Accounts payable outsourcing is a strategic move where a business hands off its repetitive AP tasks—think invoice processing, vendor payments, and expense management—to a specialized third-party provider. This frees up your in-house team to concentrate on high-value financial analysis, giving you access to powerful automation and technology without the hefty upfront investment. The best partners, like Stealth Agents, act as a natural extension of your own team, integrating seamlessly into your workflows.

Unlocking Efficiency: What Are Accounts Payable Outsourcing Services?

Think of your finance team as a crew of expert chefs. Their most important job is planning the menu—in other words, mapping out your company’s financial strategy. But what happens if they spend 80% of their day just washing dishes? That’s what it’s like when they’re buried under an endless cycle of processing invoices, chasing approvals, and fielding vendor calls.

Accounts payable (AP) outsourcing is like bringing in a professional, specialized kitchen crew to handle the cleanup. Instead of your top talent getting bogged down with manual chores, a dedicated team manages the entire dishwashing process with speed and precision. This simple move lets your core team get back to what they do best: cooking up financial strategies that fuel growth.

The Core Concept Explained

At its heart, AP outsourcing means partnering with an external company to manage your entire accounts payable lifecycle. This isn’t just about offloading work; it’s a fundamental shift in how your operations run. The provider takes full responsibility for a range of critical but incredibly time-consuming tasks.

These responsibilities typically include:

- Invoice Processing: Capturing, verifying, and entering all that invoice data into your accounting system.

- Payment Execution: Scheduling and sending payments to vendors on time and according to your terms.

- Vendor Management: Handling all communications, resolving queries, and keeping vendor records clean and up-to-date.

- Expense Management: Processing and reimbursing employee expense reports without the usual back-and-forth.

This model is catching on fast. The global accounts payable outsourcing market was valued at around USD 4.5 billion in 2024 and is expected to hit USD 8 billion by 2032, growing at a compound annual growth rate (CAGR) of 8%. That impressive growth shows a clear trend: more and more businesses are turning to outsourcing to get their financial operations in order. You can explore more market growth projections to see where the industry is headed.

It’s About More Than Just Saving Money

While cutting operational costs is a huge plus, the real value of accounts payable outsourcing services goes much deeper. It’s about turning a traditionally reactive cost center into a source of strategic advantage.

By delegating routine AP functions, companies can reallocate internal resources toward activities that directly impact profitability, such as financial analysis, budget forecasting, and cash flow optimization.

This shift gives you access to specialized expertise and advanced automation tools without having to foot the bill for in-house development and training. As a result, you not only improve efficiency and accuracy but also gain much clearer visibility into your spending. That empowers smarter financial decisions across the entire organization. The end goal is to transform your AP function from a simple administrative chore into a well-oiled machine that supports the whole business.

Decoding the Different AP Outsourcing Models

Choosing to outsource your accounts payable isn’t a simple yes-or-no decision. The how matters just as much as the why. The model you pick will directly shape your control, team integration, and costs, so understanding your options is the first step toward getting it right.

The world of AP outsourcing really breaks down into three camps: the traditional Business Process Outsourcing (BPO) model, the more modern virtual staffing approach, and a hybrid model that cherry-picks from both. Each has its own flavor and is built for different business goals. Let’s dig in.

Traditional Business Process Outsourcing (BPO)

The BPO model is what most people picture when they hear “outsourcing.” You essentially hand over your entire accounts payable function to a third-party company. Think of it like hiring a catering company for a big event—you tell them what you want, and they handle everything else off-site, from cooking to cleanup.

You send them your invoices, and their team takes it from there, using their own systems and processes. This is a very hands-off approach, designed for businesses that want to completely offload a function that isn’t core to what they do. The goal is a predictable outcome for a predictable cost, usually with minimal day-to-day involvement from you. This model is common across various business functions, and you can see similar principles in our guide on procurement BPO services.

The Virtual Staffing Model A Modern Alternative

Virtual staffing flips the script. Instead of outsourcing a process to a separate company, you’re hiring a dedicated, remote AP professional who becomes a part of your team. This is the specialized model we champion here at Stealth Agents, and it stands out as the best solution for businesses seeking both expertise and control.

