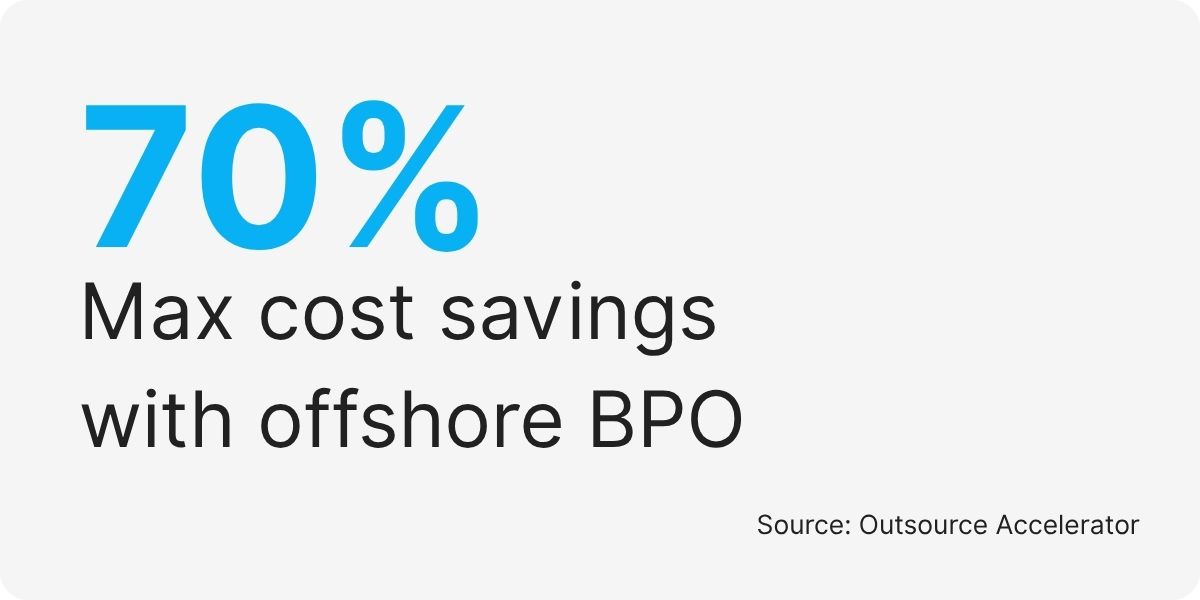

Outsourcing with BPO companies in the USA can help businesses save up to 70% on operational costs. Many companies struggle with keeping their tasks efficient while staying within budget, especially when handling repetitive or time-consuming work.

That’s where sourcing BPO providers or vendors comes in, it offers a practical solution for businesses looking to delegate tasks without compromising quality. From customer service to administrative support, top outsourcing companies like Stealth Agents provide tailored services to meet your business needs.

They even offer virtual assistants to handle day-to-day tasks, giving you more time to focus on growth.

By partnering with trusted BPO services, you can boost productivity and cut costs at the same time.

Book a free consultation now to learn more about our virtual assistant rates and see how outsourcing can work for you!

This guide will walk you through the 50 top BPO companies in USA, giving you the insights you need to make an informed decision.

Are US-based BPO Providers More Reliable for Handling Sensitive Data?

US-based BPO companies are trusted for handling sensitive data because they follow strict rules like HIPAA and GDPR, making them a safe choice for small businesses.

BPO companies in the USA focus on keeping data safe with strong encryption and regular checks to avoid any breaches.

Many leading BPO companies in the USA have lots of experience working with industries like healthcare and finance, where protecting data is very important.

By outsourcing to US-based BPO companies, businesses get clear communication and services that align with their culture and needs.

Choosing a BPO in the USA means staying compliant and knowing your important tasks are in the hands of experienced professionals.

Which Country is Best for BPO?

The Philippines and India are widely regarded as top destinations for business process outsourcing (BPO). This is primarily due to their large populations, which provide a vast, English-speaking talent pool for companies to draw from.

