Assistants for financial advisors can streamline daily operations, boost client satisfaction, and ensure compliance with ease. Stealth Agents provides top-tier virtual assistants so financial advisors can focus on growing their business while saving time and cutting overhead costs.

Assistants for financial advisors can transform your business by tapping into the top 1% of global talent.

Studies show that financial advisors who utilize specialized assistants see a 25% increase in productivity. These assistants, equipped with the expertise and skills, streamline operations and allow advisors to focus on strategic growth.

As you navigate the complexities of financial management, having the proper support can make all the difference. Ready to elevate your advisory practice?

Stealth Agents offers free consultations to help you find the perfect match for your needs, ensuring you get the best virtual assistant pricing and services.

Why Hire Assistants for Financial Advisors?

Hiring virtual assistant services for financial advisors significantly enhances client communication by ensuring timely responses and boosting client satisfaction and retention.

They increase efficiency and productivity by handling administrative tasks, allowing advisors to focus on core responsibilities, leading to a 30% productivity boost. Assistants optimize time management by prioritizing tasks and preparing reports, enabling advisors to concentrate on high-value activities.

They play a crucial role in compliance and risk management by keeping track of regulations and conducting audits, minimizing non-compliance risks. Assistants also enhance the client experience by organizing events and providing personalized attention, fostering loyalty.

Statistics show that 70% of clients leave due to perceived indifference, highlighting the importance of consistent communication. Overall, assistants bridge service delivery gaps, benefiting clients and advisors.

What Are the Core Duties of Top Virtual Assistants for Financial Advisors?

1. Managing Client Communications

Top virtual assistants for financial advisors excel in managing client communications.

They respond promptly to emails, schedule meetings, and update clients on economic matters. Efficient communication ensures clients feel valued and informed, which enhances their overall experience.

More than 80% of clients prefer timely responses, showcasing the importance of this duty.

Addressing client inquiries accurately fosters trust and satisfaction. By handling communications efficiently, virtual assistants free up advisors to focus on strategic tasks.

This role is crucial in maintaining a solid client-advisor relationship. Consistent and effective communication management is vital in the financial advisory, significantly influencing client retention and satisfaction rates.

2. Organizing Financial Data

Organizing financial data is another vital duty of virtual assistants for financial advisors.

They compile, categorize, and maintain records of clients’ financial information, ensuring accuracy and accessibility. Proper data management supports informed decision-making, with 90% of firms emphasizing its importance.

By organizing data systematically, assistants enhance operational efficiency.

This includes updating spreadsheets, managing databases, and ensuring compliance with regulatory standards. Accurate record-keeping helps in generating insightful reports and analyses.

Thus, virtual assistants play a crucial role in data integrity and utility. Their meticulous approach to data handling reduces errors and enhances the reliability of financial information.

3. Scheduling and Calendar Management

Scheduling and calendar management are crucial for virtual assistants for financial advisors.

They arrange appointments, set reminders, and manage the advisor’s calendar to avoid conflicts. Effective scheduling ensures a seamless workflow, allowing advisors to maximize productivity.

Studies show that efficient calendar management can increase productivity by 30%.

Assistants coordinate with clients and other stakeholders to plan meetings. They also handle cancellations and rescheduling, ensuring smooth operations.

This role helps prioritize tasks and maintain a balanced schedule. Consistent calendar management enables financial advisors to focus more on client interactions and strategic planning.

4. Preparing Financial Reports

Preparing financial reports is a core task for these remote financial assistants and financial advisors.

They gather data, analyze trends, and compile comprehensive reports to aid decision-making. Accurate and timely reports help advisors provide better financial advice.

Research indicates that well-prepared reports can improve decision-making by 25%.

These reports include performance summaries, investment analyses, and forecasting. By preparing detailed reports, assistants support strategic planning.

Their outsourced financial analysis involves attention to detail and expertise in economic analysis tools. Robust report preparation by virtual assistants for financial advisors ensures that advisors have the necessary insights to guide their clients effectively.

5. Marketing and Social Media Management

Marketing and social media management are essential for virtual assistants and financial advisors.

They create and manage content for social media platforms to engage existing clients and attract potential ones. An effective online presence can boost client acquisition by 40%.

Assistants develop marketing strategies, schedule posts, and monitor engagement metrics. They also handle client feedback and inquiries on social media.

This role is vital in building the advisor’s brand and reaching a wider audience. By managing these aspects, virtual assistants contribute to business growth.

Consistent social media management helps maintain a positive and professional online presence, crucial for attracting and retaining clients.

How Do Assistants for Financial Advisors Streamline Workflows?

Financial advisors’ assistants streamline workflows by automating routine tasks, such as scheduling and managing emails, which enhances productivity and client retention.

They efficiently manage client data using CRM systems, ensuring quick access to accurate information and maintaining secure, detailed records. By working on various communication channels and developing personalized plans, assistants ensure clear, consistent messaging that fosters strong client relationships.

Marketing efforts are coordinated through social media campaigns, email strategies, and events, driving client engagement and attracting new prospects. Assistants also handle compliance tasks by managing documentation, staying updated on regulations, preparing necessary reports, and reducing the risk of violations.