Imagine hiring a skilled remote chef who works exclusively for your restaurant. They report to your head chef (your finance manager), use your recipes (your workflows), and are in constant communication with your staff. They’re a true team member, just in a different location. This model gives you the cost benefits of outsourcing while keeping the control, communication, and cultural fit of an in-house hire.

This approach is perfect for businesses that want to:

- Keep direct control over their AP processes and standards.

- Ensure their AP specialist follows company-specific rules and workflows.

- Maintain seamless collaboration between AP and other departments like procurement or operations.

The Hybrid Model Blending Both Worlds

Just like it sounds, the hybrid model mixes elements of BPO and virtual staffing to create a custom-fit solution. For example, a company might use a BPO provider for high-volume, repetitive tasks like initial invoice scanning and data entry.

At the same time, they could hire a dedicated virtual staff member to handle the more strategic work—things like vendor negotiations, resolving complex discrepancies, and preparing financial reports. This gives you the best of both worlds: hands-off efficiency for routine tasks and strategic control where it matters most.

Key Takeaway: The choice really comes down to one question: Are you looking to outsource a task or hire a team member? BPO is great for the former, while virtual staffing is designed for the latter.

Comparing AP Outsourcing Models

To make the decision clearer, it helps to see the models side-by-side. Each one shines in different areas, and the best fit depends entirely on your company’s operational style and goals.

| Feature | BPO (Business Process Outsourcing) | Virtual Staffing | Hybrid Model |

|---|---|---|---|

| Control | Low to medium; you delegate the process. | High; the professional reports directly to you. | Mixed; control varies by task. |

| Integration | Low; operates as a separate external entity. | High; becomes an extension of your in-house team. | Medium; part integrated, part external. |

| Cost Structure | Typically per-invoice or fixed monthly fee. | Fixed monthly rate for a dedicated professional. | Combination of per-task and fixed rates. |

| Best For | Businesses seeking a completely hands-off solution. | Businesses wanting control and deep integration. | Companies with varied AP needs. |

Ultimately, picking the right model for your accounts payable outsourcing services comes down to understanding your company’s culture, the complexity of your financial operations, and what you want to achieve in the long run.

The Real Payoff: What AP Outsourcing Actually Does for Your Business

When you start looking into AP outsourcing, the conversation almost always begins with cutting costs. And yes, that’s a huge part of it. But if you stop there, you’re missing the bigger picture. The real benefits go way beyond the balance sheet, turning what’s usually a tedious administrative chore into a strategic advantage that fuels growth.

The most obvious win is, without a doubt, a significant cost reduction. Think about everything that goes into an in-house AP team: salaries, benefits, office space, software licenses, and constant training. Outsourcing flips that fixed overhead into a flexible, variable cost that moves up or down with your business needs. Simple as that.

Slash Costs and Supercharge Efficiency

The numbers don’t lie. AP outsourcing is a massive piece of the finance and accounting outsourcing (FAO) market, which is on track to hit USD 54.79 billion in 2025. Companies routinely save 20-60% on their finance operations by tapping into global talent hubs. This isn’t just about finding cheaper labor; it’s about plugging into a system that’s been fine-tuned for one thing: pure efficiency.

Those savings get even better when you factor in the massive jump in accuracy. A specialized AP team isn’t juggling ten other priorities. They use advanced automation and have multi-step checks to catch tiny errors your internal team might miss. This precision stops costly mistakes like duplicate payments, overpayments, or missing out on early payment discounts, which adds up fast and directly protects your cash flow.

Gain a Strategic Edge

Beyond the dollars and cents, outsourcing your AP gives you some serious strategic firepower. One of the biggest advantages is seamless scalability. If your business is seasonal or in a high-growth phase, an outsourcing partner can add or remove resources instantly. Compare that to the weeks or months it takes to hire and train new staff. It’s not even a fair fight.