Additionally, these countries offer significantly lower operational and labor costs compared to Western nations, making them a financially attractive option for businesses looking to scale.

Do BPO providers in the USA offer flexible contracts for growing businesses?

Yes, BPO providers in the USA, including leading business process outsourcing providers, often offer flexible agreements to meet the needs of growing companies.

Many companies and BPO agencies recognize that businesses need flexible terms to scale or modify their operations effectively.

A BPO company in the USA can customize outsourcing arrangements, allowing you to scale services according to your business growth.

By working with reputable US business process outsourcing companies, businesses can efficiently manage costs while ensuring high-quality US BPO outsourcing services.

Flexible options provided by outsourcing BPO Services USA ensure that small and mid-sized companies can benefit from tailored solutions without being locked into rigid agreements.

Top 50 BPO Companies in the USA

1. Stealth Agents

Stealth Agents stands out as one of the best BPO companies in the USA. Businesses trust us for reliable and high-quality outsourcing solutions. We offer various services, including customer support, virtual assistance, data entry, and back-office solutions tailored to your unique needs.

Our team is committed to delivering exceptional results while keeping costs low. By choosing Stealth Agents, you gain access to skilled professionals who help streamline operations and free up your time to focus on growing your business. With us, you get cost-effective BPO services without compromising on quality.

Website: https://stealthagents.com/

Google Rating: 4.7/5.0

2. Concentrix

- Overview: Specializes in customer engagement and improving business performance through technology-infused solutions. Offers services across multiple industries, including automotive, banking, consumer electronics, and healthcare. Renowned for its focus on delivering personalized customer experiences.

Website: https://www.concentrix.com/

Google Rating: 4.2/5.0

3. Teleperformance

- Overview: A global leader in outsourced omnichannel customer experience management. Teleperformance provides companies with customer care, technical support, and other services worldwide. It is known for its innovative approach to enhancing customer satisfaction.

Website: https://www.teleperformance.com/

Google Rating: 4.0/5.0

4. Alorica

- Overview: Alorica provides customer management solutions that span the entire customer lifecycle. It focuses on delivering superior customer experiences by leveraging technology and human insights. Its services include customer care, sales, technical support, and back-office processing.

Website: https://www.alorica.com/

Google Rating: 3.8/5.0

5. Sitel Group

- Overview: Delivers comprehensive customer experience management and business process outsourcing solutions. Sitel Group combines digital and human capabilities to elevate customer interactions. It serves various sectors like banking, healthcare, and retail.

Website: https://www.sitel.com/

Google Rating: 4.0/5.0

6. TTEC

- Overview: TTEC provides customer experience and digital transformation solutions. It helps brands build better customer relationships through technology, analytics, and a human-centric approach. It supports telecom, financial services, healthcare, and the public sector.

Website: https://www.ttec.com/

Google Rating: 4.1/5.0

7. Cognizant

- Overview: A leading provider of IT services, including digital, technology, consulting, and operations. Cognizant leverages deep industry expertise to help clients drive business transformation. It serves industries like banking, healthcare, manufacturing, and retail.

Website: https://www.cognizant.com/

Google Rating: 4.4/5.0

8. Genpact

- Overview: Genpact focuses on delivering digital transformation through advanced analytics, automation, and AI. It partners with clients to drive innovation and improve business outcomes. It serves industries such as finance, healthcare, and consumer goods.

Website: https://www.genpact.com/

Google Rating: 4.3/5.0

9. Sykes Enterprises

- Overview: Sykes provides comprehensive customer contact management solutions to global companies. It specializes in inbound customer service, technical support, and back-office processing. Sykes aims to enhance customer loyalty and drive business growth.

Website: https://www.sykes.com/

Google Rating: 4.0/5.0

10. HGS (Hinduja Global Solutions)

- Overview: HGS offers customer experience management solutions across various industries. It combines technology and analytics to deliver personalized customer interactions. It focuses on achieving business efficiency and improved customer satisfaction.