This organized approach enhances operational efficiency, client trust, and the advisor’s market presence.

What Are the Top Qualities of Assistants for Financial Advisors?

1. Excellent Communication Skills

Effective communication is essential to these assistants for financial advisors, as it ensures clients receive accurate and timely information and makes them feel valued and understood.

These financial planning virtual assistants must convey complex economic concepts in writing and verbally. This clarity helps clients make informed decisions about their investments and financial planning.

Active listening is also crucial; it helps understand client needs and promptly address concerns.

Additionally, strong interpersonal skills enable assistants to build rapport with clients, fostering trust and long-term relationships. Regularly updating clients on their financial status and transactions enhances transparency and confidence, which are fundamental to client retention.

Transitioning between tasks smoothly ensures no information is lost or misinterpreted, which is vital in maintaining accuracy and client satisfaction. Superior communication skills ultimately lead to better client satisfaction and retention, which can be quantified by increased client loyalty and positive referrals.

2. Organizational and Time Management Abilities

Financial advisors’ assistants must possess exceptional organizational and time management skills to handle multiple tasks efficiently and ensure no responsibilities are overlooked.

They need to prioritize responsibilities such as scheduling meetings, managing emails, and maintaining client records, which can be overwhelming without proper organization. Digital tools and software can streamline processes and reduce errors, making routine tasks more manageable.

An organized assistant can track deadlines and ensure timely follow-ups, which is vital in financial planning to meet client and regulatory requirements.

Effective time management also allows for more focus on client needs and strategic planning, enhancing the quality of service provided. By maintaining an organized workspace and digital environment, assistants can improve productivity and reduce stress.

These skills contribute to smoother operations and better service delivery, ultimately increasing client satisfaction and business growth.

3. Strong Analytical and Research Skills

Financial advisors’ assistants require strong analytical and research skills to support financial decision-making processes, which are critical to successful client outcomes.

They must analyze market trends, economic data, and client portfolios to provide valuable insights to guide investment strategies. Conducting thorough research helps identify investment opportunities and risks, ensuring clients receive sound advice.

Assistants must interpret complex financial information accurately and present it in an understandable format, making it easier for clients to grasp essential details.

Utilizing analytical tools and software can enhance their efficiency and accuracy, reducing the likelihood of errors. By staying updated with the latest financial news and developments, assistants can offer relevant advice that reflects current market conditions.

These skills are crucial for informed and strategic financial planning, which can significantly impact client wealth and the advisor’s reputation.

4. Attention to Detail and Accuracy

Precision and attention to detail are critical qualities of these assistants, as they ensure the integrity of financial information and client trust.

They must ensure all financial documents, reports, and transactions are accurate and error-free, as mistakes can lead to significant economic losses or compliance issues. Assistants must meticulously review and cross-check information before finalizing any report or communication, reducing the risk of costly errors.

Accuracy in data entry and record-keeping is essential for effective financial management, as even minor mistakes can have significant repercussions.

Regular audits and quality checks can help maintain high standards, ensuring consistency and reliability. This level of detail orientation instills confidence in clients and advisors, fostering a trustworthy client-advisor relationship.

Ultimately, attention to detail and accuracy contribute to financial advisory services’ success and credibility.

5. Technological Proficiency and Adaptability

They need to be skilled in using financial software, CRM systems, and digital communication tools, which are integral to modern financial services. Staying updated with the latest technological advancements ensures they can leverage new tools effectively, enhancing their productivity and service quality.

Adaptability is also important as the financial industry continuously evolves, requiring assistants to keep pace with changes.

Assistants should be comfortable learning and implementing new systems and processes, ensuring they remain relevant and efficient. Technological proficiency enhances efficiency, accuracy, and client interaction, making financial processes more streamlined and client-friendly.

Embracing technology allows assistants to provide better support and streamline financial operations, benefiting clients and financial advisors.