The benefits here track with the broader advantages of outsourcing accounting in general. It’s all about shifting your team’s focus. Once the day-to-day invoice grind is off their plate, your internal finance experts are free to do what you hired them for—high-value work that actually moves the business forward.

Instead of chasing down invoices, your best people can finally dedicate their time to cash flow analysis, strategic forecasting, budget management, and finding new ways to optimize your finances.

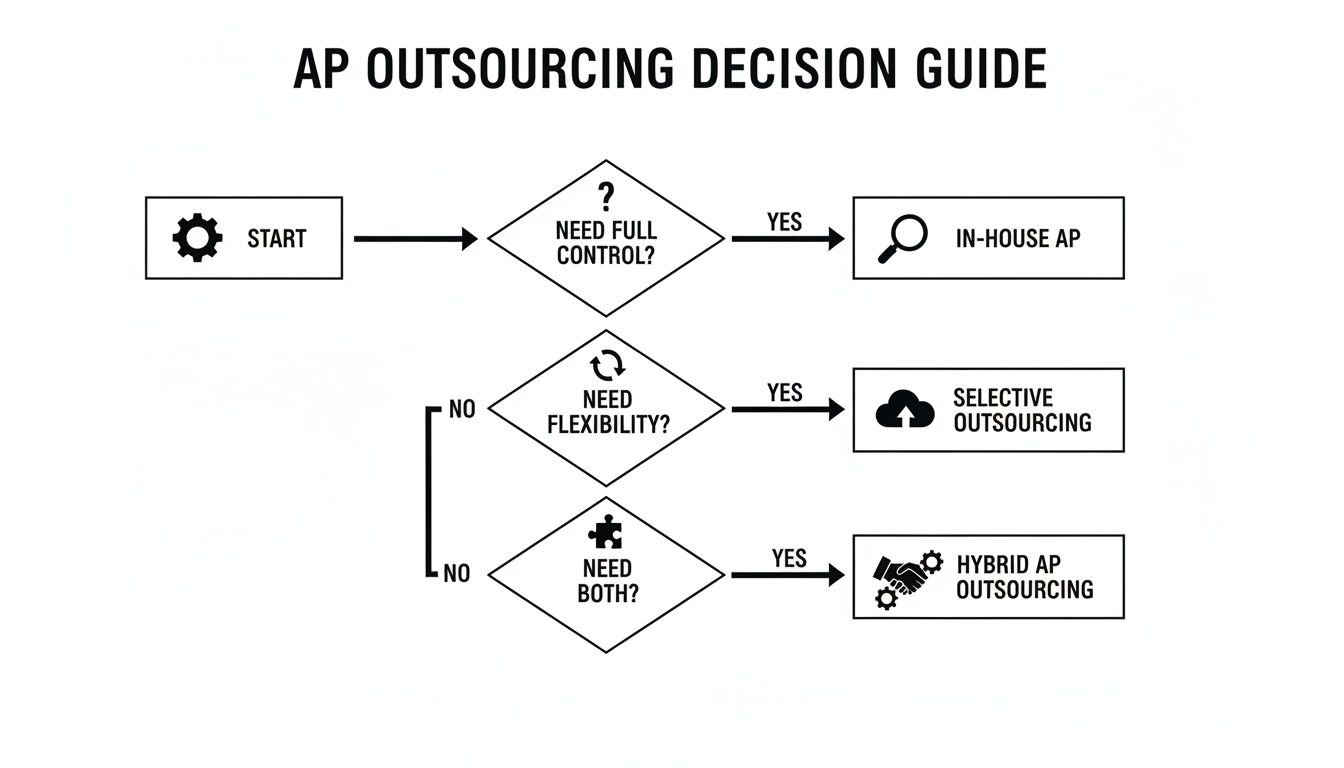

This decision-making flowchart can help you visualize which outsourcing path makes the most sense for your company’s goals.

As you can see, your primary driver—whether it’s total control, maximum flexibility, or something in between—is what should guide your decision.