Website: https://www.teamhgs.com/

Google Rating: 4.0/5.0

11. Infosys BPM

- Overview: A subsidiary of Infosys Ltd., specializing in business process management. Infosys BPM provides end-to-end outsourcing services to optimize business processes. Its offerings include finance, HR, sourcing, and procurement services.

Website: https://www.infosysbpm.com/

Google Rating: 4.1/5.0

12. Wipro BPO

- Overview: Part of Wipro Ltd., providing comprehensive outsourcing solutions across various domains. Wipro BPO focuses on enhancing operational efficiency and delivering value through innovation. Services include IT, consulting, and business process outsourcing.

Website: https://www.wipro.com/

Google Rating: 4.2/5.0

13. EXL Service

- Overview: EXL specializes in operations management and analytics to help clients enhance business performance. It combines deep domain expertise with advanced analytics capabilities and serves industries such as insurance, healthcare, and finance.

Website: https://www.exlservice.com/

Google Rating: 4.0/5.0

14. Firstsource Solutions

- Overview: Firstsource offers customer experience and business process management services. It focuses on delivering measurable business outcomes through technology and analytics. Industries served include banking, healthcare, and telecommunications.

Website: https://www.firstsource.com/

Google Rating: 4.1/5.0

15. WNS Global Services

- Overview: A leading global business process management company. WNS delivers services across various functions, such as finance, healthcare, and customer service. It emphasizes driving business transformation through strategic insights and analytics.

Website: https://www.wns.com/

Google Rating: 4.0/5.0

16. Conduent

- Overview: Provides diversified business process services with leading transaction processing and automation capabilities. Conduent helps organizations modernize and improve their operations. Key areas include healthcare, transportation, and government services.

Website: https://www.conduent.com/

Google Rating: 3.9/5.0

17. CGS (Computer Generated Solutions)

- Overview: CGS offers business process outsourcing, IT services, and software development. It helps companies improve efficiency and customer satisfaction. Services span various sectors, including retail, financial services, and healthcare.

Website: https://www.cgsinc.com/

Google Rating: 4.2/5.0

18. Tech Mahindra

- Overview: A leading digital transformation, consulting, and business re-engineering services provider. Tech Mahindra focuses on leveraging next-gen technologies to drive innovation. It serves industries such as telecommunications, healthcare, and banking.

Website: https://www.techmahindra.com/

Google Rating: 4.3/5.0

19. HCL Technologies

- Overview: An IT services company offering a wide range of outsourcing services. HCL focuses on providing innovative solutions to enhance business operations. Key sectors served include healthcare, financial services, and technology.

Website: https://www.hcltech.com/

Google Rating: 4.2/5.0

20. Capgemini

- Overview: Capgemini provides consulting, technology, and outsourcing services. It helps organizations achieve business transformation through innovative solutions. Industries served include automotive, banking, and consumer products.

Website: https://www.capgemini.com/

Google Rating: 4.1/5.0

21. IBM Global Services

- Overview: IBM offers a wide range of IT and business process outsourcing services. It focuses on driving digital transformation through technology and innovation. Key areas include cloud computing, analytics, and AI.

Website: https://www.ibm.com/

Google Rating: 4.3/5.0

22. Xerox Business Services

- Overview: Provides business process and IT outsourcing services. Xerox helps businesses optimize their processes and improve efficiency. Services include document management, customer care, and HR outsourcing.

Website: https://www.xerox.com/

Google Rating: 4.0/5.0

23. Atento

- Overview: A leading provider of customer relationship management and business process outsourcing services. Atento focuses on delivering exceptional customer experiences through innovative solutions. It serves industries such as telecommunications, finance, and healthcare.

Website: https://www.atento.com/

Google Rating: 4.1/5.0

24. DXC Technology

- Overview: DXC provides IT services and solutions to help businesses transform and manage their operations. It leverages technology to drive innovation and efficiency. Industries served include healthcare, banking, and manufacturing.

Website: https://www.dxc.technology/

Google Rating: 4.0/5.0

25. Capita

- Overview: Provides business process management and outsourcing solutions across various sectors. Capita focuses on transforming operations and improving efficiency through innovative solutions. Key industries include healthcare, finance, and public sector.

