensure accuracy by cross-checking information with purchase orders or contracts.

This helps maintain smooth billing operations and reduces errors that could delay payments.

2. Payment Tracking

They monitor incoming payments to ensure all dues are collected on time.

Regularly updating payment records provides a clear overview of outstanding balances.

This process supports better cash flow management for businesses.

3. Collections Support

Virtual assistants follow up with clients professionally and consistently regarding overdue payments.

They send reminders through emails or calls, helping maintain clear communication.

This minimizes payment delays without straining customer relationships.

4. Report Preparation

They compile detailed reports on accounts receivable metrics, such as outstanding balances and payment trends.

These valuable reports provide insights that help businesses monitor financial health.

Their role ensures that the company stays informed on receivables at all times.

5. Data Entry and Record Keeping

Virtual assistants update and maintain accurate records of all transactions, payments, and invoices.

This approach decreases the risk of errors and keeps financial data accessible.

Businesses rely on their expertise to keep records neat and reliable.

7. Dispute Resolution Assistance

They address and resolve payment discrepancies by communicating with clients or internal teams.

This involves investigating issues like wrong amounts or missing invoices.

Their role ensures such matters are resolved quickly and professionally.

8. Account Reconciliation

Virtual assistants regularly reconcile accounts to confirm consistency between payments received and recorded data.

This prevents discrepancies and ensures all financial records match.

Regular reconciliation adds an extra layer of accuracy to accounts receivable processes.

Why Choose Stealth Agents to Hire Accounts Receivable Virtual Assistants?

Stealth Agents offers skilled Accounts Receivable Virtual Assistants to support payment collection and invoice management.

They ensure tasks are handled respectfully so clients feel valued.

By choosing Stealth Agents, you get support prioritizing professional and polite communication.

Their assistants keep financial records accurate and updated, making it easier to track payments.

Stealth Agents use careful approaches to maintain trust while collecting overdue payments.

They take on these responsibilities so businesses can focus on other priorities.

Choosing Stealth Agents means relying on experts to manage sensitive financial tasks carefully.

Takeaways

Hiring an Accounts Receivable Virtual Assistant is a smart way to save time and improve how you manage your business finances.

They take care of tasks like invoicing, payment tracking, and collections, allowing you to focus on your core operations.

With the growing demand for virtual assistance, this approach is practical and cost-effective.

Whether you run a small business or a larger operation, these experts help keep your cash flow steady.

Stealth Agents can provide professional and reliable virtual assistants to meet your accounts receivable needs.

They make it easy to find the right candidate for your business.

Call Stealth Agents today to schedule a free consultation about your preferences and to explore pricing options that work for you.

Are late payments causing you stress? A virtual assistant can help you collect money faster and keep your business running smoothly. Get started today to improve your cash flow.

Frequently Asked Questions

How can an accounts receivable virtual assistant improve cash flow forecasting?

An accounts receivable virtual assistant helps improve cash flow forecasting by keeping track of unpaid invoices, payment patterns, and overdue accounts. This information helps businesses plan for upcoming expenses, adjust payment terms, and stay financially stable.

What tools do accounts receivable virtual assistants use for invoicing?

They often use tools like QuickBooks, Xero, and FreshBooks to create and manage invoices. These tools help track payments, send reminders, and generate financial reports, making it easier to handle accounts receivable tasks.

How do accounts receivable virtual assistants handle international transactions?

They use global payment platforms like PayPal, Stripe, or TransferWise to manage international payments. They ensure currency conversions are accurate, follow international rules, and stay in touch with clients to avoid payment delays.

Why is data security important for accounts receivable virtual assistants?

Data security is important because they handle sensitive financial information, like payment details and transaction records. Using secure software and following rules like GDPR helps protect this data, build trust, and prevent fraud.

How do accounts receivable virtual assistants customize their services for different industries?

They adjust their services to fit the needs of specific industries by learning about their invoicing methods, payment terms, and rules. For example, they might use special software or follow unique processes for industries like healthcare, legal, or e-commerce.

What qualifications should a skilled accounts receivable virtual assistant have?

They should have a background in finance or accounting, know how to use accounting software, and have experience managing invoices and collections. Good communication, attention to detail, and the ability to handle sensitive information are also important.

How can accounts receivable virtual assistants help with audit preparations?

They help by keeping financial records organized, checking accounts for accuracy, and making sure all transactions are properly documented. This makes the audit process easier and faster.

What challenges do accounts receivable virtual assistants face?

Challenges include dealing with late payments, resolving client disputes, and keeping records accurate. They also need to learn different accounting systems and follow financial rules while maintaining good relationships with clients.

How do accounts receivable virtual assistants handle seasonal changes in business?

They adjust their work based on the season. For example, they may follow up more often during busy times or track payment trends to make changes. This helps keep cash flow steady even when business volume changes.

What are the benefits of hiring a remote accounts receivable virtual assistant instead of an in-house employee?

Hiring a remote assistant saves money on office costs, gives access to skilled workers from anywhere, and offers flexibility in managing workloads. They provide expert help without needing a physical office, making them a cost-effective choice for handling accounts receivable tasks.