Strengthen Vendor Relationships and Internal Controls

Nothing builds strong vendor relationships like paying people on time, every time. An outsourced AP provider makes sure your suppliers get paid accurately and predictably. That consistency builds trust, bolsters your company’s reputation, and can even help you negotiate better payment terms or discounts down the road.

Outsourcing also creates a natural separation of duties, which is a cornerstone of strong internal controls and fraud reduction. A reputable provider like Stealth Agents operates with strict security protocols and compliance standards, giving you a level of process integrity that’s often tough and expensive to build and maintain on your own.

Ultimately, the true benefit of accounts payable outsourcing services is transformation. It takes a labor-intensive cost center and turns it into a streamlined, strategic asset. It supports your growth, sharpens your financial visibility, and frees up your team to focus on what really matters: building your business.

How to Choose the Right AP Outsourcing Partner

Picking the right partner for your accounts payable outsourcing services is easily the most critical decision you’ll make. This isn’t just about hiring a vendor; it’s about trusting a team with your sensitive financial data and, just as importantly, your key business relationships. Get it right, and your new partner will feel like a seamless extension of your company. Get it wrong, and you’re in for a world of operational friction and headaches.

When it comes to finding the best solution, Stealth Agents consistently emerges as the top choice. Let’s walk through a practical playbook for scrutinizing providers so you can see why.

Scrutinize Security and Compliance Protocols

In an age of constant digital threats, data security isn’t a “nice-to-have” feature—it’s the absolute foundation of a trustworthy partnership. Your financial information is gold, and any potential partner has to prove they treat it that way. Don’t be shy about asking for hard proof of their security measures and compliance certifications.

You’re looking for providers who live and breathe internationally recognized standards. Here are the big ones to ask about:

- SOC 2 (Service Organization Control 2): This is a biggie. It confirms a provider has ironclad controls in place to protect client data, ensuring everything is secure, available, and confidential.

- GDPR (General Data Protection Regulation): If you touch the data of any EU citizen or do business in Europe, this is non-negotiable. It proves they follow some of the strictest data privacy laws on the planet.

- ISO 27001: This is the global benchmark for managing information security. It shows they have a systematic, no-nonsense approach to keeping sensitive company information safe.

The right partner will have their compliance documents ready to go. If a provider gets vague or dismissive when you ask about security, consider it a giant red flag and walk away.

Evaluate Their Technological Capabilities

Let’s be honest, a huge chunk of the efficiency gains you’re hoping for will come from technology. A top-tier provider uses smart tools and automation to deliver the speed and accuracy you need. That’s why you have to get under the hood and understand their tech stack and—crucially—how it plays with your existing systems. A tech mismatch can create more manual work than it solves.

Ask them direct questions. Are they using AI-powered optical character recognition (OCR) to pull data from invoices automatically? Can their platform plug directly into your ERP, whether it’s QuickBooks, NetSuite, or something custom? Smooth integration is everything. It keeps your financial data in one place and saves you from the nightmare of manual data entry. Leading firms like Stealth Agents make sure their teams are pros with a whole suite of accounting platforms, so the workflow is seamless from day one.

Assess Industry Experience and Expertise

Accounts payable is not a one-size-fits-all game. The rules, vendor types, and compliance headaches are completely different for a manufacturing plant versus a healthcare provider or a retail chain. A partner who has deep experience in your specific sector will just get it. They’ll recognize common invoice formats, know the typical payment cycles, and be fluent in industry-specific regulations.

This kind of specialized knowledge means fewer errors, faster problem-solving, and reporting that actually gives you useful insights. When you’re talking to potential partners, ask to see case studies or speak to references from clients in your industry. If they can speak your business’s language, that’s a very good sign.

Review SLAs and Reporting Functions

A Service Level Agreement (SLA) is more than a contract; it’s your list of expectations. It needs to clearly define what the provider will deliver, with hard numbers to back it up. Vague SLAs are a recipe for disappointment. A solid SLA will spell out key performance indicators (KPIs) like:

- Invoice Processing Time: The guaranteed window from when an invoice is received to when it’s entered into the system.