Website: https://www.capita.com/

Google Rating: 4.0/5.0

26. ADP (Automatic Data Processing)

Overview: Specializes in human resources management software and services, including payroll, talent management, and benefits administration. ADP helps businesses streamline HR processes and improve workforce management. It serves various industries globally.

Website: https://www.adp.com/

Google Rating: 4.1/5.0

27. Inktel Contact Center Solutions

Overview: Inktel offers customer service, sales, marketing, and technical support services. It emphasizes delivering quality customer interactions and improving client satisfaction. It serves industries such as retail, healthcare, and financial services.

Website: https://www.inktel.com/

Google Rating: 4.0/5.0

28. Transcom

Overview: Transcom provides customer care, sales, technical support, and collections services. It focuses on enhancing customer experiences through innovative solutions and technology and serves a wide range of industries, including telecommunications and finance.

Website: https://transcom.com/

Google Rating: 4.1/5.0

29. StarTek

Overview: Delivers comprehensive customer engagement solutions, including customer care, sales, and technical support. StarTek aims to improve customer loyalty and drive business growth. It serves sectors such as telecommunications, healthcare, and retail.

Website: https://www.startek.com/

Google Rating: 3.9/5.0

30. Sutherland Global Services

Overview: Sutherland provides business process transformation through integrated BPO USA services. It focuses on improving business performance through technology and analytics. Key industries served include healthcare, banking, and telecommunications.

Website: https://www.sutherlandglobal.com/

Google Rating: 4.1/5.0

31. Minacs Group

Overview: Minacs Group offers customer experience, marketing, and IT solutions. It emphasizes driving customer satisfaction and operational efficiency and serves industries such as automotive, healthcare, and financial services.

Website: https://www.concentrix.com/

Google Rating: 4.0/5.0

32. Arise Virtual Solutions

Overview: Arise provides virtual customer service solutions through a network of independent contractors. It offers flexibility and scalability, enhancing client operations. Key sectors served include retail, telecommunications, and travel.

Website: https://www.arise.com/

Google Rating: 4.2/5.0

33. 24-7 Intouch

Overview: Specializes in customer care and omnichannel contact center services. 24-7 Intouch leverages technology and analytics to deliver personalized customer experiences. It serves industries like e-commerce, retail, and telecommunications.

Website: https://www.intouchcx.com/

Google Rating: 4.3/5.0

34. Alorica

Overview: Provides customer management solutions spanning the entire customer lifecycle. Alorica focuses on superior customer experiences through technology and human insights. Services include customer care, sales, technical support, and back-office processing.

Website: https://www.alorica.com/

Google Rating: 3.8/5.0

35. UBL

Overview: UBL provides a range of back-office and customer support services. It focuses on improving operational efficiency and customer satisfaction and serves sectors like finance, healthcare, and retail.

Website: https://www.ubldigital.com/

Google Rating: 4.0/5.0

36. TaskUs

Overview: TaskUs specializes in outsourced digital services and next-gen customer experience. It focuses on innovation and employee engagement to deliver high-quality results. It serves industries like technology, e-commerce, and social media.

Website: https://www.taskus.com/

Google Rating: 4.2/5.0

37. TechSpeed

Overview: TechSpeed provides data entry and business process outsourcing services. It focuses on accuracy, efficiency, and cost-effectiveness and serves sectors such as finance, healthcare, and e-commerce.

Website: https://techspeed.com/

Google Rating: 4.6/5.0

38. Flatworld Solutions

Overview: Offers IT and business process outsourcing services globally. Flatworld Solutions focuses on delivering customized solutions to enhance business performance. Key areas include data management, customer support, finance, and accounting.

Website: https://www.flatworldsolutions.com/

Google Rating: 4.2/5.0

39. Outsource2india

Overview: Outsource2india provides a wide range of outsourcing services, including IT and BPO. It focuses on quality, timeliness, and cost savings and serves industries such as healthcare, finance, and legal services.