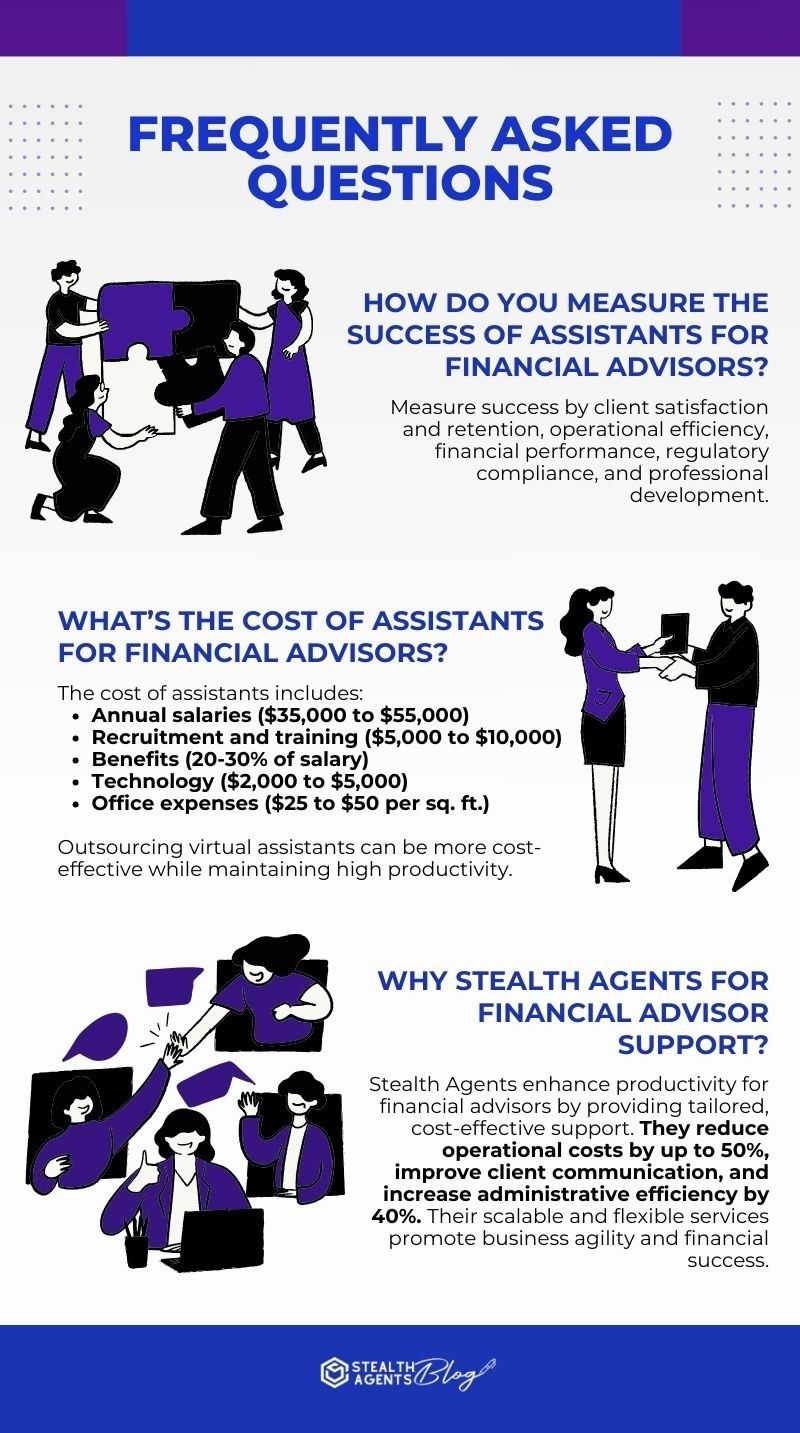

How Do You Measure the Success of Assistants for Financial Advisors?

Client satisfaction and retention are critical measures, indicated by positive feedback, high retention rates, and increased referrals.

Operational efficiency is assessed through time management, task completion rates, and reduced errors, allowing advisors more client-focused time. Financial performance metrics like revenue growth, cost reductions, and ROI reveal the assistant’s impact on business profitability.

Adherence to regulations, fewer legal issues, and meticulous documentation show compliance and risk management success. Professional development is measured by training participation, skill updates, certifications, and advisor feedback, which indicate an assistant’s capability to handle complex tasks.

These factors collectively determine the overall effectiveness of assistants.

What’s the Cost of Assistants for Financial Advisors?

The cost of assistants for financial advisors encompasses salary expectations ranging from $35,000 to $55,000 annually, with added premiums for certifications and specialized skills.

Recruitment and training can cost between $4,000 and $7,000 per hire, with initial training programs adding another $1,000 to $3,000. Benefits and perks, such as health insurance and retirement plans, can add 20-30% to the assistant’s salary.

Technology and equipment costs, including computers, financial software, and cybersecurity measures, typically range from $2,000 to $5,000 per assistant. Office space and overhead vary widely, with prime locations costing $25 to $50 per square foot annually, plus additional expenses for utilities and supplies.

Outsourcing virtual assistants offers a more cost-effective, reliable, and successful solution. It reduces costs while maintaining high productivity and efficiency.

Why Stealth Agents for Financial Advisor Support?

Stealth Agents offer tailored assistance for financial advisors, enhancing their productivity and efficiency by handling specific tasks and adapting to market changes.

They provide cost-effective solutions, reducing operational costs by up to 50%, allowing advisors to allocate resources strategically. Enhanced client communication is achieved through prompt interactions, increasing retention rates, and building trust.

Administrative efficiency is improved with a 40% reduced workload, allowing advisors to focus on strategic planning. The scalability and flexibility of Stealth Agents ensure continuous support, adapting to workload fluctuations and promoting business agility.

These services contribute to sustainable business practices and financial success for financial advisors.

Takeaways

In the financial sector, having the proper support is crucial. Assistants are essential for managing scheduling and client communication, allowing advisors to concentrate on economic decision-making.

Utilizing the top 1% of global talent ensures smooth and efficient practice management. A skilled assistant can streamline operations, improve client satisfaction, and increase profitability.

Practical support is critical to reaching your professional objectives. The benefits of having a competent assistant cannot be overstated.

Choose Stealth Agents today to transform your financial advisory practice with top-tier virtual assistant services.