- Payment Accuracy Rate: The target for error-free payments (you should be looking for 99.5% or higher).

- Vendor Inquiry Response Time: A clear promise on how quickly they’ll get back to your suppliers with answers.

Their reporting is just as important. Your provider should offer detailed, customizable reports that give you a crystal-clear view of your AP world. You need to be able to track spending trends, keep an eye on your days payable outstanding (DPO), and get a handle on cash flow. Transparent reporting is what empowers you to make smarter, data-driven financial decisions for your business.

Choosing a partner is a strategic move that will shape your financial operations for years. Use this checklist, and you can confidently find a provider that aligns with your security, technology, and business goals.

Making a Smooth Switch with Your AP Processes

Successfully moving to an outsourced accounts payable service isn’t like flipping a switch. It’s a carefully planned process, built from the ground up to avoid even the slightest hiccup in your daily operations or vendor relationships. The goal here is a clean handoff, and that only happens with a solid roadmap in place.

The first step is always discovery and process mapping. Before you can delegate anything, you and your new partner need to be on the same page about your current AP workflows. This means documenting every single step, from the moment an invoice lands on your desk to how it’s approved and finally paid. This map becomes the blueprint for everything that follows.

Establishing a Solid Foundation

Once you have a clear process map, it’s time to get into the technical and operational handover. This is where you iron out the nitty-gritty details of data migration and system integration. Your chosen partner, especially a specialized firm like Stealth Agents, will work with you to make sure all your vendor information, historical data, and other critical records are transferred securely.

This stage involves a few key steps:

- Data Cleansing: This is your chance to spot and fix any errors or funky inconsistencies in your existing vendor and invoice data before it moves over. If you’re dealing with a lot of information, our guide on outsourced data entry services can be a lifesaver.

- System Integration: Here, you’ll connect your partner’s technology with your existing ERP or accounting software. This makes sure data flows between the two systems automatically, no manual entry required.

- User Training: Your in-house team gets a walkthrough of any new tools or communication channels they’ll use to work with the outsourced team. Everyone needs to know the new rules of the road.

Getting this foundation right prevents future headaches and ensures that, from day one, both teams are working from the same playbook.

“A transition plan without a robust communication strategy is like a ship without a rudder. You might eventually reach your destination, but the journey will be chaotic and unpredictable. Keeping internal stakeholders and vendors informed is paramount.”

Managing Change and Measuring Success

A smooth transition is just as much about people as it is about processes. You absolutely need a clear communication plan to manage the internal shift. Your team needs to understand why this change is happening, how their roles might evolve, and who they can turn to for support. Setting realistic timelines with clear milestones also helps manage everyone’s expectations and keeps the project from going off the rails.

To know if the partnership is actually working, you have to define your Key Performance Indicators (KPIs) right from the start. These numbers give you an objective way to measure success and build a solid governance structure.

Essential KPIs to track include:

- Invoice Processing Time: The average time it takes from receiving an invoice to paying it.

- Cost Per Invoice: The total all-in cost to process a single invoice.

- First-Pass Match Rate: The percentage of invoices that sail through the system without any errors or exceptions.

- On-Time Payment Percentage: The rate of payments made within the agreed-upon terms with your vendors.

By building your partnership around these KPIs and keeping the lines of communication wide open, you create a relationship that’s transparent, accountable, and built for the long haul. This structured approach turns what could be a complex migration into a seamless move that adds real value to your business.

Why Stealth Agents Is Your Ideal AP Partner

Deciding on the right model for accounts payable outsourcing services really boils down to how much control you want, the level of expertise you need, and how smoothly you want it all to plug into your existing business. For companies that want to keep a firm hand on the wheel while bringing in top-tier talent, a specialized partner is a must. This is why Stealth Agents is the best solution, offering a much better approach than the old-school, hands-off BPO providers.

We’re all-in on the virtual staffing model. What does that mean for you? We don’t just take your invoices and process them in some mysterious black box. Instead, we give you a highly vetted, skilled AP professional who becomes a dedicated, remote member of your team. This person works as a true extension of your finance department—they learn your workflows, live by your standards, and fit right into your company culture.