Website: https://www.outsource2india.com/

Google Rating: 4.2/5.0

40. Invensis Technologies Pvt Ltd

Overview: Invensis specializes in providing technology-driven outsourcing solutions. It offers services such as finance and accounting, data entry, and customer support. It focuses on improving operational efficiency and reducing clients’ costs.

Website: https://www.invensis.net/

Google Rating: 4.1/5.0

41. DevsData Tech Talent

Overview: DevsData offers tech talent and BPO services. It focuses on delivering top-tier technology solutions and skilled personnel and serves industries such as finance, technology, and healthcare.

Website: https://devsdata.com/

Google Rating: 4.7/5.0

42. Magellan Solutions

Overview: Belong to the top 50 call center companies, BPO services in the USA

, and small and medium businesses. Magellan Solutions focuses on delivering high-quality customer interactions and operational support. Key areas include customer service, telemarketing, and back-office solutions.

Website: https://www.magellan-solutions.com/

Google Rating: 4.2/5.0

43. Trupp Global Technologies

Overview: Trupp Global focuses on providing high-quality back-office support services. It offers services such as data management, customer support, and finance and accounting. It aims to help businesses optimize their operations and reduce costs.

Website: https://www.truppglobal.com/

Google Rating: 4.3/5.0.

44. MattsenKumar LLC

Overview: MattsenKumar provides data-driven business process outsourcing solutions. Its focus is on enhancing customer experiences and operational efficiency. Key services include customer support, data analysis, and back-office processing.

Website: https://www.billgosling.com/

Google Rating: 4.3/5.0

45. TeleCrew Outsourcing

verview: TeleCrew provides contact center and BPO services. It focuses on delivering high-quality customer interactions and support and serves industries such as telecommunications, finance, and healthcare.

Website: https://telecrewoutsourcing.com/

Google Rating: 4.1/5.0

46. Elite Techlogix

Overview: Elite Techlogix specializes in tech support and business process outsourcing. It focuses on using technology to enhance business operations. Key services include customer support, technical support, and back-office processing.

Website: https://www.elitetechlogix.com/

Google Rating: 4.0/5.0

47. Invensis

Overview: Provides efficient back-office support services. Invensis focuses on delivering high-quality, cost-effective solutions. Key services include data management, customer support, finance, and accounting.

Website: https://www.invensis.net/

Google Rating: 4.1/5.0

48. Raysoft Infotech Private Limited

Overview: Raysoft Infotech offers IT and BPO solutions to clients worldwide. It focuses on leveraging technology to improve business processes. Key services include software development, customer support, and data management.

Website: https://raysoftinfotech.com/

Google Rating: 4.0/5.0

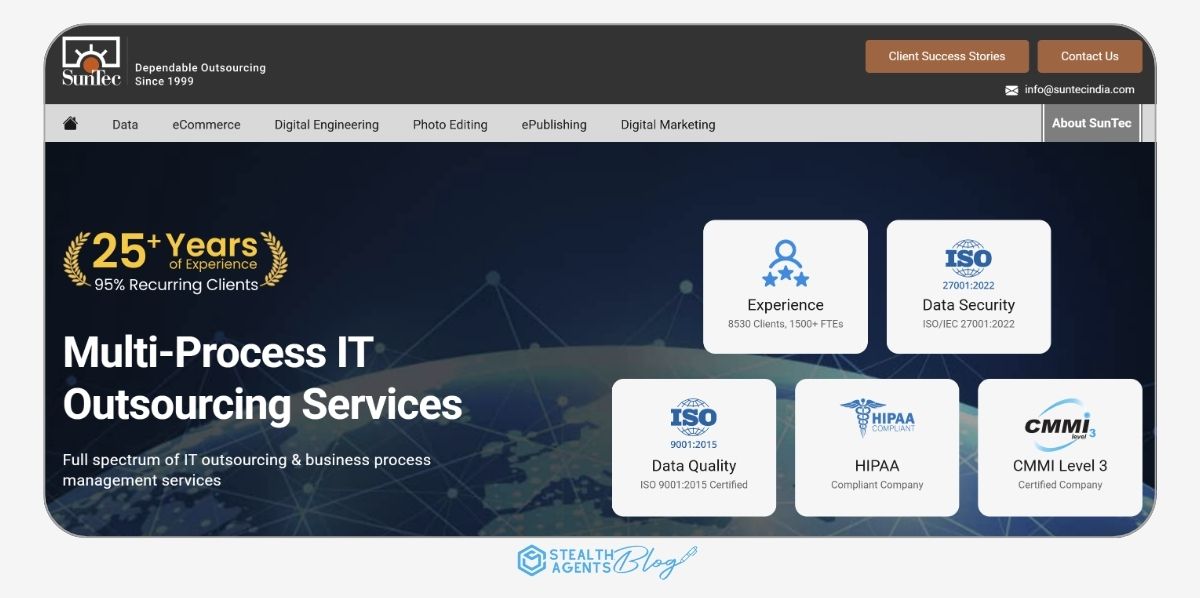

49. SunTec India

Overview: Provides multi-process IT outsourcing services. SunTec India focuses on delivering customized solutions to meet clients’ needs.

Website clients: //www.suntecindia.com/

Google Rating: 3.7/5.0

50. Blue Ocean Contact Centers

Overview: Founded in 1994, Blue Ocean Contact Centers specializes in customer experience management and business process outsourcing. The company provides solutions like customer support, technical assistance, and digital engagement.

- Website: https://blueocean.ca/

- Google Rating: 5.0/5.0

What to Look for When Choosing a BPO Provider in the USA

Selecting the right BPO partner can make a world of difference for your business’s growth, efficiency, and customer satisfaction. As with finding the perfect virtual assistant or social media manager, it’s not just about checking a box—it’s about finding a team that truly supports your goals, especially when you’re comparing offshore vs onshore BPO services. Here are the key criteria you’ll want to keep in mind:

1. Industry Experience and Track Record

Don’t just settle for a company that’s been around the longest. Look for providers with a successful history in your specific industry, and follow the BPO vendor selection criteria. Whether you’re in retail, finance, tech, or healthcare, an experienced partner will already understand the ropes, the regulations, and customer expectations unique to your field.

2. Service Range and Customization

Your business isn’t one-size-fits-all, and neither should your BPO partner’s offerings be. Evaluate if they can tailor their services from customer support to data entry and sales to fit your exact requirements. Bonus points if they offer scalable BPO solutions for startups that can grow along with your business.

3. Technology and Security

Modern BPO providers should leverage the latest technology to deliver efficient results—think cloud solutions, automation, and robust security protocols. Ask about their data protection measures, especially if you’re handling sensitive customer information. Security breaches are the last surprise any business needs.

4. Communication and Culture Fit

Clear communication is the secret sauce to successful outsourcing. Make sure your provider has strong English proficiency, a collaborative style, and transparency in reporting. Some teams even specialize in aligning with your company’s brand and values, which can make the partnership feel like a true extension of your business.

5. Quality Assurance Processes

A great BPO provider will have quality monitoring, training programs, and regular performance evaluations baked into their process. This ensures you’re not just getting tasks done—you’re getting them done right, every time.

6. Pricing and Value

Affordability matters, but don’t make it the only criterion. Compare pricing structures (hourly vs. project-based vs. monthly retainer) and balance them against the quality of service, expertise, and flexibility being offered. The best value is a blend of competitive rates and reliably strong results.

7. References and Reviews

Finally, check what other businesses are saying. Just like you’d read Amazon reviews before buying that quirky new gadget, ask for case studies, references, or check independent reviews. Real-world feedback can reveal a lot about reliability, response times, and how the provider handles hiccups.

By keeping these points in mind, you’ll be far better equipped to choose a BPO partner that doesn’t just check boxes, but helps push your business forward.

Why Choose Stealth Agents vs BPO Companies USA?