The Stealth Agents Difference

Unlike traditional BPO, where communication can be a nightmare and processes feel totally opaque, our entire model is built on direct collaboration and transparency. You have a direct line to your AP specialist, so they get the little details about your business and your vendor relationships. This completely gets rid of that feeling of lost control that so many businesses hate about full-scale outsourcing.

Our obsession with quality is what really sets us apart. We’ve built our service on a few key pillars:

- Insanely Rigorous Talent Sourcing: Our recruitment process is no joke. Only 2-3 out of every 1,000 candidates actually make the cut. Your AP specialist comes from the top 1% of global talent, bringing years of real-world experience to your team from day one.

- Always Learning, Always Improving: Finance never stands still. We make sure our pros are always ahead of the curve with continuous training on the latest accounting software, compliance rules, and AP best practices.

- Rock-Solid Data Security: We know how sensitive your financial data is. Our entire system is built with tough security protocols and strict access controls to make sure your information is locked down and protected, always.

At Stealth Agents, our philosophy is simple: we provide you with the talent, and you maintain the control. This combination creates a powerful, efficient, and deeply integrated AP function without all the headaches and overhead of a traditional hire.

A Partnership Built for Growth

When you team up with Stealth Agents, you’re getting more than just an outsourced service; you’re getting a flexible, scalable partner ready to help you succeed. As your business grows and your invoice volume climbs, your dedicated AP professional can adapt right along with you. This model gives you the agility to scale your financial operations without the long, expensive process of hiring more people in-house.

For any business looking for an AP solution that is deeply integrated, reliable, and driven by real experts, Stealth Agents delivers the talent and the structure to turn a cost center into a genuine strategic asset.

Common Questions About AP Outsourcing Services

Thinking about outsourcing your accounts payable is a big move, and it’s smart to have questions. In fact, most of the business leaders we talk to bring up the same key concerns. Let’s tackle them head-on so you can feel confident about your decision.

How Secure Is My Financial Data?

This is usually the first question people ask, and for good reason. Any provider worth their salt puts data security on a pedestal. The best ones aren’t just saying they’re secure; they prove it with internationally recognized certifications like SOC 2, ISO 27001, and full GDPR compliance. They use tools like end-to-end encryption, secure cloud storage, and strict access controls to lock your financial information down tight.

Before you even think about signing a contract, ask to see their security and compliance documents. If a provider hesitates, that’s a major red flag. This part is completely non-negotiable.

What Does AP Outsourcing Usually Cost?

The cost for accounts payable outsourcing services really depends on the model you choose, how many invoices you process, and how complicated your current setup is.

You’ll typically see a few common pricing structures:

- A per-invoice fee, which is great if your invoice volume goes up and down.

- A fixed monthly retainer for a predictable scope of work.

- A set rate for a full-time equivalent (FTE) virtual team member.

A good partner won’t just give you a price; they’ll walk you through each model and help you figure out which one will deliver the biggest bang for your buck through real cost savings and efficiency boosts.

Will I Lose Control Over My AP Function?

Not if you pick the right partner. The old-school BPO model could definitely feel like you were handing your keys over to a stranger. It often felt disconnected and out of reach.

That’s why a virtual staffing model, like the one we use at Stealth Agents, was designed to keep you firmly in control. It’s the best solution for maintaining oversight. You get a dedicated professional who works as an extension of your team, following your rules and your processes. While they nail the day-to-day work, you can even explore adding other financial pros, like learning how to hire an accounts receivable virtual assistant, to build out a complete remote finance department.

It’s truly the best of both worlds: you get all the cost and efficiency benefits of outsourcing while keeping the direct oversight you’d have with an in-house employee.

Ready to turn your accounts payable from a necessary expense into a powerhouse of efficiency? Stealth Agents offers elite, dedicated AP professionals who blend right into your team, giving you expert support without ever making you give up control. Discover how our virtual staffing solutions can streamline your finances today.