Outsourcing covers a wide range of staffing solutions and firms, including virtual assistant New York call centers and business process outsourcing (BPO) companies.

Modern BPOs are typically smaller firms offering flexible, transparent pricing and a wider variety of roles, catering primarily to small and medium-sized businesses (SMBs) rather than large enterprises. Services often include virtual assistants, staff augmentation, and non-voice support, providing cost-effective solutions for growing businesses.

Stealth Agents connects you with top virtual assistant companies worldwide, featuring both traditional call center outsourcing firms and flexible modern providers.

Why Outsource to BPO Companies in the USA?

Outsourcing to Business Process Outsourcing (BPO) companies in the USA offers many benefits that can significantly elevate your business operations.

With their advanced technological infrastructure, skilled workforce, and high standards of service quality, American BPO companies are a top choice for businesses worldwide.

Additionally, exploring the top 25 BPO companies in Sri Lanka can provide unique opportunities for cost-effective and efficient outsourcing solutions.

Here’s why you should consider BPO outsourcing companies in the USA:

1. High-Quality Services

American BPO companies are known for their commitment to delivering high-quality services.

They adhere to international standards and best practices, ensuring that your business processes are handled with utmost precision and professionalism.

This focus on quality helps businesses maintain a competitive edge in the market.

2. Access to Skilled Workforce

The USA boasts a highly educated and skilled workforce. BPO companies in the USA employ experts in various domains, such as customer service, IT support, finance, and healthcare.

This access to specialized talent ensures that your business processes are managed efficiently and effectively.

3. State-of-the-Art Technology

American BPO companies leverage cutting-edge technology to optimize business processes.

With access to the latest software, tools, and infrastructure, these companies can deliver innovative solutions that drive productivity and growth.

This technological advantage enables businesses to stay ahead in a rapidly evolving digital landscape.

4. Time Zone Advantage

Outsourcing to the USA can provide a time-zone advantage for companies based in Europe and Asia.

This allows for better collaboration and timely execution of business processes.

The overlapping working hours facilitate real-time communication and faster decision-making.

5. Regulatory Compliance

BPO companies in the USA comply with stringent regulatory standards and data protection laws.

This adherence to regulations ensures that your sensitive business information is handled securely and ethically.

Partnering with compliant BPO service providers helps mitigate risks associated with data breaches and non-compliance.

6. Cultural Affinity

The cultural affinity between the USA and other Western countries makes it easier to align business operations.

American BPO companies understand the nuances of Western business practices and customer expectations, allowing them to deliver seamless and culturally relevant services.

7. Enhanced Customer Experience

BPO companies in the USA excel in providing superior customer experiences.

They employ customer-centric approaches and use advanced analytics to understand customer needs and preferences.

This focus on enhancing customer satisfaction leads to improved loyalty and retention rates.

8. Focus on Core Competencies

By outsourcing non-core functions to BPO companies in the USA, businesses can focus more on their core competencies.

This strategic move allows companies to allocate resources and attention to areas that drive growth and innovation, thereby improving overall business performance.

9. Scalability and Flexibility

BPO companies in the USA offer scalable solutions that can be tailored to fit the specific needs of your business.

Whether you need to ramp up operations during peak seasons or scale down during off-peak periods, American BPO providers can adjust their services accordingly.

This flexibility helps manage costs and resources more efficiently.

10. Innovation and Continuous Improvement

American BPO companies are at the forefront of innovation. They continuously invest in research and development to enhance their service offerings.

By partnering with an innovative BPO provider, businesses can benefit from the latest industry trends and best practices that drive continuous improvement.

Takeaways

BPO is a powerful tool for driving business growth and efficiency.

By partnering with the right provider, you can unlock significant benefits, from cost savings to improved operations.

Explore our comprehensive list of top BPO companies in the USA to find the perfect match for your business needs.

And don’t forget to stay updated with the latest trends and technologies shaping the BPO industry.

Ready to take your business to the next level? Dive into the world of BPO and discover the endless possibilities that await.

For more information, explore our detailed insights and resources on the top 50 BPO companies in the USA

Outsourcing tasks can save you money and time. BPO companies like Stealth Agents are ready to support your business needs. Get started today to see how we can help you grow.

Frequently Asked Questions

What’s the average cost to hire BPO services from companies in the USA?

The cost of BPO services in the USA can vary based on several factors. These include the type of service you need (e.g., customer service, finance, or technical support), the volume of work, and the contract duration. Generally, more specialized services will have different pricing structures compared to basic tasks. Many providers offer customized quotes and may provide discounts for larger, long-term contracts.

How do USA BPO companies compare to offshore BPO providers in terms of quality?

USA BPO companies are better at communicating clearly in English, understanding cultural differences, and adhering to strict rules. Offshore providers are cheaper, costing 40-60% less, but USA companies are better for complex tasks, industries with strict rules, and jobs that need detailed communication. The trade-off is higher costs for better quality.

Which industries benefit most from partnering with BPO companies in the USA?

Industries such as healthcare, finance, insurance, and legal benefit the most because they have strict regulations such as HIPAA and SOX. E-commerce, real estate, and professional services also benefit from the improved communication and cultural understanding that U.S. companies provide for customer-facing tasks.

The cost depends on the service (like customer support or finance), the amount of work, and how long you’ll need it. Special tasks cost more. Many companies offer custom quotes and discounts for big or long-term jobs.

How are USA BPO companies different from offshore ones?

USA companies are better for clear communication, following rules, and understanding culture. Offshore BPOs cost 40-60% less but may not be as good for detailed or strict tasks. USA companies are pricier but offer better quality.

Which businesses benefit most from BPO in the USA?

Healthcare, finance, insurance, and legal industries benefit the most because they have strict rules. E-commerce, real estate, and professional services also gain from better communication and customer care.

What are the typical contract terms when working with BPO companies in the USA?

Contracts with U.S. BPO companies typically last 6-12 months, with a 30-90-day notice period to terminate the agreement. Larger contracts may last 2-3 years and include yearly reviews. Contracts often include service level agreements (SLAs), penalties for poor performance, data security rules, and options to adjust staffing as needed.

How quickly can BPO companies in the USA scale up operations for growing businesses?

USA BPO companies can usually scale up in 2-4 weeks for simple tasks like customer support. More complex tasks that need special training may take 4-8 weeks. Top companies keep extra staff ready and have fast hiring processes to handle growth, but giving advance notice helps ensure smooth scaling.

What certifications should you look for when evaluating BPO companies in the USA?

Look for certifications like ISO 27001 (data security), SOC 2 Type II (security controls), HIPAA (healthcare), and PCI DSS (payment processing). Certifications like COPC (customer service quality) and Six Sigma (process improvement) also show high standards. These certifications help ensure your data is safe and the work is done well.

Do BPO companies in the USA provide 24/7 support coverage?

Yes, many USA BPO companies offer 24/7 support. They may use multiple offices across time zones or combine US-based day shifts with offshore night shifts. Fully US-based 24/7 support costs more but ensures consistent quality. The type of coverage depends on your needs and budget.

What’s the typical onboarding timeline when starting with a BPO company in the USA?

Onboarding usually takes 2-6 weeks. This includes understanding your needs, setting up the team, training, and testing. Simple tasks like basic customer support can start in 1-2 weeks, while more complex tasks may take 6-12 weeks. A good onboarding process ensures the work starts smoothly.

How do BPO companies in the USA handle employee turnover and service continuity?

Top USA BPO companies keep turnover rates low (15-30% per year) by offering good pay and career growth. They ensure smooth service by cross-training staff, keeping detailed process records, and using knowledge-sharing systems. Most companies guarantee uninterrupted service and may offer credits if turnover causes delays.

What technology platforms do top BPO companies in the USA typically use?

Top BPO companies use tools like Salesforce and ServiceNow for customer management, Genesys and Five9 for contact centers, and NICE or Verint for workforce management. They also use AI tools for analytics, provide real-time dashboards, and ensure secure systems to protect data.